OIL PRICE: NOT ABOVE $75 AGAIN

REUTERS - July 28, 2021 - Oil prices climbed on Wednesday after industry data showed U.S. crude and product stockpiles dropped more than expected last week, bolstering expectations that demand will outpace supply growth even amid a surge in COVID-19 infections.

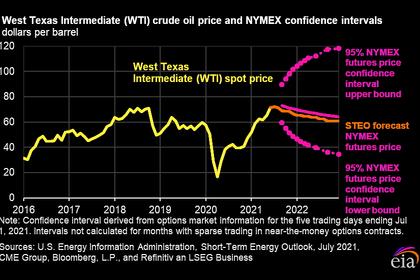

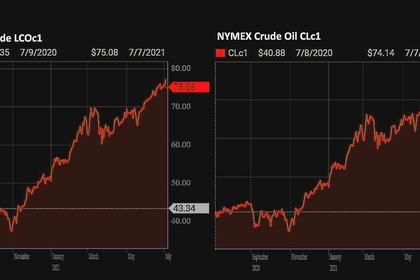

Brent crude futures rose 38 cents, or 0.5%, to $74.86 a barrel at 0641 GMT, after shedding 2 cents on Tuesday in the first decline in six days.

U.S. West Texas Intermediate (WTI) crude futures were up 42 cents, or 0.6%, at $72.07 a barrel, reversing Tuesday’s 0.4% decline.

“Oil prices are riding the tailwind of a weakening U.S. dollar and falling API crude inventories today,” said Margaret Yang, a strategist at Singapore-based DailyFX.

“But the upward momentum appears to be weak amid virus concerns and sporadic lockdowns around the world,” Yang added.

Data from the American Petroleum Institute industry group showed U.S. crude stocks fell by 4.7 million barrels for the week ended July 23, according to two market sources, who spoke on condition of anonymity.

That compared with analysts’ expectations for a 2.9 million fall in crude stocks, following a surprise rise in crude inventories the previous week in what was the first increase since May.

Traders are awaiting data from the U.S. Energy Information Administration (EIA) on Wednesday to confirm the drop in stocks.

“A more significant than expected fall (in EIA data) could be enough to shake Brent and WTI out of their ranges and test the upside,” said Jeffrey Halley, analyst at brokerage OANDA.

The API data showed U.S. gasoline inventories dropped by 6.2 million barrels in the week to July 23, while analysts had expected a 900,000-barrel decline.

Gasoline demand in the United States has nearly recovered to 2019 levels, but analysts said the summer rebound in fuel consumption could be turning into a slowdown because of resurgent coronavirus cases and structural changes in commuting patterns.

The International Monetary Fund on Tuesday, however, maintained its 6% global growth forecast for 2021, upgrading its outlook for the United States and other wealthy economies but cutting estimates for developing countries struggling with surging COVID-19 infections.

-----

Earlier: