INDIA SOLAR POWER 100 GW

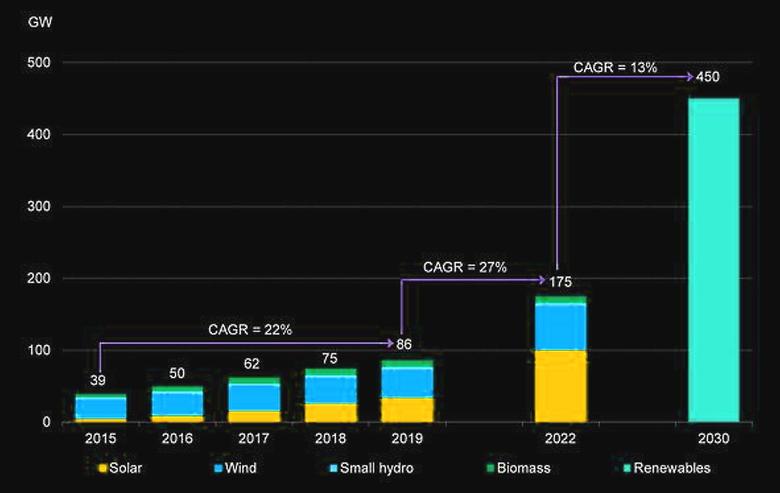

IEEFA - September 16, 2021 - India has set an ambitious target of achieving 175 gigawatts (GW) of renewable energy capacity by 2022, which includes 100GW of solar. To date, we have installed 44GW. Closing the gap between the target and installed capacity will mean higher demand for solar panels and modules in the next two to three years.

Technological advancement

The photovoltaic (PV) manufacturing supply chain consists of five sub-elements: silicon production from silicate or sand; silicon ingots; solar wafers; solar cells and solar modules. The Indian solar manufacturing story still revolves around the latter two – cells and modules, which are in a nascent stage.

As per a recent report by JMK Research & Analytics India’s cumulative solar cell and module manufacturing capacities are about 4GW and 16GW respectively. We have zero capacity to develop solar wafers or ingots and still depend on imports for raw materials like wafers, ethylene vinyl acetate (EVA), back sheet, reflective glass, semiconductors etc.

This highlights our huge technology dependency and an urgent need to develop and fund domestic R&D in the semiconductor industry.

Transitioning to a circular model for resource usage would ensure the raw materials we have available in the country are used more efficiently. The creation of ancillary markets to recycle and reuse solar cells and modules will require focused policy, technical and financial support by the government, which will, in turn, attract and motivate the private sector. Private players like Borosil Renewables Limited could play a huge role in meeting the domestic manufacturing targets.

Borosil Renewables is India’s first and only solar glass manufacturer and recently announced plans to double its capacity to 900 tonnes per day with a planned investment of Rs500 crore (US$67.5 million). Undoubtedly, the company has the potential to lead and innovate in the solar panel glass recycling process to enhance the circular efficiency of the sector.

Policy to practice

Over the past few years the Indian government has introduced various initiatives and schemes to support the domestic manufacturing industry including Make in India, the Safeguard Duty (SGD), the Basic Customs Duty (BCD), the ‘Atmanirbhar Bharat’ scheme and the recent production-linked incentive (PLI) scheme.

The 40% BCD on solar modules and 25% on solar cells starts from 1 April 2022. Although developers have a window from July 2021 (end of SGD) to April 2022 to prepare and secure the required raw materials lack of availability of a domestic raw material supply chain would impact the success and cost of manufacturing. Another key point to be considered is the positive impact of BCD on nullifying the price differential (2-3 cents/watt-peak) between domestic and Chinese modules, though the magnitude of cost parity would strongly depend on the volume and scale of manufacturing.

The COVID-19 pandemic has been an eye-opener for the renewable energy industry, spotlighting the impact of global supply disruptions on domestic solar capacity additions.

India imported approximately Rs16,000 crore (US$2.16 billion) worth of solar PV cells, panels and modules in 2018-19. And of the Rs71,000 crore (US$9.6 billion) of power equipment imports in 2018-19 in the conventional power space, Chinese equipment accounted for nearly one-third or around Rs20,000 crore (US$2.7 billion).

To enable manufacturing of all power sector equipment in India and also to encourage healthy competition amongst states, the Ministry of Power recently announced it will set up three categories of manufacturing zones in coastal, land-locked and hilly states. Here lies a great opportunity to create manufacturing hubs with availability of clean and affordable electricity; efficient usage of land and water; skilled human resources; and an ancillary equipment industry.

However, structured focus would be required to open the ancillary market to smaller businesses, energy entrepreneurs and micro, small and medium enterprises (MSME). In addition to reducing dependency on global imports, this would also lead to socio-economic development with enhanced employment opportunities, reduction in fuel imports, GDP growth and energy security.

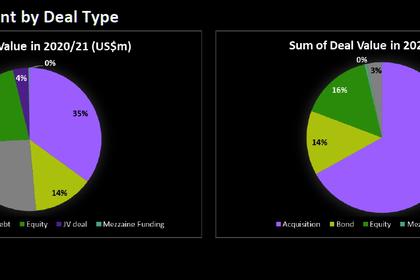

Circular investment for growth

Developing a domestic manufacturing and recycling ecosystem will be crucial to India achieving deep decarbonisation and walking a net zero pathway. To achieve this, the Rs4,500 crore (US$60.6 million) PLI scheme ‘National Programme on High Efficiency Solar PV Modules’ focuses on three factors: development of an integrated plant (silicon + wafer + cell + module); performance of modules; and capacity and scale. The higher the efficiency of the module, the higher the PLI. The more integrated the plant, the better the PLI.

Another crucial factor is ‘local value addition’ which encourages usage of local raw materials, such as glass and aluminium, but the value chain for it is still missing in India. This could lead to reduced PLI for developers as they would still depend on global exports. In addition, more clarity is required to define ‘high efficiency’.

The PLI led to positive ripples in the clean power industry with giants like Reliance Industries Ltd and First Solar announcing commitments and plans. Reliance plans to invest approximately Rs750 billion (US$10 billion) over three years to build ‘giga-factories’ in Gujarat to manufacture integrated solar PV modules, batteries, electrolysers to produce green hydrogen, and fuel cells. These plans, when implemented, will put India on the map as a global solar manufacturing player.

To facilitate its push into solar manufacturing, Reliance is now looking to buy the Norwegian solar module maker, REC Group. In addition, First Solar plans to invest Rs5,000 crore (US$67.3 million) to set up a solar manufacturing facility in India. Similarly, other Indian players like Adani Solar, Gautam Solar, Vikram Solar Limited, Waaree Energies, JSW and ReNew Power etc. are ramping up their domestic manufacturing capacity.

These positive developments will give a much-needed boost to the domestic manufacturing market. However, much more effort is needed to translate the commitments into action. Now is the time for India to seize this unique opportunity through accelerated R&D in semiconductor manufacturing; technology advancement in PV modules, cells and other manufacturing equipment; and increase private sector participation to assure investors and raise the risk appetite of developers.

-----

Earlier: