COAL POWER RETURNING

By SIMON GOESS Co-founder cr.hub

ENERGYCENTRAL- Sep 15, 2021 - In the course of 2021 so far, prices on the energy markets have reached record highs. Coal and gas prices in particular have risen sharply, reaching their highest levels in over a decade. These developments have partly led to a backswitch from gas to coal-fired power generation and thus, in connection with rising CO 2 prices, also to high electricity prices. In the following we want to clarify the connections a little.

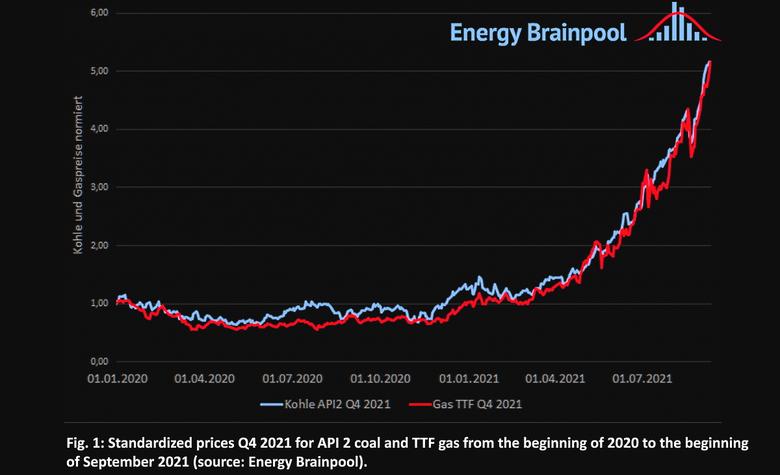

The prices of the front months and quarters for the fuels hard coal and gas have reached over 13-year and even all-time highs in the past few weeks. On the coal price side, rising global electricity demand led to higher consumption. Together with the simultaneous delivery restrictions due to strikes and weather events in Colombia and Australia, this led to sharply rising prices. The prices of the API 2 index for hard coal more than doubled from just under USD 70 / ton at the beginning of 2021 to over USD 160 / ton in September.

Record highs in coal and gas prices

Gas prices in the EU have risen due to the cold first half of the year and low storage levels. Low deliveries from Russia and deliveries of liquefied natural gas (LNG) in the even higher-priced Asian region also contributed to this. The price has tripled since the beginning of the year: At the most liquid gas trading point in the EU, the Dutch TTF, the price rose for the fourth quarter of 2021 from around EUR 17 / MWh at the beginning of 2021 to over EUR 55 / MWh at the beginning of September.

Figure 1 shows the normalized prices of the futures market contracts Q4 2021 for the hard coal price index API2 and the European reference gas price at the TTF trading point in the Netherlands from the beginning of 2020 to September 9th, 2021. The normalized price movement since the beginning of last year shows that the Prices have moved up very sharply, especially from the 2nd quarter of 2021 onwards.

Power from coal is coming back

Electricity demand in Europe has risen again since the pandemic-induced slump in 2020. At the same time, the wind energy feed-in was very low compared to the average in the first half of 2021. In Germany, electricity generation by onshore wind turbines recorded a year-on-year decline of 21 percent, while offshore plants fell by 16 percent. This means that more and more thermal power plants have generated electricity. The rising fuel costs and the higher CO 2 prices of over 50 EUR / ton thus had a price-increasing effect on the electricity prices.

The mentioned effects of low generation from renewable energies and higher consumption led to a significant increase in coal-fired power generation, at least in Germany (source: Fraunhofer ISE ). Lignite power plants, although with increasing CO 2Prices, but did not have to calculate with rising fuel costs, experienced an increase in electricity generation of almost 38 percent in the first half of 2021 compared to the same period of the previous year. Likewise, the generation of hard coal power plants up to the end of June 2021 was 39 percent above the values from the first six months of 2020. Nevertheless, generation from coal power in the first half of 2021 was still below the values from 2019. Figure 2 shows the percentage Shows changes in the net electricity production of the various generation technologies in the first half-year comparison between 2020 and 2021.

Fuel Switch or Backswitch?

Despite the sharp rise in gas prices, there is still a fuel switch from coal to gas in the overall view. In the first six months of this year, for example, German gas-fired power plants generated almost 19 percent more electricity than in 2020 and 25 percent more electricity than in 2019. The increase in coal-fired power generation is thus primarily driven by low levels of renewable generation and increased demand for electricity, but also in part due to the high gas prices this year. However, a clear backswitch from gas back to coal cannot yet be identified in Germany, despite increasing coal-fired power generation.

In this context, the relationship between the price increases between coal, gas and CO 2 is particularly important . If the increase in CO 2 prices is higher than the increase in gas prices, and if hard coal prices continue to rise, the generation costs of hard coal-fired power plants are in most cases still higher than the electricity generation costs of modern and efficient gas-fired power plants due to the higher CO 2 intensities of electricity generation . Lignite power plants also slide with even higher CO 2-Prices than before are slowly but surely falling into the red. Depending on the gas price, this would either lead to higher gas generation in Germany or higher imports of electricity to meet demand. In the past few weeks, however, the percentage increase in gas prices was higher than that in CO 2 prices , so that coal-fired power plants are in some cases driving gas-fired power plants out of the market again.

In any case, the current development shows the complex relationships on the energy market and the interaction of the various commodity prices with the shifts in the generation mix.

-----

This thought leadership article was originally shared with Energy Central's Generation Professionals Group. The communities are a place where professionals in the power industry can share, learn and connect in a collaborative environment. Join the Generation Professionals Community today and learn from others who work in the industry.

-----

Earlier: