U.S. TAX BENEFITS FOR CLEAN ENERGY

By KIMBERLY MCKENZIE-KLEMM Industry Technical Writing and Editing TPGR Solutions

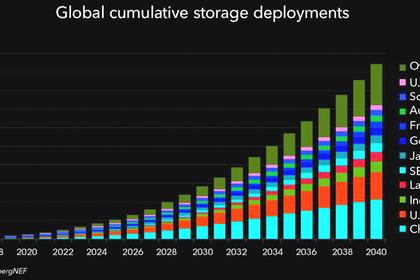

ENERGYCENTRAL - Jun 3, 2021 - Within the last five (5) years the taxes relaxation on alternate "safe" energy has allowed the energy community to broaden its base and to continue to formulate interactive use exchange variables and savings. On the other hand, the energy community has Suffered under massive job loss rates, and alternative energy (wind, solar, hydroponics, natural gas, etc.) is already relying heavily on energy storage credits, or “banked energy” to compensate for employment deficits. Tax credit extensions and cash refunds for clean energy are current motions under consideration in the US House of Representatives cabinets. In 2017 the Senate posed the Tax Cuts and Job Act that "left out most of the changes that caused angst to the renewable energy industry" (Tracy, Stephen B., "How Does Renewable Energy Fare under House, Senate Tax Reform Proposals"; Novogradac, November 21, 2017). Moving cautiously forward with changes to the 2017 Tax Cuts and Job Act, most proposed injection funds and tax duration suspensions benefit the end user customers more than enriching energy community companies.

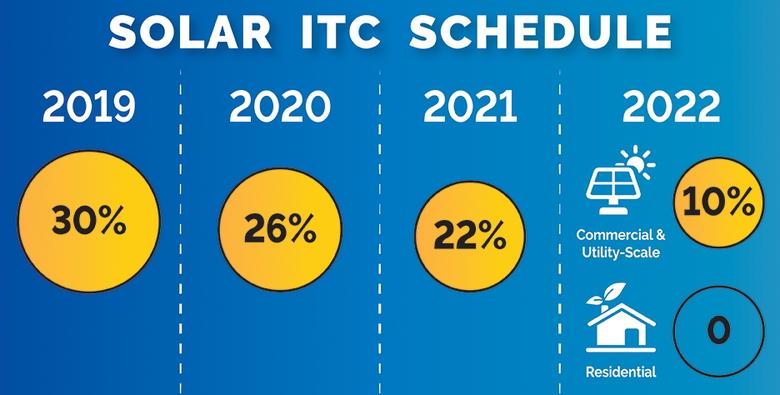

Specific tax credits for renewable energy, (such as the “Production Tax Credit” (PTC)), are in the process of expiring in 2020 through 2023. As these cancellations include energy efficiency provisions and property protections, the energy community is facing and increased difficulty in recovering investments. This expiration of current tax reforms creates a market barrier for both clean energy customers and alternate energy companies and producers. (Sherlock; Crandall-Hollick and Marples; “Energy Tax Provisions Expiring in 2020, 2021, 2022, and 2023 (“Tax Extenders”)”; Congressional Research Service, (FAS), July 14, 2020). The Investment Tax Credit (ITC) functions as an optional decision used instead of the PTC and carries an extension into 2021 and 2022. The ITC is a lengthier funding decision with energy industry communities requiring the support of the beginning of construction (BOC) for new renewable energy efforts.

The beginning of construction (BOC) support for alternate energy sustainability enlists PTC or ITC rolled into the BOC deadline years that stretch in some renewable energy communities up to 2024 through 2026. (Kwok, Judy; “Renewable Tax Extenders Passed by Congress''; MINTZ, December 22, 2020). These tax credits are subject to reforms under the U.S. Senate review as they are held status quo in the U.S. House of Representatives. Under some of the best options, changes to the current renewable energy communities taxation policies will not be altered until the tax extension expirations presently set in place. Included in better decisions to hold to, for gains investment rollbacks, profits cannot be eliminated in efforts to offset tax credits without imposing too many operable limitations. Alternate energy operations functions focus on sustainable foundations instead of government tax and business props. To remain healthy businesses, the renewable energy provider communities require the capability per capita of a percentage of private sector investment to realize the full benefits of tax credits and reforms.

Stating the renewable energy community as finding expansion of systems use moving forward under PTC follows with a caution to not over extend within the tax credit environment and to keep moderate investments for alternative energy operations. Household customers and community-wide (“tribal”) green energy developments are a focus of the 2020 and 2021 ITC extensions. This assures alternative clean energy does not divest from industry structures issues. There is some worry that customer systems sustainability will backlash when tax credit extensions expire if industry level claims remain largely ignored in current distribution and recyclable energy expanded efforts. Commenting on renewable energy in 2018 “The reduced corporate tax rate, as well as the opportunity to immediately expense newly acquired assets...allowing (allows) for manufacturing operations in the U.S. to be more profitable”, (Hunt, Dorian; Sprately, Christine; “The Renewable Energy Industry Must Adapt to U.S. Tax Reform”; https://www.areadevelopment.com/energy/Q1-2018/renewable-energy-industry-must-adapt-to-US-tax-reform.shtml ). Current assessments of renewable energy tax reforms have attention at each individual category of alternative clean energy production.

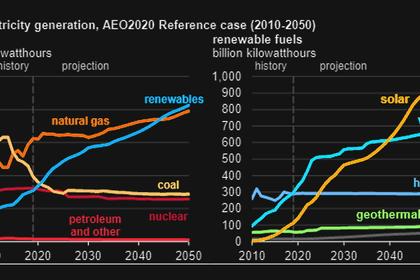

Looking forward, best practices from wind, solar, hydroponic, natural gas and combination energy systems have a void to fill to contain expansion within sustainability rates. As the renewable energy community ramps up production and takes stock of tax reforms quickly running out of benefits, consumers need to remain persuaded to continue alternate energy use and to subscribe to primary or combination alternate energy generation. Proof of service and continued availability of renewable energy sources will encourage end users to keep investing and assist the energy community with the struggles of providing clean alternative energy during the decision struggles of the tax reforms under consideration.

-Dr. Kimberly A. McKenzie-Klemm

- (Tracy, Stephen B., "How Does Renewable Energy Fare under House, Senate Tax Reform Proposals"; Novogradac, November 21, 2017).

- (Sherlock; Crandall-Hollick and Marples; “Energy Tax Provisions Expiring in 2020, 2021, 2022, and 2023 (“Tax Extenders”)”; Congressional Research Service, (FAS), July 14, 2020).

- (Kwok, Judy; “Renewable Tax Extenders Passed by Congress''; MINTZ, December 22, 2020).

- (Hunt, Dorian; Sprately, Christine; “The Renewable Energy Industry Must Adapt to U.S. Tax Reform”; https://www.areadevelopment.com/energy/Q1-2018/renewable-energy-industry-must-adapt-to-US-tax-reform.shtml

-----

-----

Earlier: