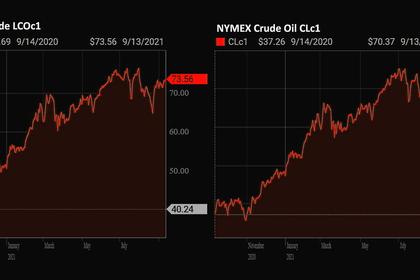

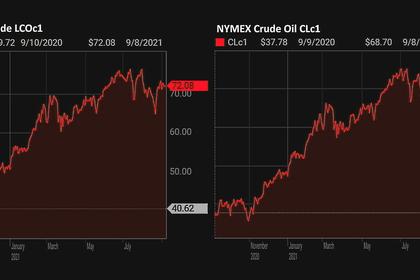

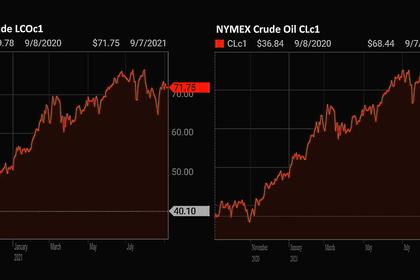

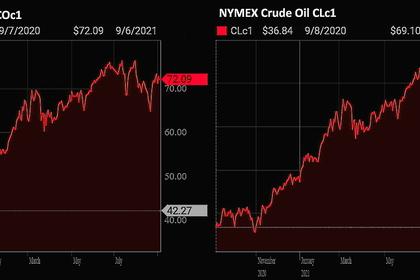

OIL PRICE: NEAR $74

REUTERS - Sept 14 - Oil prices hit a six-week high on Tuesday as another hurricane threatened to bring heavy rain to Texas and parts of Louisiana that were still recovering from Ida, and as the International Energy Agency forecast a big demand rebound for the rest of the year.

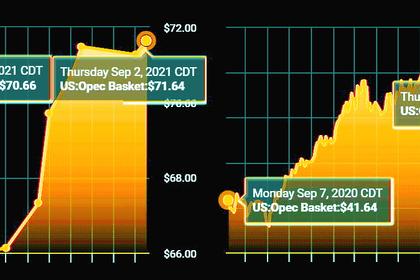

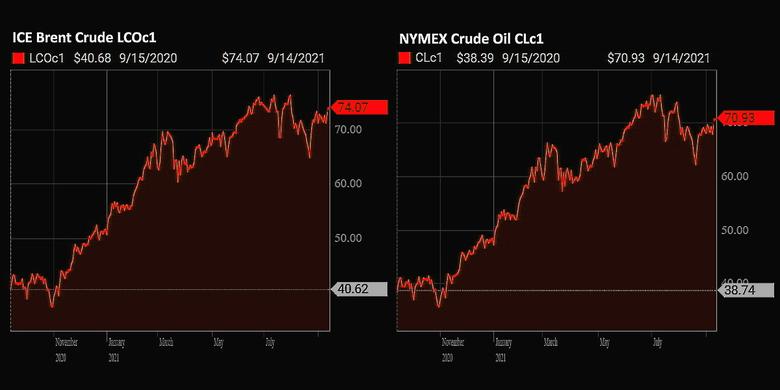

Brent crude was up 50 cents, or 0.7%, at $74.01 a barrel by 0842 GMT. U.S. West Texas Intermediate (WTI) crude also climbed 43 cents, or 0.6%, to $70.88 a barrel.

Both contracts have risen for three consecutive sessions and were trading at their highest since early August.

Evacuations were underway on Monday from offshore U.S. Gulf of Mexico oil platforms, as onshore oil refiners began preparing for Hurricane Nicholas.

"The substantial production outages in the Gulf of Mexico remain one of the factors driving prices," Commerzbank said.

About 794,000 barrels per day (bpd), or more than 40% of the U.S. Gulf's oil and gas output remained offline on Monday, two weeks after Ida slammed into the Louisiana coast, according to offshore regulator Bureau of Safety and Environmental Enforcement (BSEE).

After three months of decline in global oil demand, COVID-19 vaccine roll-outs are set to rekindle appetite for oil that was suppressed by pandemic restrictions especially in Asia, the International Energy Agency (IEA) said on Tuesday.

The IEA sees a 1.6 million bpd demand rebound in October, and continuing to grow until the end of the year.

Overall, the agency lowered its 2021 global oil demand growth forecast by 105,000 bpd to 5.2 million bpd, but raised its 2022 figure by 85,000 bpd to 3.2 million bpd.

These forecasts are well below those of the Organization of the Petroleum Exporting Countries which sees demand growing by about 5.96 million bpd this year and 4.15 million bpd next year.

The U.S. government agreed to sell crude oil from the nation's emergency reserve to eight companies including Exxon Mobil (XOM.N) and Chevron (CVX.N), under a scheduled auction to raise money for the federal budget.

Traders noted China's planned release of oil from strategic petroleum reserves (SPRs) could boost supplies available in the world's second biggest oil consumer.

Adding to price pressures, U.S. oil output from seven major shale formations is expected to rise by about 66,000 bpd in October to 8.1 million bpd, the highest since April 2020, according to the Energy Information Administration's monthly drilling productivity report.

-----

Earlier: