OPEC+ NO QUOTAS

PLATTS - 07 Jul 2021 - Crude oil futures were slightly lower to steady during mid-morning trade in Asia July 7, following a deterioration in sentiment in the broader financial markets and a deadlock over the OPEC+ production plan sent prices lower overnight.

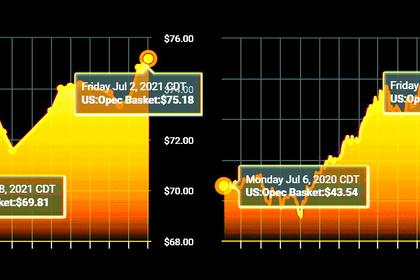

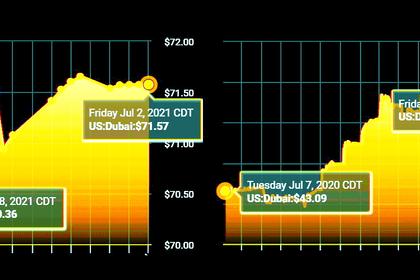

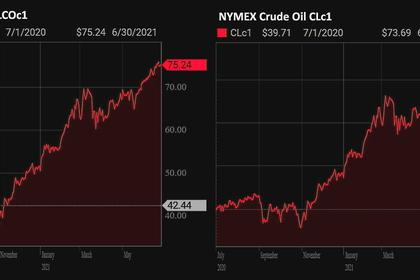

At 11:48 am Singapore time (0348 GMT), the ICE September Brent futures contract was down 6 cents/b (0.08%) from the previous close at $74.47/b, while the NYMEX August light sweet crude contract was down 2 cents/b (0.03%) at $73.35/b. The Brent marker and the NYMEX light sweet crude market had plummeted 3.41% and 2.38% overnight to settle at $74.53/b and $73.37/b, respectively.

Vandana Hari, CEO of Vanda Insights, told S&P Global Platts July 7 that the overnight fall came as markets went into a risk-off mode, which resulted in a sell-off across risk assets and a rise in the US dollar.

"The bearish sentiment came ahead of the [July 7] release of the minutes for the June meeting of the [Federal Open Market Commission], which will likely be scrutinized by investors for clues on monetary policy. The June meeting had rattled the markets earlier as it had a hawkish tilt to it, with dot plots from the meeting showing that Federal Reserve officials are leaning towards interest rate increases [by the end of 2023]," Hari said.

Meanwhile, analysts also expect greater volatility in the markets amid uncertainty over the OPEC+ coalition's supply agreement.

The OPEC+ had failed to agree to increase production quotas from August onward after the UAE objected to Saudi Arabia's plan to tie the production increases to a lengthening of the supply management pact through to the end of 2022. The UAE instead insisted that its baseline production level, from which its quota is determined, be raised first from the current 3.168 million b/d as per its October 2018 production level to around 4 million b/d, its claimed capacity.

The failure to reach a new agreement means that the alliance will rely on the fallback agreement, which calls for output quotas to remain flat at July levels, keeping 5.8 million b/d of output away from the market.

With demand expected to rise significantly in the coming months, there are concerns that keeping production quotas steady will tighten the oil market further. White House Press Secretary Jen Psaki said on July 6 that the White House has had "a number of high-level conversations" with officials in Saudi Arabia and the UAE aimed at allowing proposed OPEC+ production increases to move forward.

"As long as the OPEC+ deadlock remains, volatility in the markets is to be expected, as at any given time, the market will be running on very thin information and hence there will be a lot of speculation," Hari said.

There are also concerns of a total breakdown in OPEC+ cooperation, as member countries may be tempted to break the current supply pact in order to capitalize on the expected surge in demand. Analysts said that this could trigger a price war and unleash a flood of oil into the market, derailing the recovery in the oil market.

"There are growing concerns that a lack of unity among the group would lead to less stability in the oil market," ANZ analysts said in a July 7 note.

-----

Earlier: