RUSSIAN OIL FOR U.S. UP

PLATTS - 21 Jan 2022 - Talks between US officials and the Kremlin to avert an invasion of Ukraine ended inconclusively Jan. 21 against a backdrop of record high oil and petroleum product deliveries from Russia to the world's largest consumer of crude.

Shipments of Russian crude to the US in 2021 averaged 202,000 b/d, the highest in 11 years, according to data from S&P Global Platts trade-flow analytics tool cFlow. Most of these imports consist of Russian export grades, such as Urals, ESPO Blend and Varandey.

Overall Russian crude and product shipments accounted for 11% of total US imports between January and October 2021, according to data from the US Energy Information Administration. Imports of Russian crude and products averaged 704,300 b/d in this period, EIA data showed. The US is now importing higher volumes from Russia than it is from key ally Saudi Arabia.

In addition to crude oil, the US imports mainly Russian fuel oil and various feedstocks such as high sulfur fuel oil, high sulfur vacuum gasoil, low sulfur vacuum gasoil, high sulfur straight run fuel oil and low sulfur straight run fuel oil.

The bulk of these flows have been delivered to ExxonMobil's 560,500 b/d Baytown plant, Valero's 335,000 b/d Port Arthur and 340,000 b/d St. Charles facilities, and Chevron's 356,400 b/d Pascagoula and 269,000 b/d El Segundo refineries, according to cFlow data.

Blinken challenge

The growing importance of Russia's crude to US refiners underscores the challenge facing US Secretary of State Antony Blinken in negotiations with his counterpart Russian Foreign Minister Sergei Lavrov, set to resume next month, as the two sides attempt to resolve tensions over the buildup of Russian troops on the Ukrainian border, as well as Moscow's requests for security guarantees from NATO.

Russian exports to the US have increased in recent years, primarily as a result of US sanctions against Venezuela. Previously, US refiners were particularly reliant on heavy and sour Venezuelan crude, which in some cases is quite similar to Russian medium sour oil.

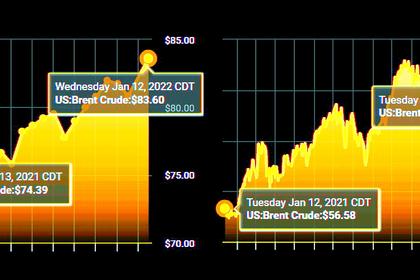

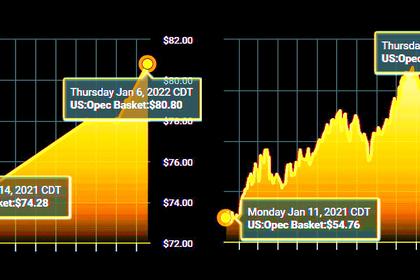

The tense Ukraine situation and rising geopolitical risks in the Middle East have partly pushed oil prices higher in recent weeks and led a number of banks to increase their price forecasts. Platts assessed Russia's key crude grade Urals at $88.34/b Jan. 20, up 30% since Dec. 20.

Following the talks Jan. 21, Blinken and Lavrov said that the US has agreed to respond to all of Russia's security demands next week.

Lavrov said that officials could meet again in February, adding that Russian President Vladimir Putin is open to meeting his US counterpart, Joe Biden.

Blinken reiterated that the US will respond swiftly and severely to any movement of Russian military forces across Ukraine's border. This response could include sanctions on the Nord Stream 2 gas pipeline, as well as further financial restrictions, including blocking use of the US dollar. The US could also build on 2014 measures targeting transfer of technology used in shale, Arctic offshore, and deepwater oil production.

Few alternatives

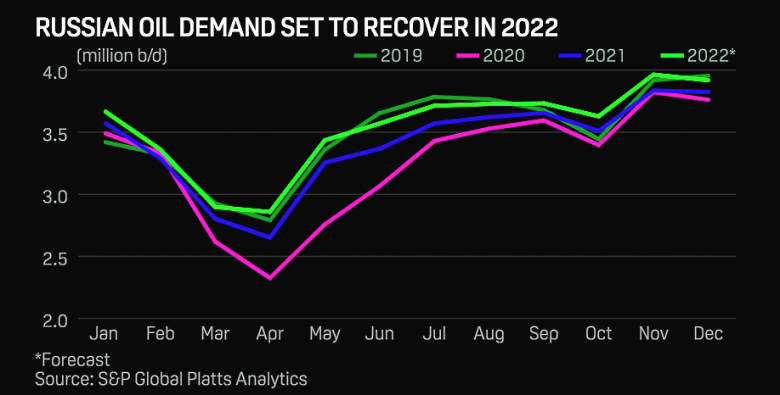

Growing imports of Russian crude to the US come at a time when sourcing alternatives could prove difficult for the world's largest consumer. Other supply risks include diminishing odds of an Iran nuclear deal, deteriorating stability in Libya, and decreasing OPEC+ spare capacity, S&P Global Platts Analytics has warned.

"Planned OPEC+ production hikes will reduce sustainable spare capacity to an uncomfortably low 800,000 b/d by June, just as oil demand is set to grow by 3.5 million b/d in H2 2022," according to Paul Sheldon, chief geopolitical adviser at Platts Analytics.

-----

Earlier: