U.S. LNG FOR BRAZIL UP

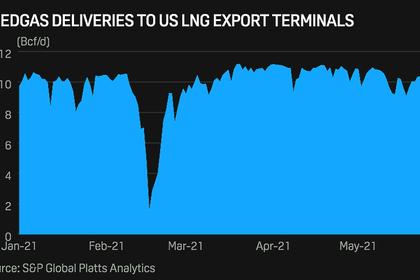

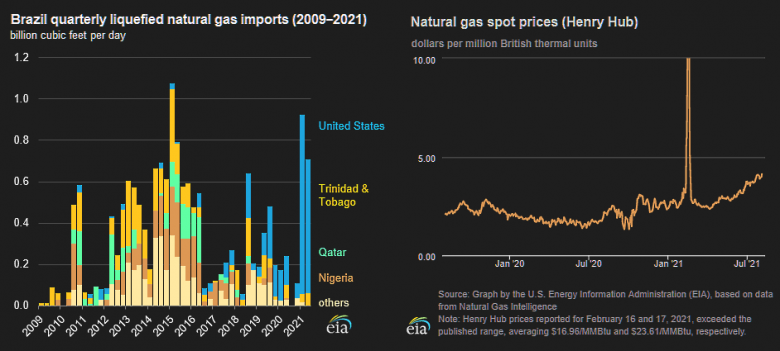

U.S. EIA - August 5, 2021 - Brazil is experiencing its worst drought in more than 90 years, leading to increased demand for electricity generation from natural gas-fired power plants to compensate for reduced generation from hydropower. LNG imports, which are typically used to manage fluctuations in Brazil’s demand for natural gas, averaged 0.9 billion cubic feet per day (Bcf/d) and 0.7 Bcf/d in the first and second quarters of 2021 compared with average volumes of 0.2 Bcf/d over the previous five years because of the increased demand from the power generation sector.

Brazil is the world’s 12th-largest economy and relies mainly on hydropower for its power generation needs. In a typical year, 65% of Brazil’s electricity is generated by hydropower plants, 20% by renewables (other than hydropower), 10% by natural gas-fired power plants, and the remaining 5% is split among coal, petroleum, and nuclear generation, according to data from Brazil’s Ministry of Mines and Energy (MME). The power and industrial sectors are the main consumers of natural gas in Brazil. In 2016–2020, power sector demand for natural gas averaged around 1.3 Bcf/d, according to MME data. However, in 2013–2015, when Brazil experienced multi-year drought conditions, natural gas consumption by the power sector increased by 0.5 Bcf/d, or about 37%, and consumption by the industrial sector increased by about 0.1 Bcf/d, or about 12%.

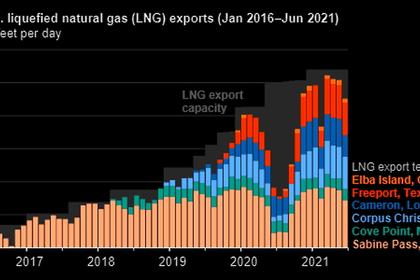

Over 90% of Brazil’s LNG import volumes in the first half of 2021 were from the United States. The 2021 quarterly LNG import values were the second-largest since 2015, when Brazil’s LNG imports were at all-time highs, according to Brazil Ministry of Economy’s foreign trade statistics (Comex Stat). Because of variability in demand for LNG imports, Brazil has no term contracts and procures LNG supplies in the global spot markets. In the last three years, most of Brazil’s LNG imports were sourced from the United States and Trinidad & Tobago.

In 2020, domestically produced dry natural gas accounted for approximately 76% (2.5 Bcf/d) of the total domestic supply, while pipeline imports from Bolivia accounted for 20% (0.6 Bcf/d), and LNG imports for 4% (0.1 Bcf/d), according to data from Brazil’s National Agency for Petroleum, Natural Gas and Biofuels. Pipelines that deliver domestically produced natural gas and imports from Bolivia are generally utilized at full capacity, while utilization of LNG import capacity in a typical year ranges from 20% to 30%. During the previous multi-year drought (2013–2015), LNG import capacity utilization averaged around 65%.

Brazil uses offshore Floating Storage and Regasification Units (FSRUs) to import LNG, which allows flexibility to move FSRU vessels between ports with existing FSRU infrastructure based on seasonal needs. The combined regasification capacity of Brazil’s four active FSRUs is 2.7 Bcf/d. Two of these FSRUs (each with a capacity of 0.7 Bcf/d) were commissioned last year as part of integrated LNG-to-power projects to serve new natural gas-fired power plants with a combined capacity 4.4 gigawatts (GW), according to the International Group of Liquefied Natural Gas Importers (GIIGNL). The first LNG cargo was transferred to the Golar Nanook FSRU at the Porto de Sergipe I in February 2020 and to BW Magna FSRU at the Port of Açu in December 2020. However, Porto de Sergipe I had not received any LNG cargoes in the first six months of this year, and Brazil’s overall LNG import capacity utilization in the first six months of 2021 averaged 30%.

-----

Earlier: