INDIA'S OIL DEMAND UP

PLATTS - 06 Sep 2021 - Indian refiners are increasingly boosting run rates amid new-found confidence that the revival in oil products demand growth is likely to be sustained, with some refiners already planning to lift runs to 100% of their capacities for the rest of the year.

Demand for gasoline hit pre-COVID levels and there are growing expectations that diesel demand would be at the pre-pandemic levels soon, although the outlook for jet fuel remains subdued. Analysts told S&P Global Platts that although the country is seeing a resurgence of the coronavirus in some pockets, it's not deep enough yet to make a large dent of overall demand.

"With the recovery in the overall demand, refining and other related operational parameters have demonstrated an even more pronounced turnaround compared to the previous year," said Shrikant Madhav Vaidya, chairman of state-run Indian Oil Corp. the country's biggest refiner.

"As I say this, the sales volume of petrol has already crossed pre-COVID level, with diesel likely to reach there in the next 2-3 months, say by Diwali," he added.

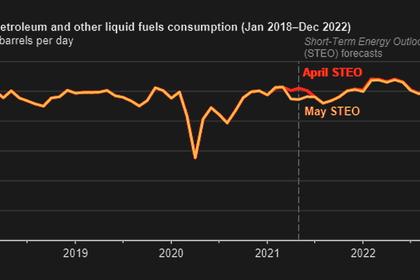

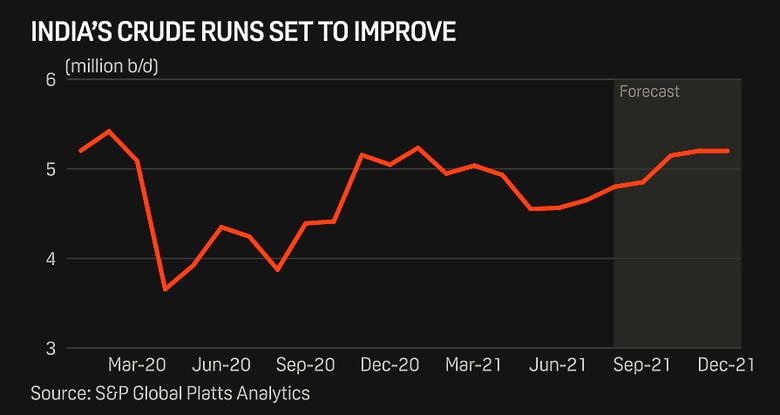

According to S&P Global Platts Analytics, India's refinery runs in the first seven months averaged 4.8 million b/d and are expected to rise to 5 million b/d for the remaining months, as demand improves in both domestic and export markets.

India's quarter-on-quarter oil demand is expected to increase by 185,000 b/d in Q3 and by as high as 525,000 b/d in Q4, driven by a more broad-based pick-up in economic activity amid widening vaccination rollout, Platts Analytics added.

Improving growth outlook

India registered a GDP growth of 20.1% year on year in the April-June quarter, according to the government data released Aug. 31.

"The high GDP growth rate confirms that the virulent second wave of the pandemic hit the medical system more than it hit the economy," said Dharmakirti Joshi, chief economist at CRISIL, a unit of S&P Global.

"That said the recovery has been uneven in recent months, with agriculture and exports being the key drives, whereas private consumption and investments have been anemic. The outlook for the rest of the year will depend on the severity of the third wave and pace of vaccination. There is some good news on the latter," he added.

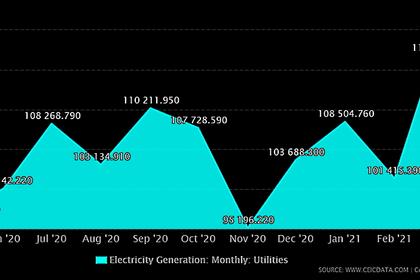

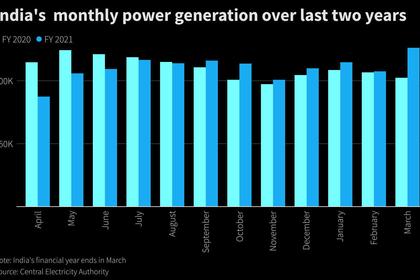

The average runs for all categories of refineries in India rose to 91% in July compared with 90% in the previous month, the latest survey of the oil ministry showed, reflecting the highest runs in three months. It was much higher than the run rate of 83% in the same period last year, a strong reflection of the overall improvement in economic activity.

In July, India's demand for oil products rose 7.9% year on year to 16.8 million mt, or 4.3 million b/d, the oil ministry said. It was 3% higher than the demand in June, according to data from the Petroleum Planning and Analysis Cell, an improvement for the second month in a row since April when the second wave of COVID-19 hit the country.

For the January-July period, demand for oil products rose 9.3% to 119.4 million mt, or 4.5 million b/d, over a year-ago period. Demand for diesel and gasoline rose by 11.9% and 15.6%, respectively, in the seven-month review period, while jet fuel demand was up 3%, LPG demand rose 2.4% and naphtha demand rose 6.5%.

In July, state-run refineries recorded 91% runs, compared with 86% in the year-ago month and 86% in June.

IOC recorded an average of 96% combined run for all its nine standalone refineries in July, compared with 91% in the year-ago and 94% in June. State-run Bharat Petroleum Corp. Ltd. registered a 100% run rate in July compared with 83% same month last year and 91% in June.

Crude runs by private refiners

Private refineries recorded an average of 90% run rates in July, compared with 78% in the year-ago period and 95% in June. Reliance's domestic unit operated at 98% in July compared with 101% in the year-ago period and 99% in June.

Its export-focused refinery ran at 76% in July compared with 49% last year and 87% in June. Reliance's combined run was 87% in July compared with 74% a year ago and 95% in June.

Rosneft-owned Nayara Energy recorded a 99% run rate in July as compared to 92% in the year ago month and 100% in June.

Indian refiners processed 19.38 million mt of crude oil in July, an average of 4.6 million b/d, up 9.6% on the year, and 5.35% higher from June levels. Analysts said refinery runs in August could improve for the second month in a row as local oil demand was set to rise.

In the January-July period, India's crude imports rose 5% year on year to 121.3 million mt, or 4.3 million b/d.

-----

Earlier: