OIL PRICE: ABOVE $75

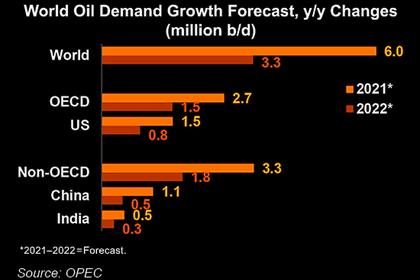

REUTERS - July 30, 2021 - Oil prices dropped on Friday but remained on track to post steep weekly gains with demand growing faster than supply, while vaccinations are expected to alleviate the impact of a resurgence in COVID-19 infections across the globe.

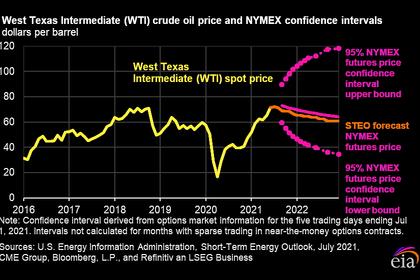

Brent crude futures for September , which expires on Friday, fell 45 cents, or 0.6%, to $75.60 a barrel by 0506 GMT, following a 1.75% jump on Thursday.

The more active Brent contract for October was down 48 cents, or 0.6% to $74.62 per barrel.

U.S. West Texas Intermediate (WTI) crude futures fell 43 cents, or 0.6%, to $73.19 a barrel, whittling down a 1.7% rise from Thursday.

"Oil prices pulled back slightly amid cautious sentiment across the Asia Pacific markets as investors weighed virus concerns and weaker-than-expected U.S. GDP and jobs data," said Margaret Yang, a strategist at Singapore-based DailyFX.

But both benchmark contracts were headed for gains of around 2% for the week, buoyed by indications of tight crude supplies and strong demand in the United States, the world's biggest oil consumer.

"This week, oil prices were buoyed by a weaker U.S. dollar and strong U.S. corporate earnings. But rising COVID-19 cases attributed to the Delta variant in the United States may cast a shadow over the demand outlook," Yang said.

U.S. refiners Valero Energy (VLO.N) and PBF Energy (PBF.N) have reported quarterly results that surpassed analysts' expectations.

Even with coronavirus cases rising in the United States, all around Asia and parts of Europe, analysts said higher vaccination rates would limit the need for the harsh lockdowns that gutted demand during the peak of the pandemic last year.

"The global recovery remains on track, and by association, oil consumption even if that recovery will be much more geographically uneven than previously expected," said Jeffrey Halley, analyst at brokerage OANDA.

Analysts also point to a rapid rebound in India's gasoline consumption and industrial production following its COVID-19 surge earlier this year as a sign that economies are more resilient to the pandemic.

"Yes, Delta is a risk, but is it going to derail demand growth in the second half? We may not see that," said Commonwealth Bank commodities analyst Vivek Dhar.

-----

Earlier: