U.S. LNG DEMAND UP

PLATTS - 23 Jun 2021 - US LNG feedgas demand hit its highest level in more than three weeks June 23 as deliveries to Cheniere Energy's Sabine Pass terminal rebounded, and maintenance appeared to have wrapped up at Sempra Energy's Cameron LNG facility, S&P Global Platts Analytics data showed.

Both facilities are in Louisiana. A Cheniere spokeswoman declined to say if Sabine Pass -- the biggest US liquefaction facility -- had been undergoing scheduled works.

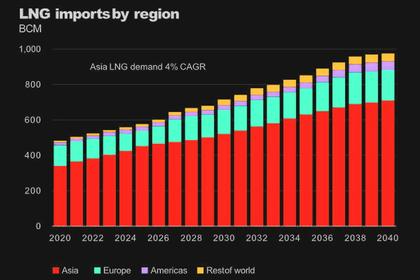

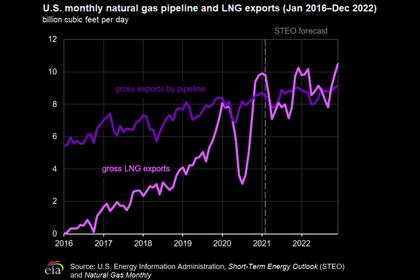

Wide spreads between the price of LNG in end-user markets in Asia and Europe and feedgas prices based on the US Henry Hub have been incentivizing robust export activity from the US Gulf and Atlantic coasts. Platts Analytics expects those trends to persist through the balance of summer.

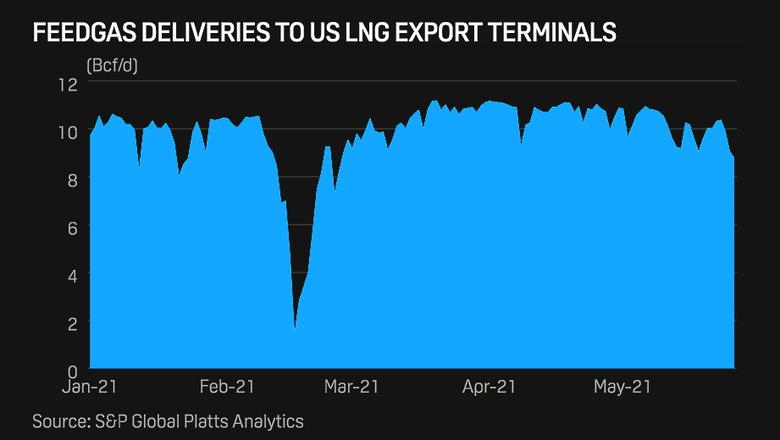

Feedgas deliveries to the six major US liquefaction facilities totaled 11.04 Bcf/d, based on nominations for the morning cycle. That was up 1.6 Bcf/d from June 22 and the highest level since June 1, Platts Analytics data showed.

The day-on-day jump was largely driven by the rebound in flows to Sabine Pass. Flows to Cameron LNG were stable above 1.8 Bcf/d for the fourth day in a row, suggesting that maintenance at the facility, which a spokeswoman previously confirmed, had concluded after lasting about two weeks.

According to Platts Analytics data, US Gulf Coast LNG netbacks are now strongly favoring the JKM through the balance of summer, which should encourage record trade flows from the Atlantic Basin to the Pacific Basin, and will likely necessitate a strong pickup in Eastward voyages around the Cape of Good Hope.

The dynamics have been fueled in part by persistent Chinese import strength, strong power-sector driven LNG demand in South Korea, and flat Asian LNG supply year on year.

Latin America represents another source of strong LNG demand. Massive hydropower shortages in Brazil due to the country's worst draught in nearly a century and a poor upstream recovery in Argentina have created additional tightness in the global LNG spot markets this summer, Platts Analytics data showed.

In the US, feedgas demand could see another boost by the end of the year, when Venture Global's Calcasieu Pass terminal in Louisiana and Sabine Pass' sixth liquefaction train are expected to begin production. That timing would be about a year earlier for both.

Elsewhere, commercial activity has picked up recently for some developers of new liquefaction terminals proposed to be built in the US.

Tellurian will soon sign a long-term lease with the port authority where its proposed Driftwood LNG facility is to be built in Louisiana so it can begin preparing the site for full construction. NextDecade continues to target a final investment decision on a two-train initial phase of its Rio Grande LNG project in Texas by the end of 2021.

After a two-year lull in firm commercial activity, Tellurian signed sales and purchase agreements -- a week apart in late May and early June -- with commodity traders Gunvor and Vitol for a combined 6 million mt/year of Driftwood supplies. NextDecade has not announced any long-term offtake deals tied to Rio Grande LNG since a 2019 agreement with Shell.

-----

Earlier: