2022-01-12 10:35:00

OIL PRICES 2022-23: $75-$68

U.S. EIA - Jan. 11, 2022 - Short-Term Energy Outlook

Forecast highlights

- This edition of the Short-Term Energy Outlook (STEO) is the first to include forecasts for 2023.

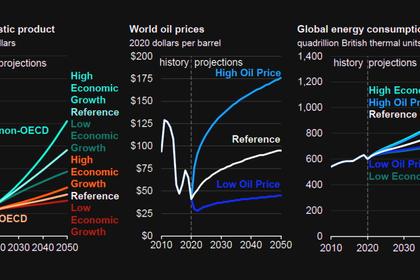

- The STEO continues to reflect heightened levels of uncertainty as a result of the ongoing COVID-19 pandemic. Notably, the Omicron variant of COVID-19 raises questions about global energy consumption. U.S. real GDP declined by 3.4% in 2020 from 2019 levels. Based on forecasts that use the IHS Markit macroeconomic model, we estimate U.S. GDP increased 5.7% in 2021 and that it will rise by 4.3% in 2022 and by 2.8% in 2023. In addition to macroeconomic uncertainties, uncertainty about winter weather and consumer energy demand also present a wide range of potential outcomes for energy consumption. Supply uncertainty in the forecast stems from uncertainty about OPEC+ production decisions and the rate at which U.S. oil and natural gas producers will increase drilling.

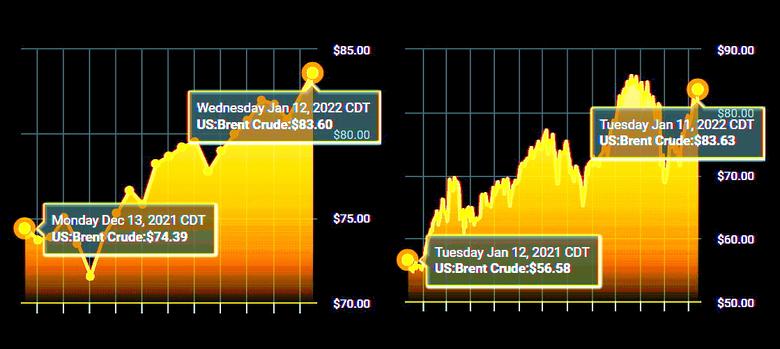

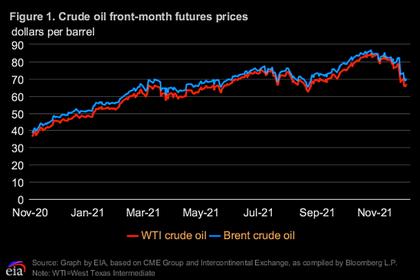

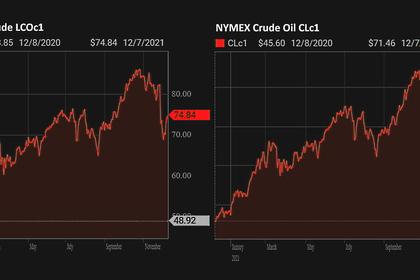

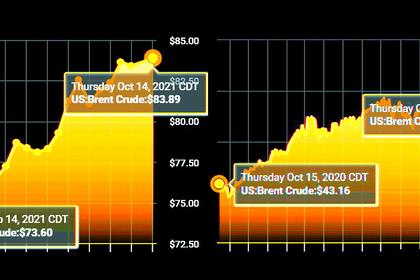

- Brent crude oil spot prices averaged $71 per barrel (b) in 2021, and we forecast Brent prices will average $75/b in 2022 and $68/b in 2023.

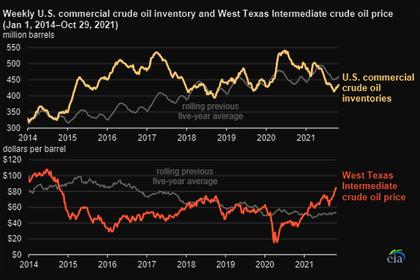

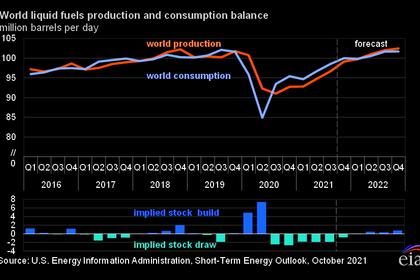

- We estimate global liquid fuels inventories fell by an average of 1.4 million barrels per day (b/d) in 2021 compared with inventory growth of 2.1 million b/d in 2020. Global oil inventories rise in the forecast, increasing at a rate of 0.5 million b/d in 2022 and 0.6 million b/d in 2023.

- Global consumption of petroleum and liquid fuels averaged 96.9 million b/d in 2021, up by 5.0 million b/d from 2020, when consumption fell significantly because of the pandemic. We expect global liquid fuels consumption will grow by 3.6 million b/d in 2022 and 1.8 million b/d in 2023.

- Crude oil production from OPEC member countries averaged 26.3 million b/d in 2021, up from 25.6 million b/d in 2020. We forecast that average OPEC crude oil production will rise by 2.5 million b/d to average 28.8 million b/d in 2022 and average 28.9 in 2023.

- U.S. crude oil production averaged 11.2 million b/d in 2021. We expect production to average 11.8 million b/d in 2022 and to rise to 12.4 million b/d in 2023, which would be the highest annual average U.S. crude oil production on record. The current record is 12.3 million b/d, set in 2019.

- U.S. regular gasoline retail prices averaged $3.02 per gallon (gal) in 2021, compared with an average of $2.18/gal in 2020. We forecast gasoline prices will average $3.06/gal in 2022 and $2.81/gal in 2023. U.S. diesel fuel prices averaged $3.29/gal in 2021, compared with $2.56/gal in 2020, and we forecast diesel prices will average $3.33/gal in 2022 and $3.27/gal in 2023.

- The natural gas spot price at Henry Hub averaged $3.91 per million British thermal units (MMBtu) in 2021. Monthly average prices reached $5.51/MMBtu in October, but they declined in November and December as mild weather prevailed across much of the country, resulting in less natural gas used for space heating. We expect Henry Hub spot prices will average $3.82/MMBtu in the first quarter of 2022 and average $3.79/MMBtu for all of 2022 and $3.63/MMBtu in 2023.

- We estimate that U.S. liquefied natural gas (LNG) exports averaged 9.8 billion cubic feet per day (Bcf/d) in 2021, compared with 6.5 Bcf/d in 2020. We expect U.S. LNG export capacity increases will contribute to LNG exports averaging 11.5 Bcf/d in 2022 and 12.1 Bcf/d in 2023.

- U.S. dry natural gas production averaged 93.5 Bcf/d in 2021, up 2.0 Bcf/d from 2020. Natural gas production in the forecast averages 96.0 Bcf/d for all of 2022 and then rises to 97.6 Bcf/d in 2023. U.S. natural gas inventories ended December 2021 at 3.2 trillion cubic feet (Tcf), 3% more than the 2016–20 average. We forecast inventories will end March 2022 at 1.8 Tcf, which would be 8% more than the 2017–21 average for the end of March.

- U.S. coal production totaled 579 million short tons (MMst) in 2021, up 8% from 2020. We expect coal production will increase by 6% in 2022 and then rise 1% to a total of 619 MMst in 2023.

- U.S. coal consumption was 545 MMst in 2021, a 14% increase from 2020. The increase reflected more use of coal-fired electricity generation amid high natural gas prices. We expect coal consumption will fall by 2% in 2022 and then be relatively unchanged in 2023 at a total of 532 MMst in 2023.

- Total U.S. retail sales of electricity remain relatively unchanged in our forecast for 2022 after increasing by 2.2% in 2021. Forecast increases in sales to the commercial and industrial sectors in 2022 offset lower sales to the residential sector. We forecast total U.S. retail sales of electricity across all sectors will grow by 1.4% in 2023.

- The share of U.S. electric power generation produced by natural gas averaged 37% in 2021, and we expect it will average 35% in 2022 and 34% in 2023. Our forecast for the natural gas share as a generation fuel declines primarily as a result of increased generation from new renewable energy generating capacity. Coal’s average generation share rose to 23% in 2021 as a result of higher natural gas prices, but we expect it to decline slightly over the next two years, averaging near 22% in 2022 and 2023. We expect the nuclear share of generation will remain near 20% over the next two years.

- We expect electricity-generating capacity from renewable energy sources to continue to grow in 2022 and 2023. Our forecast includes both wind and solar capacity growth, with solar capacity growing at a faster rate. The extreme drought conditions in the West may moderate somewhat in the next year, and we forecast that the share of U.S. generation from hydropower will rise from 6% in 2021 to 7% in 2022 and 2023.

- The U.S. retail electricity price for the residential sector in our forecast averages 14.2 cents per kilowatthour in 2022, which is 4% higher than the average retail price in 2021. Forecast residential prices remain relatively the same in 2023.

- Total energy-related carbon dioxide (CO2) emissions increased by 6.2% in 2021 as the U.S. economy started to recover from the impacts of the COVID-19 pandemic. We forecast that emissions will rise by 1.8% in 2022 and by 0.5% in 2023. Even with growth over the next two years, forecast CO2 emissions in 2023 are 3.4% lower than 2019 levels. Energy-related CO2 emissions are sensitive to changes in weather, economic growth, energy prices, and fuel mix.

-----

Earlier:

2021, December, 8, 16:10:00

OIL PRICES 2021-22: $71-$70

We expect Brent prices will average $71/b in December and $73/b in the first quarter of 2022 (1Q22). For 2022 as a whole, we expect that growth in production from OPEC+, of U.S. tight oil, and from other non-OPEC countries will outpace slowing growth in global oil consumption, especially in light of renewed concerns about COVID-19 variants. We expect Brent prices will remain near current levels in 2022, averaging $70/b.

2021, December, 7, 18:05:00

OIL PRICE: NEAR $75

Brent were up $1.49, or 2%, at $74.57 a barrel, WTI was up $1.71, or 2.5%, at $71.20.

2021, November, 10, 12:20:00

OIL PRICES 2021-22: $82-$72

We expect Brent prices will remain near current levels for the rest of 2021, averaging $82/b in the fourth quarter of 2021. In 2022, we expect that growth in production from OPEC+, U.S. tight oil, and other non-OPEC countries will outpace slowing growth in global oil consumption and contribute to Brent prices declining from current levels to an annual average of $72/b.

2021, November, 9, 17:20:00

GLOBAL OIL DEMAND GROWTH

This year, demand for petroleum, both in the United States and globally, has largely returned to the pre-pandemic levels in 2019. Demand has grown faster than supply, reducing inventories and contributing to higher prices for crude oil and petroleum products.

2021, October, 15, 09:35:00

GLOBAL OIL DEMAND WILL UP BY 5.8 MBD

World oil demand is estimated to increase by 5.8 mb/d in 2021, revised down from 5.96 mb/d in the previous month’s assessment.

2021, October, 14, 12:55:00

OIL PRICES 2021-22: $81-$72

We expect Brent prices will remain near current levels for the remainder of 2021, averaging $81/b during the fourth quarter of 2021. In 2022, we expect that growth in production from OPEC+, U.S. tight oil, and other non-OPEC countries will outpace slowing growth in global oil consumption and contribute to Brent prices declining from current levels to an annual average of $72/b.

2021, October, 11, 11:50:00

GLOBAL ENERGY CONSUMPTION WILL UP BY 50%

Global energy consumption will increase nearly 50% over the next 30 years.