ASIA INDEXES UPDOWN

REUTERS - July 2, 2021 - Asian stock markets made a subdued start to the second half of 2021 on Thursday, weighed by worries about new coronavirus infections and fresh lockdowns, while bond and currency markets were on edge ahead of U.S. labour data.

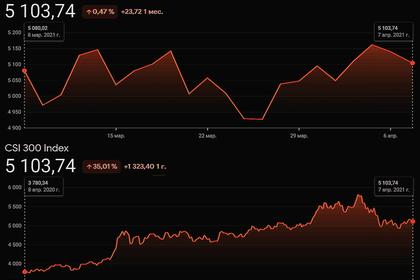

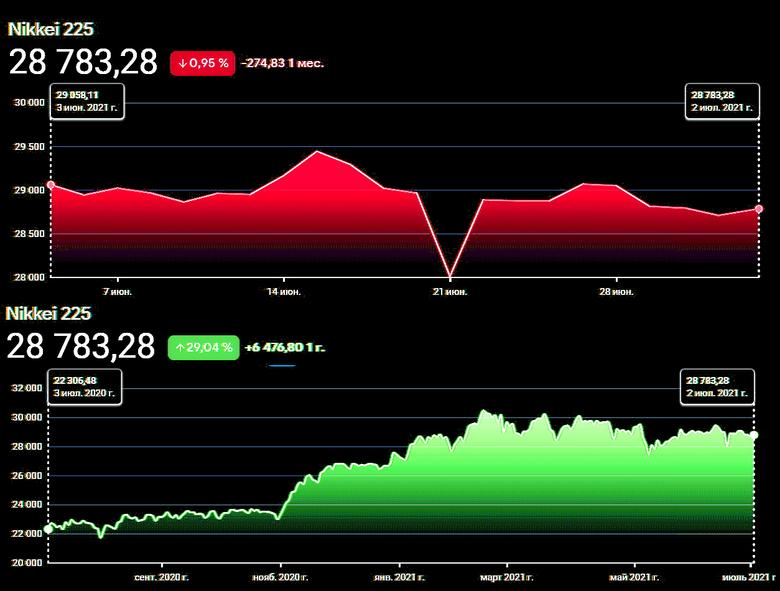

Japan's Nikkei (.N225) was 0.3% lower while MSCI's broadest index of Asia-Pacific shares outside Japan (.MIAPJ0000PUS) fell 0.2% in thin trade as Hong Kong markets were shut for a holiday.

The U.S. dollar hit a 15-month high against the Japanese yen and Treasury yields held steady.

"The virus is still playing a role ... although it's difficult to see much direction in anything at the moment," ING economist Rob Carnell said on the phone from Singapore.

"There's a broad sense that the dollar isn't such a bad unit to be holding," he said, as traders turned to U.S. jobs data due Friday for the next clue on the Federal Reserve's rates outlook.

"Everyone is a little bit jittery ... and there's so much money around that virtually every bet is covered," he said.

"The market is completely divided - I think that's why things are pretty rangey," he added.

U.S. private payrolls beat expectations overnight, although they are an unreliable guide to the broader labour-market data due out on Friday, which economists forecast will show 700,000 jobs were added in June.

Data in Asia on Thursday painted a mixed picture, with Japanese manufacturers' mood at a two-and-a-half year high, but factory activity growth there slowing down in the face of difficulty sourcing computer chips.

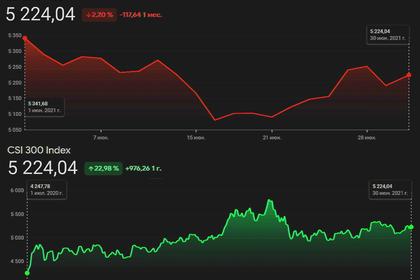

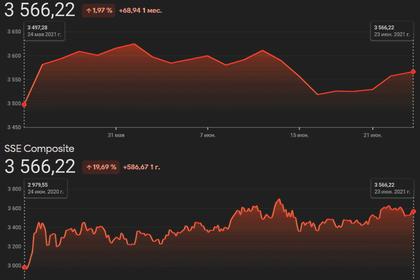

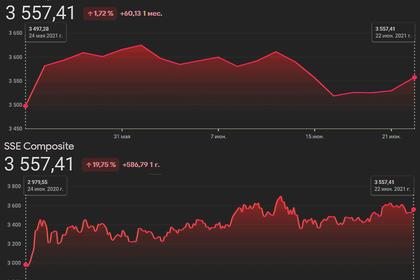

Slower vaccination rates in Asia and the extension of restrictions to curb the spread of the virus as the delta variant spreads - as well as a regulatory crackdown on Chinese tech giants - have had regional markets lagging this year.

The MSCI index closed out the first half with a gain of 5.8% compared with world stocks' (.MIWD00000PUS) rise of 11.4% and a gain of 14.4% for the S&P 500, which logged its fifth consecutive record closing high to end last month.

EYES ON PAYROLLS

For bond and currency markets the focus this week is on the U.S. non-farm payrolls data and its implication for rates.

Since a hawkish shift in tone from the Federal Reserve last month, the U.S. dollar has been elevated and bond markets whipsawed by worries about high inflation and whether it prompts a sooner or swifter than expected end to ultra-easy policy.

Signs of strength in the labour market could add pressure on the Fed to act, and the prospect of higher rates could lift the dollar, while it is vulnerable if the data misses expectations.

Economists polled by Reuters expect a gain of 700,000 jobs for June, up from 559,000 in May. But variation among the 63 estimates is big, ranging from 376,000 to more than a million.

"Unless the monthly jobs report disappoints, the level to beat for the dollar index is the year's high at 93.4," analysts at DBS Bank in Singapore said in a note.

The U.S. dollar index , which measures the greenback against a basket of six major currencies, hit its highest since April overnight and sat at 92.406 on Thursday.

The dollar also traded near its strongest against the euro since April at $1.1850 and hit its highest since March 2020 at 111.16 yen .

The yield on benchmark ten-year U.S. Treasuries was steady in Asia at 1.4663%.

In commodity markets, prices for metals seem to be stabilising below May peaks and oil was edging up to re-test the multi-year highs touched earlier in the week.

Brent crude futures were last up 0.3% at $74.81 a barrel. Corn extended a sharp overnight bounce as lower-than-expected U.S. planting supported prices.

-----

Earlier: