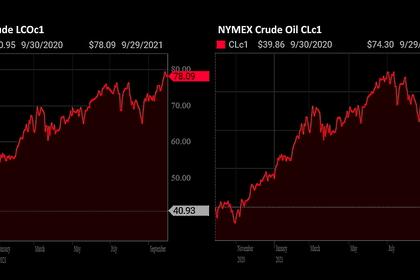

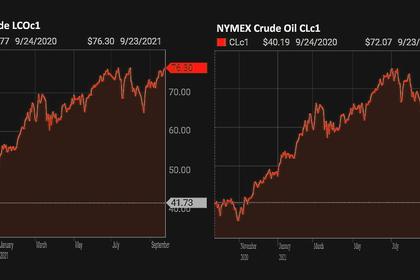

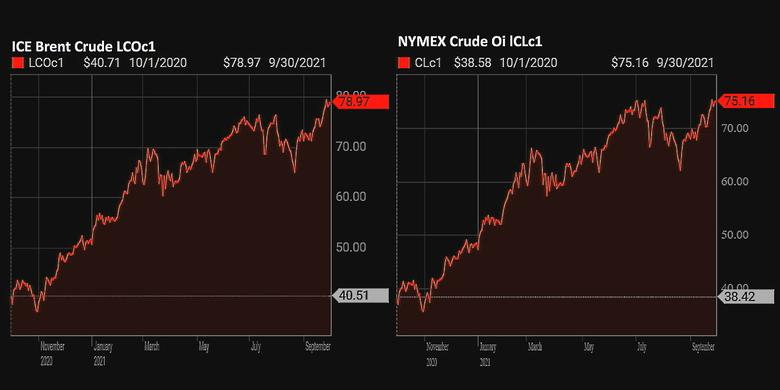

OIL PRICE: NEAR $79 ANEW

REUTERS - Sept 30 - Oil prices were mixed on Thursday as selling prompted by an unexpected rise in U.S. inventories eased, with analysts predicting supply may not keep up with a recovery in demand.

Brent crude was down 8 cents at $78.56 a barrel by 0615 GMT, after falling 0.6% on Wednesday. U.S. oil rose 11 cents to $74.94 a barrel, having also declined by 0.6% in the previous session.

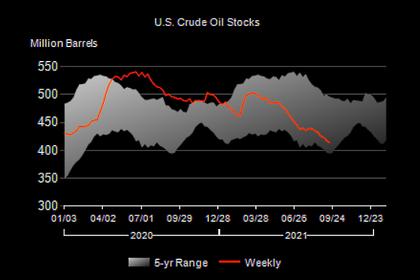

U.S. oil and fuel stockpiles increased last week, the U.S. Energy Department's Energy Information Administration (EIA) said on Wednesday.

Crude inventories were up by 4.6 million barrels in the week to Sept. 24 to 418.5 million, EIA data showed, compared with analysts' expectations in a Reuters poll for a 1.7 million-barrel drop.

Both contracts tilted into higher territory earlier in the session, following two days of losses, with oil bulls possibly looking for the next barrier to breach after Brent rose above $80 for the first time in three years on Tuesday.

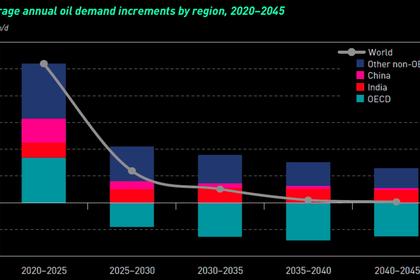

"The underlying physical fundamentals remain supportive, with the gradual ramp-up of OPEC+ supply still lagging the demand recovery," Citigroup Global Markets analysts said in a note.

Citigroup is forecasting oil balances to be in a 1.5 million-barrel-per-day deficit on average over the next six months, even with continued supply increases.

Next week, the Organization of the Petroleum Exporting Countries and allies including Russia, a grouping known as OPEC+, are expected to hold to a pact on adding 400,000 barrels per day (bpd) to their output for November.

The rise in U.S. inventories came as production in the Gulf returned to around the levels they were before Hurricane Ida hit about a month ago. Output rose to 11.1 million barrels per day last week, but U.S. drillers haven't been so quick to turn the taps on after being slammed by shareholders for fast and loose expansion in the past.

The power crisis and housing market concerns in China have also hit sentiment recently because any fallout for the world's second-biggest economy would likely have meant a hit on oil demand, analysts have said.

"Demand from fuel-switching into the power generation sector could even increase the deficit," Citigroup anlysts noted.

China is the world's biggest crude importer and its second-largest user after the United States.

-----

Earlier: