OPEC+ 2 MBD

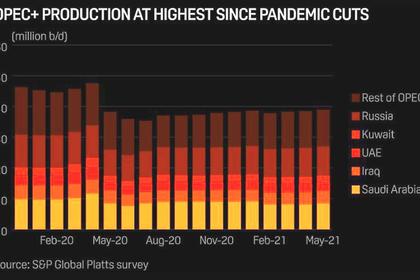

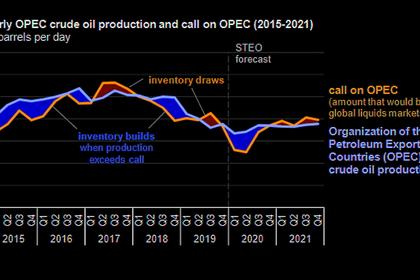

PLATTS - 01 Jul 2021 - OPEC and its allies appear in striking distance of a deal on production quotas, discussing proposals that call for an output increase of about 2 million b/d from August to December to meet recovering global oil demand, three sources told S&P Global Platts.

If agreed, the OPEC+ alliance's collective production cuts would shrink by about one-third by the end of the year to about 3.76 million b/d, from July's 5.76 million b/d.

The sources, who spoke on condition of anonymity, said the deal was not yet finalized and that Saudi Arabia was seeking some flexibility to rescind all, or part of the output increases, if Washington and Tehran revive the nuclear deal that relieves sanctions on Iran's oil exports.

Platts Analytics forecasts that Iranian crude and condensate exports could rise to 1.5 million b/d in December from 600,000 b/d in May, if a nuclear deal can be clinched in the coming weeks, though talks appear to have stalled after six rounds of negotiations in Vienna.

OPEC ministers began their formal meeting earlier July 1. Russia and nine other partners will join the talks later in the day.

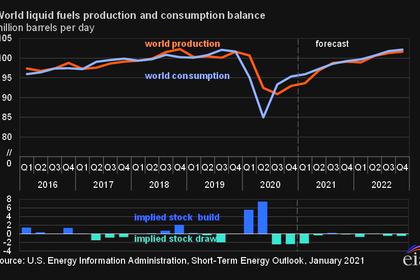

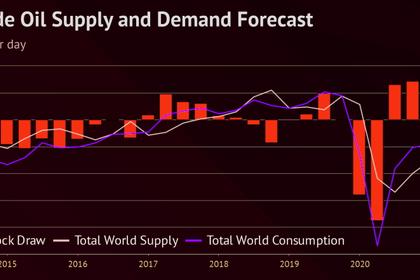

An advisory technical committee met June 29 to review the latest forecasts devised by the OPEC secretariat, the base case of which sees oil demand rising 6 million b/d in 2021, with world economic growth at 5.5%.

According to the analysis, which was seen by Platts, if OPEC+ countries hold production levels flat through the rest of the year, global oil demand would exceed supply by 1.6 million b/d in Q3 and 2.2 million b/d in Q4.

Ministers are also considering whether to extend the OPEC+ supply cooperation accord beyond its April expiry to the end of 2022, delegates said.

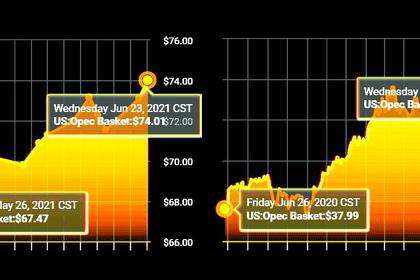

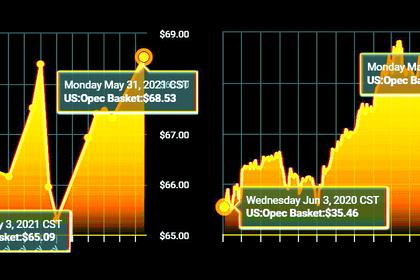

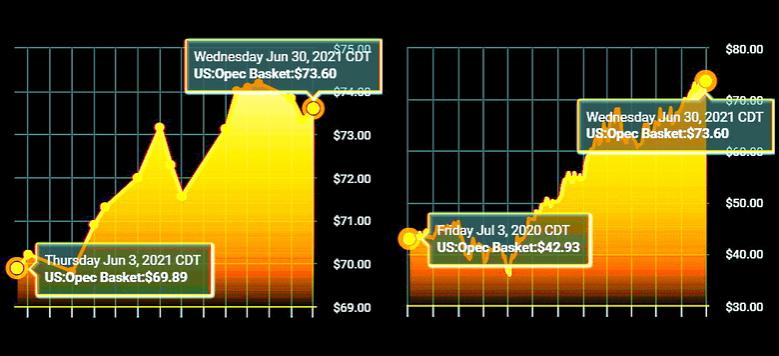

Platts assessed Dated Brent at $76.19/b on June 30, a more than 50% rise since the beginning of the year and a far cry from when the price bottomed out at $13.24/b on April 21, 2020.

-----

Earlier: