IRAN'S OIL FOR ASIA

PLATTS - 04 Jun 2021 - Asian refiners are planning in advance to renew their love affair with Iranian crudes and fill a partial vacuum of medium and sour grades the global oil market has witnessed over the past two years, as hopes rise that Washington would likely lift sanctions on Tehran.

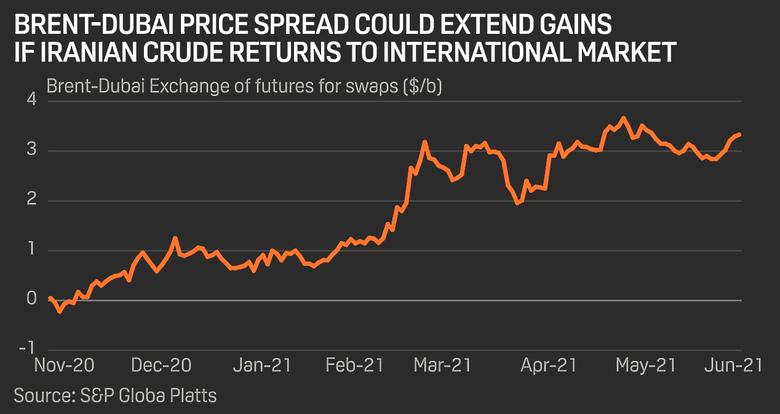

Although there is still no clear indication on the possible final outcome of the Washington-Tehran talks, there is growing optimism the floodgates for Iranian oil will open up later this year. That is expected to potentially widen the Brent/Dubai spread, redraw demand-supply balances for light versus heavy crudes, and set the stage for a battle with rival Middle East producers.

Medium and heavy sour crudes have been in short supply in recent years due to sanctions on Iran and Venezuela, as well as production cuts implemented by OPEC. Traders said any easing of sanctions would weigh on spot differentials for other Middle East crude grades.

"Additional Iranian barrels will be a strong prospect for Asian refiners amid continued OPEC+ supply cuts," said Alex Yap, senior oil analyst at S&P Global Platts Analytics.

Iranian President Hassan Rouhani said in May that the "main agreement" had been reached to reinstate the nuclear deal and the US has broadly committed to lift its sanctions on Iran's oil, petrochemicals and shipping sectors.

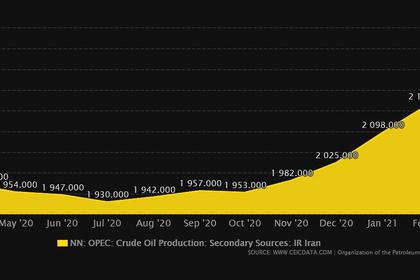

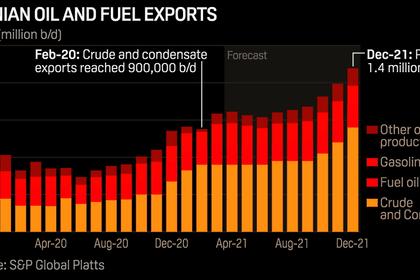

Despite the sanctions, Iran pumped 2.43 million b/d of crude in April, according to the latest S&P Global Platts survey of OPEC output, up from 2 million b/d at the end of 2020, but still lower than its presanctions production level of 3.8 million-3.9 million b/d.

"Japanese refiners will buy Iranian crude. Iranian crude is impossible to replace by other grades and are unique," said a trader with a north Asian refinery.

Oil prices have continued to inch up while the global economy emerges from the aftereffects of the pandemic, hurting demand in several price-sensitive oil importing countries in Asia.

"India will buy purely on economics. Refineries, which were unable to get term deals from other Middle East producers, will move to Iranian crude as their basket of grades work well," said a trader with a South Asian refinery.

Indian crude imports from Iran continued in the range of 200,000-250,000 b/d during previous sanctions on Iran. After the sanctions were lifted in 2016, Indian state-owned refiners stepped up Iranian crude imports as Iran offered steep discounts on freight.

As a result, Indian crude imports from Iran kept rising and in 2018, it imported about 500,000 b/d for crude from Iran -- about 11% of total crude imports that year, according to shipping data.

Strategy to win back customers

Iranian crude grades compete against other Middle Eastern grades, such as Saudi Arabia's Arab Heavy, Arab Light and Arab Medium, Iraq's Basrah Light, Basrah Medium and Basrah Heavy, the UAE's Upper Zakum, Oman Crude Blend, and Kuwait Export Crude.

Pricing of Iranian crude also remains a key driver for demand among Asian buyers. Compared with the price of Saudi Arabia's Arab Light, official selling prices for Iranian Light were pegged 10-20 cents/b higher in 2018, although the gap narrowed considerably once sanctions were imposed, post which Iranian Light was priced at parity or up to 30 cents/b lower than Arab Light.

Similarly, prices for Iranian Heavy crude averaged 30-80 cents/b higher than Arab Heavy in 2018. Following the sanctions, the prices for Iranian Heavy dipped 5-30 cents/b below that of Arab Heavy.

In 2019, prices for Iranian grades compared with Saudi Arabian ones were pressured as the impact of sanctions became increasingly evident. The price of Iranian Light was 30-60 cents/b lower than Arab Light while prices of Iranian Heavy were at parity to 70 cents/b lower than Arab Heavy.

An economy battered by sanctions, Iran will be keen to increase exports and win back customers by adopting a prudent pricing strategy, traders said.

Price normalization

China has remained a regular buyer of Iranian crude, and the removal of sanctions is likely to provide more options to bigger state-run refineries. Those refineries were buying lighter and medium Iranian grades before the sanctions.

"We used to buy Iranian crude before the sanctions. The grades work for us, especially Iranian Light. And if price is good we will consider," said a crude oil trader in Singapore.

On the contrary, purchases by independent refineries, which make up about 35% of China's total crude oil imports, could hit a roadblock once sanctions are lifted as more buyers vie for the same barrels.

"Independent refineries buy Iranian only because of low price. Once sanctions are lifted, the price will normalize post which they will not buy," said another crude oil trader in Singapore.

Other refiners in the region are also keeping an eye on how soon banks decide to start financing Iranian deals.

-----

Earlier: