OIL PRICE: NOT BELOW $75

REUTERS - Sept 22 - Oil prices climbed more than $1 on Wednesday, extending overnight gains after industry data showed U.S. crude stocks fell more than expected last week in the wake of two hurricanes, highlighting tight supply as demand improves.

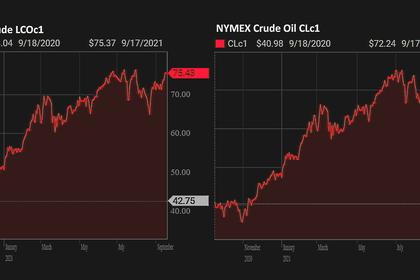

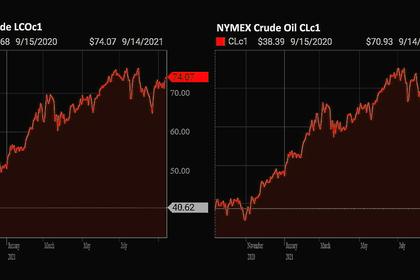

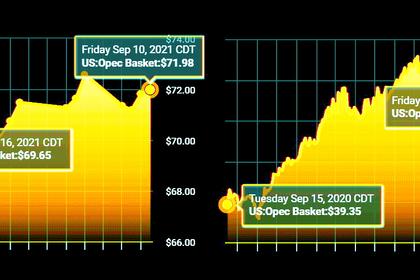

U.S. West Texas Intermediate (WTI) crude futures rose $1.08, or 1.5%, to $71.57 a barrel by 0643 GMT, adding to a 35- cent gain from Tuesday.

Brent crude futures climbed $1.03, or 1.4%, to $75.39 a barrel, after gaining 44 cents on Tuesday.

The oil market’s focus turned to concerns of tight supply, after Monday’s pressure from broad market jitters over the possible default of Chinese property developer China Evergrande Group.

“Crude is supported by the API weekly report, which noted a bigger-than-expected decline in U.S. crude oil stocks,” said Ravindra Rao, vice president of commodities at Kotak Securities.

“Prices are still rangebound ahead of the EIA weekly report due later today and ahead of the U.S. Federal Reserve’s monetary policy decision ... In the near term, crude may move with larger markets with focus on China and Fed policy.”

U.S. crude stocks fell by 6.1 million barrels for the week ended Sept. 17, market sources said, citing Tuesday’s figures from the American Petroleum Institute.

That was a much bigger decline than the drop of 2.4 million barrels in crude inventories that 10 analysts polled by Reuters had expected on average.

The market will be watching for data from the U.S. Energy Information Administration on Wednesday to confirm the big drops in crude and fuel stocks.

“Given the variety of supportive factors in the energy space, notably sky-high natural gas prices, which increase oil’s appeal as a substitute, and robust physical demand, dips in prices right now are likely to be short-lived,” said Jeffrey Halley, an analyst at brokerage OANDA.

Global gas prices are expected to break records this winter as a hot northern hemisphere summer leaves inventories low in key markets.

Supply is expected to stay tight after Royal Dutch Shell, the largest U.S. Gulf of Mexico producer, said damage to its offshore transfer facilities would cut production into early next year.

Further supporting the market, some producers in the Organization of the Petroleum Exporting Countries and their allies, together called OPEC+, are struggling to increase output up to targeted levels, sources told Reuters.

Most of the shortfall is from Nigeria, Angola and Kazakhstan.

-----

Earlier: