OIL PRICE: BELOW $76

REUTERS - July 2, 2021 - Oil prices edged lower on Friday after OPEC+ ministers delayed their output policy meeting, with sources saying the United Arab Emirates had balked at plans to return 2 million barrels per day (bpd) to the market in the second half of the year.

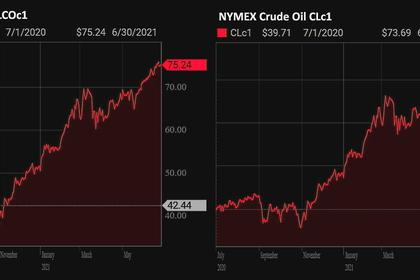

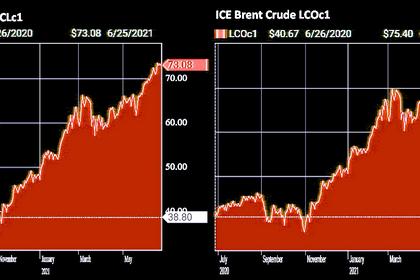

Brent crude futures were down 20 cents at $75.64 a barrel by 0720 GMT after rising 1.6% on Thursday.

U.S. West Texas Intermediate (WTI) crude futures were down 15 cents at $75.08, having jumped 2.4% on Thursday to close at their highest since October 2018.

Both benchmark contracts had registered Thursday's gains on unexpectedly cautious plans by the Organization of the Petroleum Exporting Countries (OPEC) and allies, together known as OPEC+. The proposal, which sources said was supported by Saudi Arabia and Russia, was for the producer group to add back 400,000 bpd a month from August until the end of the year.

Prices retreated, though, after the plan was reported to have met resistance from the UAE and OPEC+ postponed a ministerial meeting to Friday.

"Oil bulls lapped up rumours that the producer alliance was close to agreeing on a deal to ease supply cuts," said Stephen Brennock of oil broker PVM. "Prices, however, pulled back from earlier highs after talks were adjourned for a day."

"Yet this hiccup will not change the inevitable. OPEC+ will relax their production curbs by raising oil output in August."

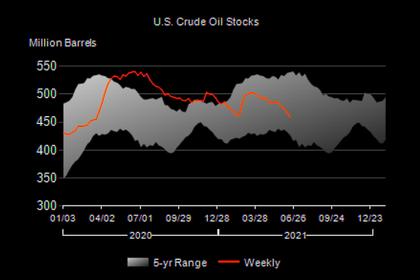

WTI was on track for a 1.6% rise for the week, with the U.S. crude market expected to tighten as refinery runs pick up to meet recovering gasoline demand.

Brent was heading for a 0.5% fall on the week, reflecting concerns about fuel demand in parts of Asia where cases of the highly contagious COVID-19 Delta variant are surging.

Citi analysts said they do not expect WTI to climb to a premium to Brent because they expect U.S. oil output to pick up at the end of 2021 and grow further in 2022.

-----

Earlier: