BEST PRACTICES FOR SOLAR ASSET MANAGEMENT

By KITTY CHACHRA CMO Quadrical Ai

ENERGYCENTRAL - Jan 6, 2022 - Solar assets differ from most financial assets, as they’re mini electrical power stations, all lined up together, to generate electricity from the sun. This annuity is not automatic, it comes with a lot more technical, safety and hazard concerns than the typical bank account. This means careful handling equals an asset that outperforms expectations versus an asset where dollars are evaporating under the sun.

Solar Asset Management is the comprehensive scope of work which ensures, that planned and modelled financial and technical returns happen at levels expected of the investment. To do this, an asset manager or more likely a team use their learnings and judgement to plan and execute services and activities needed to get optimal performance from their assets. Even in normal conditions, a Solar Asset Management team saves the hassle of monitoring, evaluating, and maintaining assets, for investors, but ‘normal’ conditions hardly ever exist in the real world.

It’s a Continuous Job

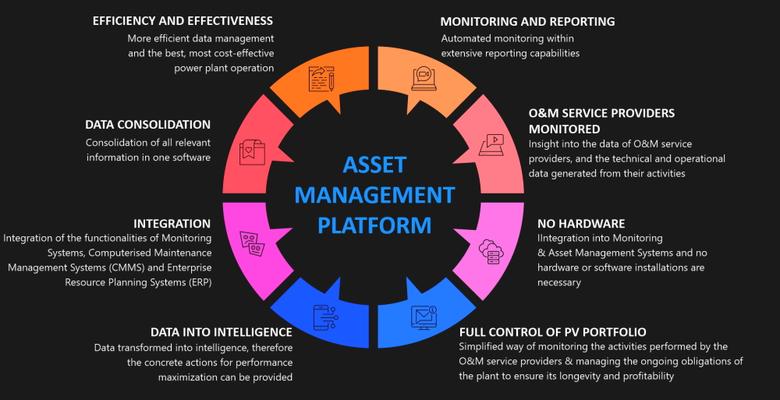

Dedicated, professional Asset Management (either internal or external) are responsible for making sure, photovoltaic (PV) plants, individually and and as a whole portfolio, achieve maximum potential from both technical and financial perspectives. Owners, investors, and lenders in the PV industry have increasingly acknowledged that competent and multidisciplinary AM services are crucial to minimizing operational risks while maximizing Return-on-Investment (ROI). Asset Managers (AM’s) also ensure vital feedback to stakeholders involved in development and construction to optimize Return on Investment (RoI).

The journey begins at plant handover (or onboarding). Whether the asset has just been constructed, or is already operational, the handover process is critical to ongoing management.

The Handover

Site Data and Information

The Asset Manager begins with collecting and mapping both static and dynamic details in a dedicated database, effectively creating a “single source of truth” to provide management continuity.

Static Data includes:

- Contact details of the contractual counterparty

- Installation identification numbers (ie grid connection identification codes)

- Key corporate information (company registration, tax numbers, directorships etc)

- Key equipment and components details

- Key contractual terms.

Dynamic information includes everything which provides site history

- Events, incidents, inspections, tests, and ad hoc studies have shaped sites from commissioning to the present.

- Outstanding events requiring immediate action.

It’s crucial to have complete site history, as each plant has individual technical and commercial behaviour which drives future decisions, for its next lifecycle phases.

Technical Asset Management

Technical Asset Management (TAM) encompasses support activities to ensure the best operation of a solar power plant or a portfolio, i.e. to maximize energy production, minimize downtime and reduce costs.

The Technical Asset Manager prepares and provides regular reporting to Asset Owners and other stakeholders. In 2021, reporting must go beyond just indicators, to the guidance of plant optimization activities. Both the Asset Manager and O&M Contractor must work better together, using advanced CMMS (Computerised Maintenance Management Systems) to measure O&M KPIs (Intervention Time, Resolution Time etc) and equipment performance (Mean Time Between Failures etc). The use of ever more advanced technologies is essential to solar plants being maintained, at tip-top levels.

The Technical Asset Manager should also report on Spare Parts stock levels, consumption, equipment status etc. The status of security and surveillance systems, with security service providers responsible for providing relevant inputs is also ideal for periodic reporting.

Managing Anomalies

As a best practice, Anomaly processing should be centralized by Technical Asset Management and O&M Contractor working together, especially, during the warranty period. As the O&M contractor often first meets the problem, it’s important to lay out a framework for management as soon as a problem is found. Systems to keep Owners in the loop are imperative, to ensure speed of resolution during the warranty window.

Pending Work, Insufficiencies, Defects

Anomalies of types that fall into “Pending Works”, “Insufficiencies” or “Defects”, usually fall under the EPC provider’s purview, but they’ll need to assess responsibility based on scope of EPC contract and determine course of action taken. The Asset Manager’s job is to communicate quickly and stay on top of the situation.

For “failure” type of anomalies, the Technical Asset Manager should speedily follow the claims process of the equipment supplier in taking the claim back to them.

Endemic Failures

Product failures at or above expected failure rates due to defects in materials, workmanship, manufacturing process, and/or design deficiencies are the manufacturer’s responsibility. Endemic failure is when product failure is due to the same root cause.

Performance Warranty

Generally, EPC’s provide a 2-Year performance warranty, beginning at the Commercial Operation Date (COD).

The Technical Asset Manager must:

- Manage interventions within warranty scope, to safeguard performance quality;

- Immediately alert Asset Owner if appearing to indicate failure risks

- Keep Asset Owner apprised on conditions of contracted performance indicators;

Contract Management

This includes both technical and commercial/financial aspects, thus Commercial/Financial Asset Managers and Technical Asset Managers must work well together.

It also means creating a well-defined Division of Responsibility (DOR) document outlining mutually agreed areas of responsibility, cooperation and action. The DOR becomes the tracking tool for the life of the contract. The key responsibility for Asset Managers is O&M Contractor oversight and performance supervision, which means quickly and accurately diagnosing under-producing plants, which will severely impact financial performance.

Technical Asset Optimization

Technical Asset Managers really shine here, if they go above and beyond to provide asset optimization solutions.

- Plant performance

- Operation cost reduction

- Technology adaptation and upgrades

- Technical People management and training

A Technical Asset Manager who can take charge, while coordinating with Owners and the O&M Contractors has the ability to future-proof assets. This makes them worth their weight in gold.

Commercial and Financial Asset Management

These activities ensure the AM deals well with external entities to provide optimal operation and turn Operational Data into financial information on the Owner’s behalf.

Financial Reporting

- Cost structure analysis reported monthly in consolidated reports should include:

- Consolidated financial statements (income statement: balance sheet/cash flow)

- Capital structure analysis

- Detailed OPEX, broken down by type of expense, comparison to previous periods

- Profitability analysis

- Cash flow backward and forward-looking overview

- Debt compliance – loan administration, including supervision of settlements, interest rates and current account payments

Strategy Management

Development and implementation of a strategic framework, (based on demand patterns, asset risks and shareholder inputs) for Asset Management activities. It should include a statement of intent, execution plans, and the ability to score them on KPI’s coupled with improvement targets.

Relationship with Asset Owner

As the “owner’s representative,” all work done by AM must also be aligned with company culture and expectations of the Asset Owner. Relationships with 3rd Parties must fit into the Asset Management contract, yet the AM should negotiate effectively and analyze with a critical eye to find ever more optimal solutions to present to Asset Owner for final decision.

The Asset Manager must also ensure PPA compliance in full, for contract requirements and also verify accuracy of tariff settlements and check if need to source alternatives or renegotiation of tariffs.

In conclusion, the Asset Manager must be swift and effective both in action to ensure plant and portfolio at maximum levels and in keeping the Owners fully apprised of all relevant events and ongoing negotiations with regular meetings, driven with a clear agenda.

Solar Equipment Procurement

A most crucial task for the AM is to find, pick, and properly manage key solar suppliers involved in running the effective operation, of all assets in the portfolio. This means they must use their specialized skills and network to find and negotiate the right trade-off between price, quality, service delivery and holding of suppliers to contract terms in a constantly shifting business environment. For this they must follow Procurement best practices.

Recommendations:

- Electricity Suppliers have a high impact as connectivity is essential to efficient plant monitoring. With plenty of available electrical suppliers, it is advisable to standardize requirements, and put plants together to win better terms while negotiating with a large number of competitors.

- Security can also be a critical service, better to guard, than worry about insurance payouts. A reputable company with a national presence across the portfolio should be the first choice.

- O&M contractors and insurance companies are more strategic suppliers. O&M quality and level impact revenues, maintenance costs and long term degradation of portfolio assets. Long term agreements, skill audits, focus on value for costs, rather than the price on its own and a long term thoughtfully collaborative approach works best. Asset Managers must continuously trust but verify in this situation.

Skilled Human Resources

As Asset Managers rely entirely on human resource capability for quality client delivery, they need to pay focused attention to skills and qualifications desired. These employees usually need formal study of Electrical and Mechanical Engineering, along with practical experience.

Technical skills:

- Effective management of O&M providers

- Familiarity with SCADA system alerts and ability to take ‘fix’ actions

- Strong written skills to make clear explanations in reports and e-mails.

- Ability to understand plant issues with on-site inspections.

- Knowledge of EH&S issues at plant and portfolio level.

- There is also need for financial management and accounting skills in the group along with industry experience.

Commercial Skills:

- Financial management and reporting

- Income Monitoring with constant comparison to P70, P90 baselines.

- Forecasting financial impact of preventative and corrective interventions

- Loan management

Essentially a multidisciplinary team covering both technical and financial issues work well together, allowing specialists to do their job while keeping communication flowing for effective action.

Monitoring and Data

Asset Managers must oversee O&M activities and ensure they are constantly looking at ways to increase, long term portfolio profitability.

Asset Managers also have technical and operational O&M service provider data to help improve plant activities. Reliable and fast internet connections at plant level allow for superior communication from plant sensors and SCADA devices to help manage operations.

Types of data collected through Platform

Project performance Asset Managers rely on several sources of data or information.

Typical data sources needed for optimal project performance include:

- Monitoring service providers

- Inverter data providers

- Data acquisition solutions

- Meter operators

- Aerial inspection data providers

- Satellite data providers

- Weather forecast data providers

- Energy exchanges

- CMMS solutions

- Exchange rate data providers

- Accounting solutions and ERP systems

AM’s must ensure Data is reliable and high quality, to ensure analysis, and conclusions found are reliable. Thus monitoring systems should be fully checked to ensure data cleansing, and quality is within their project scope.

Technical data

SCADA data is obtained directly from the plant and used to calculate an overview of plant performance using KPI’s to give the best indication of plant and portfolio performance on one screen.

Operational Data

Going beyond technical data, this includes O&M activities and their effects.

- Alerts identified through monitoring systems.

- Decisions made based on alerts or technical data, including response time

- “On- or Off-site” actions taken by the O&M team,

a.Response time of decisions

b. Warranty & Insurance information

c. Spare parts used

4. Updated performance projections.

5. Maintenance, repair records

Financial & Commercial Data

Financial and commercial data should be integrated with operational and technical data into a standardized AM Platform so figures are looked at holistically.

- Revenue

- Billings, payments & collections

- Expenses, both planned /unplanned and including financing costs

- Financing information and expectations (debt, equity, etc.)

- Financial statements (balance sheet, profit & loss, and cash flow)

- SPV administration (signatories, authorizations, structures, requirements)

- Tax status, filing timings, etc.

- Insurance (status, conditions, claims, etc.)

- Documentation (requirements, key documents, etc.)

- Compliance records

- Contractual & regulatory data

Data related to contract management: • Amendments • Updates • Renewals

Effectiveness and efficiency of AM’s are hugely dependent on quality data as they have full administrative, financial, regulatory, technical, and contractual responsibilities. Thus it is imperative that managing this data is an important part of the Asset Manager’s job.

Key Performance Indicators of a Solar Project

Just like strong Asset Managers use KPI’s to ensure contractors are doing their job well, AM’s need to set KPI’s to ensure the AM themselves, are fulfilling their responsibilities at a superior level. To do this, they must repeatedly obtain Asset Owner feedback, ensuring all work is aligned with needs of the Asset Owner. These allow the team to learn effectively and increase the quality of their work continuously, thereby being a high-quality service provider and partner to the Asset Owner.

Asset Manager Experience

The AM’s track record and experience carry from one project to future projects. Setting KPI’s on increases in processes managed, cost reductions as well as comparisons to baselines and historical records as well as KPI’s of suppliers allow the AM to shine.

Ultimately though, profitability based on ethical, quality smarts, strategy planning and action taken will always be well understood and respected by Asset Owners.

Earlier: