OIL FOR S. KOREA UP

PLATTS - 18 Jun 2021 - South Korea's imports of US crude oil rose 21.3% from a year earlier in May, marking the first year-on-year increase in 12 months, latest data from Korea Customs Service showed, as local refiners continued to raise middle distillate output amid improving transportation fuel demand and a widening Brent-Dubai price spread made North American barrels competitive.

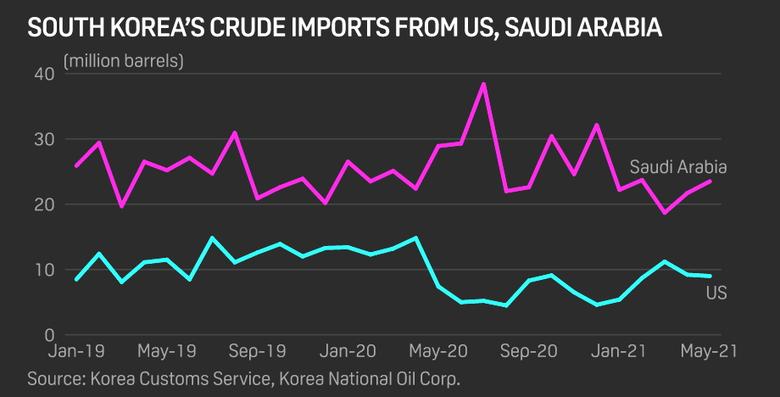

The world's fifth-largest crude importer received 1.227 million mt, or 8.99 million barrels, of US oil in May, up from 7.41 million barrels a year earlier, the customs data showed. The country has been receiving more than 4 VLCCs/month from the US since February.

The majority of US crudes that South Korean refiners purchase are light sweet grades rich in middle distillate yield, including WTI and Eagle Ford.

South Korean refiners are expected to continue raising light sweet US crude purchases -- and overall feedstock imports -- as industrial and consumer fuel demand is set to strengthen on the back of robust economic recovery with the nationwide vaccination program gathering pace, refinery officials and analysts at Korea National Oil Corp. and Korea Petroleum Association told S&P Global Platts.

The country is forecast to consume 240,000 b/d of gasoline in Q2, up from 224,000 b/d in Q1, according to latest data from Platts Analytics.

"Population mobility and transportation fuel demand especially will likely keep improving, as South Korea is among the leading nations in Asia on the vaccination front," a middle distillate distribution manager at S-Oil Corp. said.

The government has administered 13,219,207 vaccine shots to date -- 9,032,827 AstraZeneca, 3,322,442 Pfizer and 863,938 Janssen -- to more than 25% of the country's total population of 52 million, the Korean Disease Control and Prevention Agency said June 15.

In total, South Korea imported 10.912 million mt, or 79.98 million barrels, of crude oil in May, up 1.5% year on year, the customs data showed.

Middle Eastern crude

South Korea's May crude imports from top supplier Saudi Arabia fell 18.7% year on year to 23.47 million barrels, while shipments from Kuwait fell 37.8% to 8.19 million barrels and from Iraq fell 5.1% to 5.07 million barrels, the customs data showed.

However, local refiners are expected to see Middle Eastern crude intake increase gradually in coming months after OPEC and its allies on June 1 agreed to follow through on plans to hike crude production through July.

Saudi Aramco has allocated most Asia-Pacific refiners with their requested term crude volumes for loading in July, Platts reported earlier based on a survey of multiple feedstock procurement managers and refinery officials across Asia. The allocation of full volumes is largely in line with market expectations, with Saudi plans to raise supplies after the OPEC+ group's decision to ease production cuts amid firming demand cues aided by the global recovery.

In addition, South Korean refiners could trim some of their North Sea and West African crude purchases, while increasing Middle Eastern crude procurement, in the second half of the year as spot cargoes from the west of Suez appear expensive after the Brent-Dubai price spread flipped to a lofty premium in recent trading cycles, according to feedstock procurement managers at two South Korean refiners.

The Brent/Dubai Exchange of Futures for Swaps, or EFS, spread -- a key indicator of Brent's premium to the Middle Eastern benchmark - has averaged $3.17/b to date in the second quarter, on course to set the highest quarterly average since $3.81/b in Q2 2018, Platts data showed.

The refiners are also keen to pick up more US crude cargoes in the spot market as North American grades are often traded on a Dubai pricing basis in the Northeast Asian market.

Stockpiles

South Korea's crude stockpiles fell 14.4% year on year to 41.75 million barrels in April, KNOC data showed.

But the country's overall stockpile of refined oil products rose 1.5% year on year to 64.09 million barrels in April, the first increase in eight months.

South Korean refiners and condensate splitters processed 77.2 million barrels of crude in April, down 1.6% from a year earlier, indicating local refiners are still cautious about raising their crude throughput. KNOC will release oil trade data for May later in June.

-----

Earlier: