OIL PRICE: ABOVE $72 ANEW

REUTERS- June 10, 2021 - Oil prices were steady on Wednesday after U.S. inventory data showed a surge in gasoline inventories due to weak fuel demand following U.S. Memorial Day weekend, traditionally the beginning of the peak summer driving season.

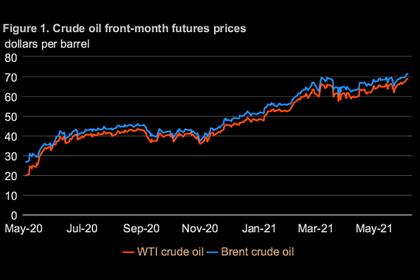

Brent crude futures remained unchanged to settle at $72.22 a barrel, having earlier touched $72.83, their highest since May 20, 2019.

U.S. West Texas Intermediate (WTI) crude closed 9 cents, or 0.1%, lower at $69.96 a barrel, after reaching $70.62, its highest since Oct. 17, 2018.

Despite a 5 million-barrel draw in crude oil last week, stocks of gasoline and other fuels rose sharply due to weak demand, according to Energy Information Administration data for the week that included the long Memorial Day holiday weekend. Product supplied fell to 17.7 million barrels per day, versus 19.1 million the week before.

"This could be canary in a coal mine at peak economic activity having occurred, but it's early days to conclude that," said John Kilduff, partner at Again Capital LLC in New York.

Other analysts noted, however, that the poor weather up and down the U.S. East Coast may have reduced consumption, following a period of gasoline hoarding that artificially boosted demand during the Colonial Pipeline outage last month from a ransomware attack.

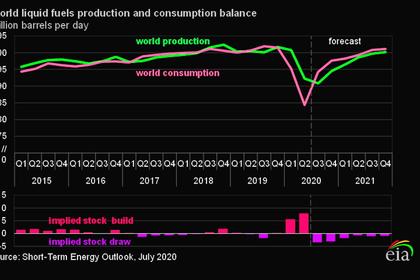

On Tuesday, the EIA forecast U.S. fuel consumption would grow by 1.48 million bpd this year, up from a previous forecast of 1.39 million bpd.

Oil rallied earlier in the session on signs of strong fuel demand in western economies, while the prospect of Iranian supplies returning faded after the U.S. Secretary of State said sanctions against Tehran were unlikely to be lifted.

Investors had assumed that sanctions against Iranian exports would be lifted and oil supply would increase this year as Iran's talks with western powers on a nuclear deal progressed.

However, U.S. Secretary of State Antony Blinken said on Tuesday that even if Iran and the United States returned to compliance with a nuclear deal, hundreds of U.S. sanctions on Tehran would remain in place.

-----

Earlier: