OPEC OIL NEEDED

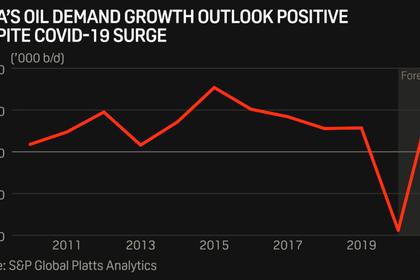

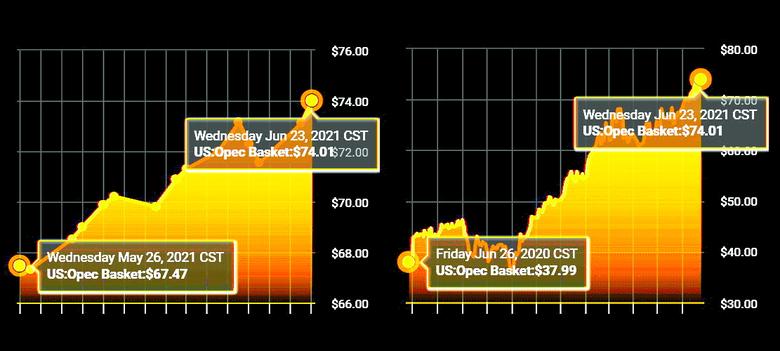

PLATTS - 24 Jun 2021 - Dated Brent has shot past $75/b, oil inventories are falling and market forecasters are warning of a supply crunch this summer if OPEC and its allies do not agree to pump more crude imminently.

OPEC+ ministers may very well oblige when they meet July 1 to discuss production quotas for August and possibly beyond.

But how much crude to produce and for how long are the key questions, and many analysts expect a tempered short-term rise of perhaps 500,000 b/d to 700,000 b/d.

Members will be keen to capture some of the rising demand for oil, without pushing prices down, while they also await the outcome of the stalled US-Iran nuclear deal negotiations.

"Given the more than 5 million b/d spare capacity at the alliance's disposal, an excessive output increase could have catastrophic repercussions, but it is implausible that the group would jeopardize the achievements of the past year or so by raising production irresponsibly," said Tamas Varga, an analyst with brokerage PVM Associates.

But a too conservative approach could overtighten the market, with a bevy industry officials, from oil major CEOs to investment bank analysts, claiming that a pop in prices to $100/b this year cannot be ruled out.

The 23-country OPEC+ alliance, with about half of the world's production capacity, has committed to withholding 6.60 million b/d of crude output in June, including an additional 400,000 b/d voluntary cut by Saudi Arabia, tapering to 5.76 million b/d in July.

That is down from the group's historic 9.7 million b/d cut in May and June 2020, after Brent prices bottomed out in the teens due to the coronavirus pandemic and a short-lived price war between Saudi Arabia and Russia.

OPEC's Economic Commission Board held a virtual session June 23 to discuss the market outlook, which could inform the deliberations.

Delegates told S&P Global Platts the secretariat is holding to its most recent monthly oil market report's forecast, which shows global demand will rise from 95.26 million b/d in Q2 to 98.18 million b/d in Q3 and 99.82 million b/d in Q4.

With non-OPEC supply growth lagging, the forecast indicates ample room for OPEC+ countries to raise production.

S&P Global Platts Analytics projects oil demand will surge 6.9 million b/d from June to August.

Avoiding a U-turn

But some delegates are sounding caution about going too fast, too soon, with many parts of the world struggling to contain coronavirus infection rates and the global aviation sector still ailing.

"The pandemic remains an uncertainty for balances," one delegate said, on condition of anonymity.

Another delegate said he was wary of a repeat of June 2018, when the OPEC+ coalition agreed to hike quotas by 1 million b/d after the US withdrew from the Iran nuclear deal, only to be wrong-footed when the White House weeks later offered waivers for several countries to continue importing Iranian oil, causing crude prices to crash.

OPEC+ ministers had to reverse course on their production increase with new, stricter quotas by November 2018.

Now Washington and Tehran are attempting to revive the nuclear deal, but talks have repeatedly hit a stalemate and Iran's election of hardliner Ebrahim Raisi as president may complicate the negotiations. That could delay a return of Iranian oil to the market, though it is also possible a deal can be clinched within weeks. Raisi will be inaugurated in August.

"We must not have short memories, and we must learn from our recent experiences," the delegate told Platts.

OPEC+ negotiations on August production levels will pick up in earnest on June 29, with a meeting of the delegate-level advisory Joint Technical Committee, before the nine-country Joint Ministerial Monitoring Committee co-chaired by Saudi Arabia and Russia convene on June 30.

The final decision on production levels will be made July 1, when the entire OPEC+ coalition assembles online.

-----

Earlier: