EUROPEAN INDEXES UP

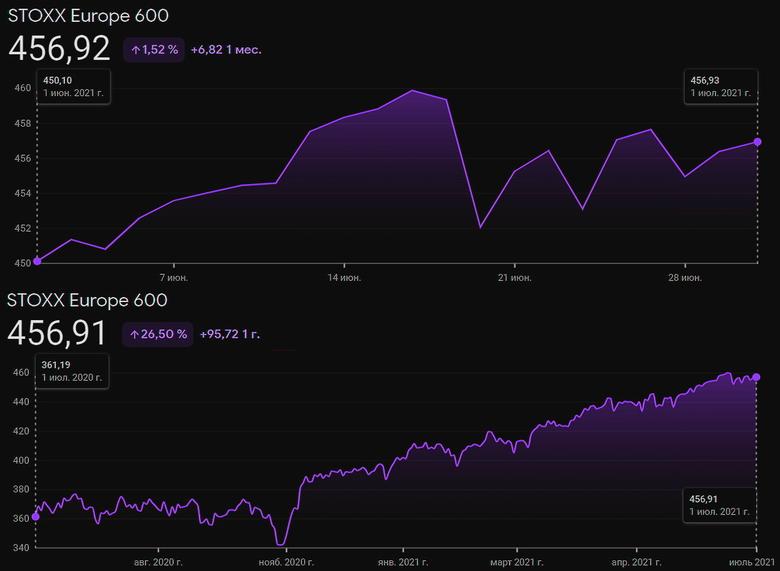

REUTERS - July 1, 2021 - European shares neared a record high on Thursday as a slate of upbeat corporate results helped investors shake off concerns around a jump in inflation as well as the global spread of the Delta variant of the novel coronavirus.

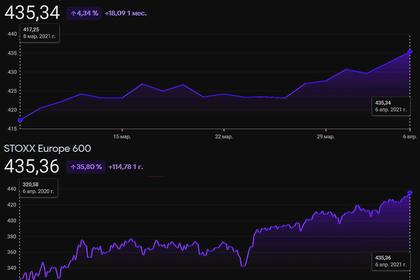

The pan-European STOXX 600 was up 1.0% after ending Wednesday with its fifth straight quarter of gains, and was set for its best session in more than a month.

Travel-related stocks jumped 2.3% after falling for four days in a row on fears of more restrictions following a spike in the number of COVID-19 cases in Asia and the UK.

Airlines EasyJet, British Airways-owner IAG and Ryanair rose between 3% and 4% to the top of the STOXX 600.

The benchmark index scaled all-time highs in June as signs of a steady economic recovery sparked demand for economically sensitive stocks, including banks and miners, but gains slowed in the past two weeks as a jump in inflation raised fears of a sudden tapering in monetary stimulus.

Now, “growing concerns about the recovery in the second-half have in turn reduced fears of an imminent withdrawal of monetary stimulus,” said Deutsche Bank strategist Jim Reid.

After data earlier in the week showed a sharp improvement in European economic sentiment in June, figures on Thursday confirmed the euro zone manufacturing sector expanded last month at its fast pace on record.

Bourses in Italy and France rose 1% and 1.1%, respectively, following upbeat domestic factory activity data, while Germany’s DAX jumped 1% as data showed retail sales in Europe’s biggest economy rebounded in May.

In company news, Associated British Foods jumped 4.5% to the top of the STOXX 600 as it said third-quarter sales at its Primark fashion stores that reopened after COVID-19 lockdowns were ahead of expectations in all markets.

French catering and food services group Sodexo surged 5.0% to a more-than-one-month high after raising its second-half revenue and profit margin forecasts, betting on the full reopening of U.S. schools.

Fashion retailer H&M, on the other hand, fell 2.3% as its second-quarter earnings remained well below pre-pandemic levels.

Underlining the “risk-on” trade, real estate and healthcare stocks — so-called defensive stocks that are considered safe bets at times of economic turmoil — were among the smallest gainers in morning trading.

-----

Earlier: