INDIA'S RENEWABLE INVESTMENT UP

IEEFA - August 20, 2021 - Renewable energy investment is rising again in India following the slowdown in the previous financial year due to the onset of the COVID-19 pandemic, finds a new briefing note by the Institute for Energy Economics and Financial Analysis (IEEFA).

In the first four months of this financial year (FY), from April to July 2021, investment in the Indian renewable energy sector reached US$6.6 billion, surpassing the US$6.4 billion level for FY2020/21 and on track to easily overtake the US$8.4 billion total achieved in 2019/20 prior to the pandemic.

“Rebounding energy demand and a surge of commitments from banks and financial institutions to exit fossil fuel financing are helping to drive investment into Indian renewable energy infrastructure,” says author Vibhuti Garg, Energy Economist, Lead India at IEEFA.

The new IEEFA note explores renewable energy investment trends during FY2020/21 and for the first four months of FY2021/22, and also highlights the key deals made during both periods.

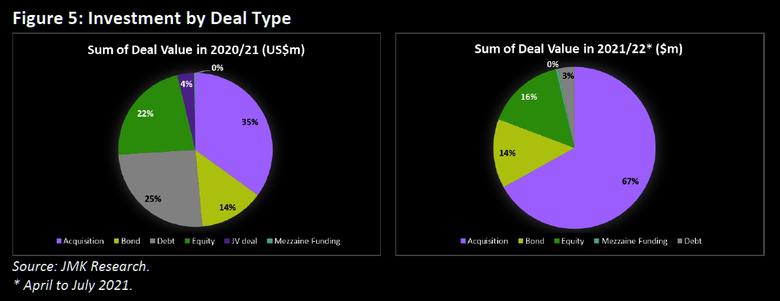

The majority of the money flowed through acquisitions which helps to recycle the capital into new projects.

The largest of around 30 deals during FY2020/21 and April to July FY2021/22 was SoftBank’s exit from the Indian renewable energy sector in May 2021 with a US$3.5 billion sale of assets to Adani Green Energy Limited (AGEL). With this acquisition AGEL became a major investor as well as the world’s largest solar developer.

Other major deals included Engie’s acquisition by Edelweiss Infrastructure Yield Plus for US$550 million, Acme’s acquisition by Scatec Solar for US$400 million, and Fortum’s acquisition by Actis for US$333 million.

Analysis of the different deal types reveals the majority of the other big deals were packaged as debt, equity investment, green bonds, and mezzanine funding.

Indian renewable energy developers are attracting huge investments from green bonds, says co-author Saurabh Trivedi, Research Analyst at IEEFA.

“In April 2021, ReNew Power raised money from green bonds with a tenor of 7.25 years at a fixed interest rate of 4.5% per annum, and this was soon trumped in August 2021 by the US$414 million 2026 green bond issue by Azure Power Global at a record low 3.575% per year.”

In the latest development, a mega US$8 billion special purpose acquisition company (SPAC) transaction between ReNew Power and RMG Acquisition Corporation II has approval from a majority of shareholders, paving the way for a Nasdaq listing with expected trading from 24 August 2021.

“This is a landmark transaction as it represents the biggest overseas listing of an Indian company via the SPAC route,” says Trivedi.

IEEFA’s note also points to several very positive developments: investment in India is clearly shifting towards renewables; the government is redoubling efforts to boost energy security and self-reliance by expanding clean energy technologies as demonstrated by Prime Minister Modi’s Independence Day speech; and Indian corporates like Reliance and JSW Energy are making big clean energy commitments.

In addition, the lending portfolios of Indian financial institutions like State Bank of India (SBI) and Power Finance Corporation (PFC) now include more renewable energy assets than fossil fuels, a trend which has picked up significantly in the last one to two years, according to the note.

In a February 2021 report, IEEFA highlighted that India will require a further US$500 billion in investment in new wind and solar infrastructure, energy storage and grid expansion and modernisation to reach 450 gigawatts (GW) of capacity by 2030.

“The decarbonisation of the energy sector will demand massive amounts of investment, and the flow of capital into this space will need to accelerate rapidly in order to meet India’s clean energy targets and enable a green recovery towards a sustainable economy,” says Garg.

India is currently investing around US$18-20 billion in energy generation capacity and a further US$20 billion in the grid on an annual basis. To achieve the Sustainable Development Scenario (SDS) in the International Energy Agency’s India Energy Outlook 2021 the country would need to triple its current rate of annual investment to US$110bn.

“This is daunting in one respect,” says Garg. “But the financial trends in Indian renewable energy and grid infrastructure over the last two to three years strongly suggest domestic and global capital can support this ambition.”

-----

Earlier: