LNG FOR S.KOREA DOWN

PLATTS- 17 Jan 2022 - South Korea's LNG imports declined for the first time in eight months in December 2021 due largely to higher import prices and the need to adjust stockpiles despite solid demand for power generation.

The country imported 3.862 million mt of LNG in December, down 9.3% from 4.257 million mt a year earlier, customs data showed Jan. 17.

It marks the first decline after rising for seven months in a row, but the December imports were up 0.4% from 3.846 million mt intake in November 2021.

For full year 2021, South Korea's LNG imports climbed 14.9% year on year to 45.938 million mt, compared with 39.982 million mt in 2020.

South Korea's LNG imports, which has been on a decline since April 2020, rebound in January 2021 on the back of stronger demand for power generation, driven by the temporary shutdown of several coal-fired power plants and nuclear reactors.

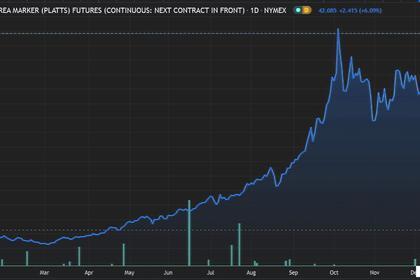

South Korean importers, including state-run Korea Gas Corp., and private power utility and city gas provider, SK E&S, paid $3.445 billion for the shipments in December, up from $1.526 billion a year earlier, according to customs officials.

This means South Korean importers paid an average $17.19/MMBtu in December, given that 1 mt is equivalent to 51.9/MMBtu, up from $7.59/MMBtu a year earlier and $15.52/MMBtu in November.

South Korean LNG importers have been less affected by soaring spot prices because nearly 80% of their purchases are based on long-term contracts, whose prices are linked to international oil prices, according to these importers.

South Korea's LNG import bill has climbed since May last year on higher crude oil and LNG spot prices.

Of South Korea's total LNG imports in December, 943,350 mt came from its long-time, biggest supplier Qatar, up 1.3% from 930,935 mt a year earlier, rising for the second straight month.

The customs data also showed that LNG imports from the US dropped 30.9% year on year to 585,795 mt last month, compared with 847,662 mt a year earlier, which marks the first decline in nine months.

But imports from Australia jumped 72.8% to 943,753 mt in December, compared with 546,239 mt a year ago, marking the seventh consecutive increase.

The decline in South Korea's LNG imports comes despite solid demand of the fuel for electricity generation.

Kogas, which has a monopoly on domestic natural gas sales, sold 32.638 million mt over January-November, up 17.3% year on year from 27.83 million mt, according to Kogas data compiled by S&P Global Platts.

The country has closed eight to 16 coal-fired power plants for three months since Dec. 1, 2021, out of 53 in total currently, to help reduce air pollution.

-----

Earlier: