CHINA NEED COAL

PLATTS - 15 Sep 2021 - China is seen falling short of 50 million mt of metallurgical coal in 2021 amid rising domestic coking output capacity, sources said Sept. 15.

Met coal is a key raw component used in producing steel.

In 2021, the country is seen retiring 28.92 million mt of old coking output capacity, and adding 58.575 million mt of new coking production capacity, which translates to a net 29.655 million mt increase in coking capacity this year, latest data by China Securities International, or CSI, showed.

Widening deficit

China is expected to see a wide deficit for met coal supply in 2021, according to Shenzhen-based brokerage Guotai Junan Securities.

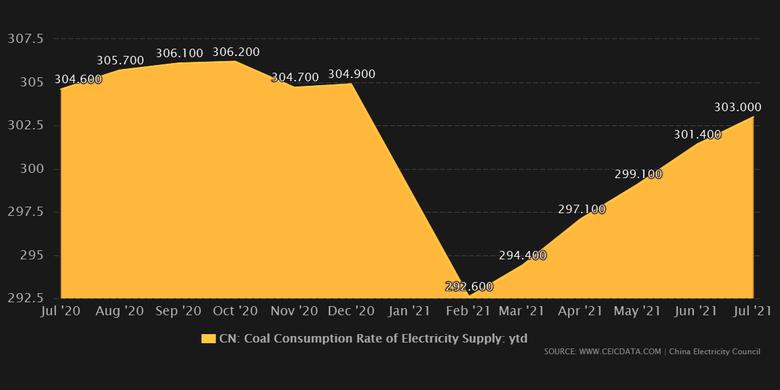

This comes at a time when China is vigorously putting effort at dual control of energy consumption and energy intensity, capping production of its high energy consuming domestic steel sector.

China has been requesting steel mills to curb their annual production in 2021 either at par, or below, 2020 levels; a move that fits into the country's plan to achieve lofty carbon goals in the coming years.

Steel mills in provinces like Jiangsu and Shandong are gradually widening their output cuts, which are expected to accelerate in the coming weeks, S&P Global Platts reported earlier.

Meanwhile, China's met coal sector has been facing its own set of issues, with domestic prices shooting up in recent weeks.

Domestic prices were at Yuan 4,035/mt ($626/mt) Sept. 8 for premium low-vol hard coking coal in the Shanxi province, rising by as much as 45% from Aug. 11, Platts data showed.

Output issues

The domestic met coal sector is finding it difficult to release back output capacity that are on hold due to environmental controls, while import restrictions play a role in propping up met coal prices, according to Guotai Junan.

China's met coal supply has been impacted by ongoing strict safety checks, the government's policy of assuring sufficient supply and price stability for thermal coal, and imported coal volume, according to CSI.

CSI said it sees limited room for domestic met coal output to rise in 2021 due to state rules capping production, while coal mine accidents in the past few months have also squeezed ore supply.

Back in August, China's National Development and Reform Commission, in a circular, agreed to let 15 coal mines in Inner Mongolia, Shanxi, Shaanxi, Ningxia and Xinjiang areas to extend joint trial production for one more year, on condition that they can only boost output by meeting safety rules.

The 15 coal mines, with a combined 43.5 million mt/year output, are expected to supply 150,000 mt/d of ore, the NDRC data showed.

Despite this, CSI sees the addition of domestic mined coal output limited in the near term, but expects coal output to rise in the medium to long run, on the back of government policy assuring supply of materials that are in shortage.

On the import side, recent COVID-19 cases have often led to the shutdown of Ganqimaodu port in Inner Mongolia, which has restricted the inflow of Mongolian met coal imports, the CSI said.

Since August, some coal truck drivers were tested positive for COVID-19 at Ganqimaodu, disrupting truck movements at customs clearance.

Ganqimaodu, a land border port, is the largest channel for importing coal from Mongolia.

Other industry sources said coal imports from North America are likely to take a long time to reach China's shores, and were expensive, which has led to limited met coal imports from the US and Canada.

-----

Earlier: