NOVATEK PROFIT RR 164.4 BLN

NOVATEK - Moscow, 28 July 2021. PAO NOVATEK today released its consolidated interim condensed financial statements as of and for the three and six months ended 30 June 2021 prepared in accordance with International Financial Reporting Standards (“IFRS”).

(in millions of Russian roubles except as stated)

|

2Q 2021

|

2Q 2020

|

|

1H 2021

|

1H 2020

|

|

260,552

|

140,641

|

Oil and gas sales

|

501,301

|

323,236

|

|

3,900

|

3,298

|

Other revenues

|

7,734

|

5,265

|

|

264,452

|

143,939

|

Total revenues

|

509,035

|

328,501

|

|

(195,164)

|

(116,239)

|

Operating expenses

|

(373,983)

|

(262,774)

|

|

186

|

(14,077)

|

Other operating income (loss)

|

(436)

|

(47,313)

|

|

69,474

|

27,336

|

Normalized profit from operations*

|

134,616

|

66,237

|

|

83,247

|

37,655

|

Normalized EBITDA of subsidiaries*

|

159,872

|

83,038

|

|

163,230

|

71,270

|

Normalized EBITDA including share in

EBITDA of joint ventures* |

307,066

|

171,938

|

|

(14,648)

|

(50,903)

|

Finance income (expense)

|

(13,040)

|

90,550

|

|

58,364

|

72,007

|

Share of profit (loss) of joint ventures,

net of income tax |

73,211

|

(73,224)

|

|

113,190

|

34,727

|

Profit before income tax

|

194,787

|

35,740

|

|

99,287

|

41,564

|

Profit attributable to

shareholders of PAO NOVATEK |

164,439

|

10,884

|

|

88,958

|

21,220

|

Normalized profit attributable to

shareholders of PAO NOVATEK*, excluding the effect of foreign exchange gains (losses) |

164,731

|

74,767

|

|

29.63

|

7.07

|

Normalized basic and diluted earnings per share*,

excluding the effect of foreign exchange gains (losses) (in Russian roubles) |

54.86

|

24.87

|

|

47,381

|

61,340

|

Cash used for capital expenditures

|

88,827

|

102,483

|

* Excluding the effects from disposal of interests in subsidiaries and joint ventures (recognition of a net gain on disposal and subsequent non-cash revaluation of contingent consideration).

COVID-19 and Macro-Economic Environment

The global economic activity began a gradual improvement during the first half of 2021 from the negative influence of the COVID-19 virus, but questions remain on the sustainability of this recovery. Various countries have reported rising infection rates, the emergence of new virus strains (Delta and Lambda variants) and differing degrees of vaccination penetration. These have all led to stricter lockdown measures in some countries and growing uncertainties on the pace of global economic recovery.

Under these factors, the OPEC+ participants maintained restricted crude oil production targets that, together with the severe cold weather in Europe, Asia, and North America in the beginning of the year, has led to significant increases in benchmark hydrocarbons prices in the first quarter 2021. Starting from May 2021, OPEC+ began to gradually lift the restrictions on crude oil production targets due to the increased mobility of the population, signs of renewed economic activities and the recovery of crude oil demand in the major consumer countries. Nevertheless, benchmark hydrocarbons prices continued to increase in the second quarter 2021 and this increase has positively affected our sales prices in the reporting period.

Further developments surrounding the COVID-19 virus spread remain uncertain and are outside of the Group’s management control, and the scale and duration of these developments are difficult to assess. Despite these uncertainties, the Group continues to demonstrate strong operating results and implement its investment projects in accordance with the Group’s approved corporate strategy. The Group’s management continues to assess the current situation and present macro-economic environment and takes appropriate actions if deemed necessary.

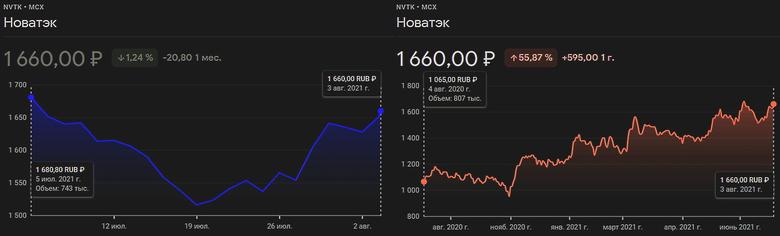

Revenues and EBITDA

In the second quarter 2021, our total revenues and Normalized EBITDA, including our share in EBITDA of joint ventures, amounted to RR 264.5 billion and RR 163.2 billion, respectively, representing increases of 83.7% and 129.0% as compared to the prior year period. In the six months ended 30 June 2021, our total revenues and Normalized EBITDA, including our share in EBITDA of joint ventures, amounted to RR 509.0 billion and RR 307.1 billion, respectively, representing increases of 55.0% and 78.6%, as compared to the corresponding period in 2020.

The increases in total revenues and Normalized EBITDA were largely due to an increase in global commodity prices for hydrocarbons, as well as an increase in natural gas and gas condensate production from the launch of gas condensate deposits of the North-Russkiy cluster in the third quarter 2020.

Profit attributable to shareholders of PAO NOVATEK

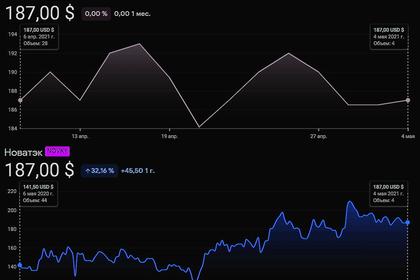

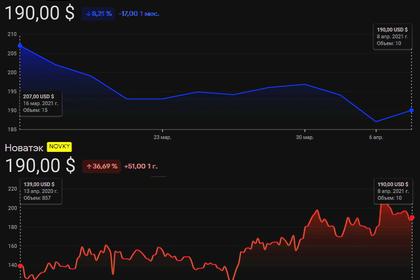

Profit attributable to shareholders of PAO NOVATEK increased to RR 99.3 billion (RR 33.07 per share) in the second quarter 2021 and to RR 164.4 billion (RR 54.76 per share) in the six months 2021 as compared to RR 41.6 billion and RR 10.9 billion, respectively, in the corresponding periods in 2020.

Normalized profit attributable to shareholders of PAO NOVATEK (excluding the effects from foreign exchange differences and the disposal of interests in subsidiaries and joint ventures) totaled RR 89.0 billion (RR 29.63 per share) in the second quarter 2021 and RR 164.7 billion (RR 54.86 per share) in the six months 2021, representing increases of 4.2 and 2.2 times, respectively, as compared to the corresponding periods in 2020.

The main factors positively impacting the Group’s Normalized profit in the second quarter and the first half 2021 were improved macroeconomic conditions, which resulted in an increase in our hydrocarbons sales prices, as well as an increase in natural gas and gas condensate production volumes.

Cash used for capital expenditures

Our cash used for capital expenditures amounted to RR 47.4 billion in the second quarter 2021 and to RR 88.8 billion in the six months 2021 as compared to RR 61.3 billion and RR 102.5 billion, respectively, in the prior year corresponding periods. A significant portion of our capital expenditures was attributable to the development of our LNG projects, the ongoing development and launch of the fields within the North-Russkiy cluster (the North-Russkoye, East-Tazovskoye, Dorogovskoye and Kharbeyskoye fields), the development of the Verhnetiuteyskiy and West-Seyakhinskiy license area, crude oil deposits of the East-Tarkosalinskoye and Yarudeyskoye fields, as well as capital spent on exploratory drilling.

Earlier: