IRAN'S LPG FOR CHINA

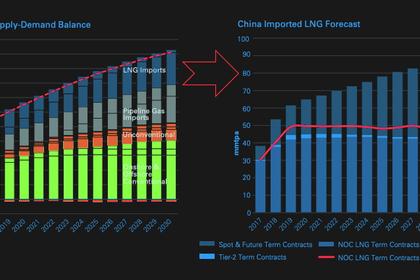

PLATTS - 27 Jan 2022 - Iran's LPG exports are projected at around 6 million mt in 2022, with China poised to remain the main buyer, and the volume could be higher if the US lifted sanctions imposed by former President Trump on the country's energy sector since 2018, sources familiar with the matter said.

"The export volume is between 450,000-530,000 mt/month, depending on vessel availability," a source told S&P Global Platts Jan. 26.

"The production is increasing, but the problem is the limited number of vessels that are calling at Iranian ports. China is the main and biggest importer of Iranian LPG and without any change in 2022."

Exports in December 2021 totaled 531,000 mt, compared with 539,500 mt in November and 363,500 in October, another source familiar with the matter said, adding that the shipments comprised a mix of propane and butane.

Last year, shipments peaked in September at around 556,000 mt, Platts reported earlier, citing trade sources.

LPG exports from Iran since July-August 2021 were hovering near two-year highs of around 500,000 mt/month, trade sources had said.

Other trade sources estimated Iran's 2022 LPG exports at around 5.6 million mt, from 5.5 million last year. But analysts said Iran is expected to boost exports by 1.9 million mt this year.

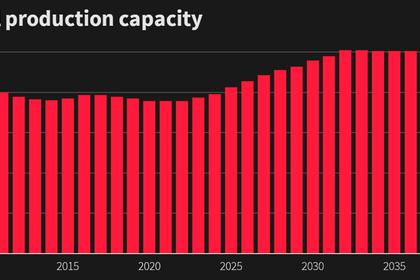

The country aims to bring onstream 130 million cu m/d of additional gas production capacity in 2022. This includes gas from the delayed phase 11 of offshore South Pars field and emergency onshore operations as domestic consumption surpasses production, Mohsen Khojastehmehr, managing director of National Iranian Oil Co. was quoted by the students news agency ISNA in December.

Discounts

China imported 4.94 million mt of Iranian LPG in 2019, 3.85 million mt in 2020, and 1.965 million mt over January-May 2021, industry data showed.

A major obstacle to higher Iranian LPG exports to Asia are restrictions that international shipping and trading firms face due to sanctions imposed for the oil producer's nuclear program.

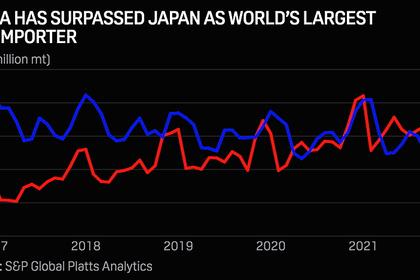

China has become the major importer of Iranian LPG, as Chinese shipowners have developed a fleet of very large gas carriers since sanctions were imposed on Iran in 2014 and then in 2018.

China is also lured by attractive Iranian LPG prices. Some trade sources said the discount that Iran's cargoes fetch to the Saudi Contract Prices could be as steep as $100/mt, while the previous rounds of Western sanctions saw the Chinese paying discounts of $40-$50/mt.

But the first source dismissed estimates of triple-digit discounts, saying that "discount levels are ranging at CP minus $5-$10, CFR China".

He said some vessels are purchased at lower prices, or time-chartered at lower rates "so for the supplier it is still OK to export at these levels".

FOB Middle East propane averaged $645.72/mt in 2021, from $371.06/mt in 2020, while FOB Middle East butane averaged $627.79/mt in 2021 and $376.63/mt in 2020, Platts data showed.

In 2022, month-to-date FOB Middle East propane averaged $742.50/mt, while butane averaged $732/mt, Platts data showed.

Iran's exports in December comprised 316,000 mt of propane and 215,000 mt of butane, according to data from trade sources.

The loading ports are mainly at Assaluyeh, and occasionally at nearby Bandar Siraf, in the central District of Kangan County, Bushehr province. Bandar Siraf port was officially inaugurated last September after undergoing trial operations in February, according to state media.

The LPG shippers included PARS, South Pars Gas Co., Parsian Sepehr Refining Co., Pars Oil and Gas Co. and Kangan Petro Refining Co., the sources said.

Shipments in December were aboard the VLGCs Gas Marta, Sea Luna, Sea Gloria, Dolphin, Gas Roma, NEXO, Fabino Gas, Sun 10, NIBA, Vela Gas and Gas Bombay, as well as smaller vessels Gloria Harvest, Gas Arma and White Purl, trade sources said.

-----

Earlier: