U.S. GAS PRICES UP

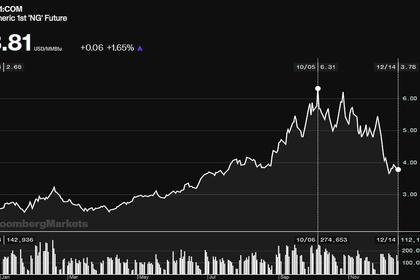

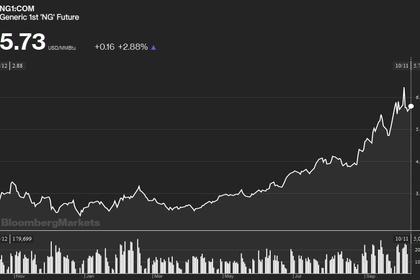

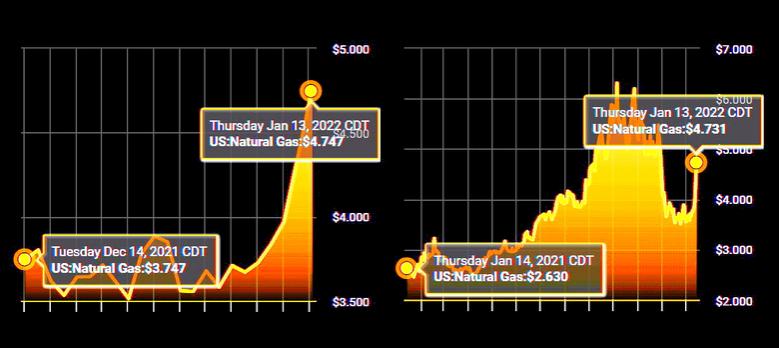

PLATTS - 12 Jan 2022 - The NYMEX Henry Hub February contract broke free of recent ranges in a Jan. 12 price rally, amid robust demand, weaker production, and bullish technical indicators.

The Henry Hub prompt-month contract soared 60.80 cents to settle at $4.857/MMBtu Jan. 12, according to preliminary settlement data from CME Group, which is the highest price for a prompt-month contract since Nov. 26.

The Jan. 12 run-up marks a fourth consecutive trade day of upward movement for the contract, which has gained more than a dollar since settling at $3.81/MMBtu Jan. 6.

The rally lifted all remainder-of-2022 contracts above $4/MMBtu, for the first time since the end of November.

Much of the upward swing can be attributed to an ongoing stretch of very cold temperatures, which has boosted demand in key gas-fired markets like the Northeast and Midwest, according to market watchers.

"Everyone assumed because temperatures were warmer than normal in December, that was it to the winter natural gas demand season, but as anyone who went outside recently and got frostbite knows, that isn't the case," Phil Flynn, senior market analyst at Price Futures Group, told S&P Global Platts in an interview.

Fundamentals

The recent stretch of cold temperatures has boosted both US residential-commercial and gas-fired power generation demand. US domestic gas demand has averaged 110.5 Bcf/d so far this January, up 16.8 Bcf/d, or 18%, from the latter half of December, data from S&P Global Platts Analytics shows.

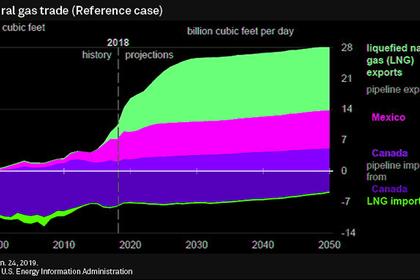

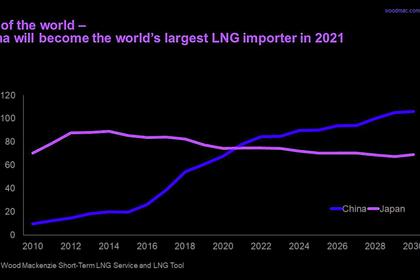

Soaring overseas demand for US LNG has also provided support for prices, with LNG feedgas demand averaging 12.1 Bcf/d month to date.

Turning to supply, lower production has played a role in the tightening fundamentals, with the buoyant production numbers of late December giving way to lower volumes in the first half of January.

Platts Analytics data shows that US gas production has averaged 92.7 Bcf/d so far in January, down nearly 3 Bcf/d from the 95.6 Bcf/d observed in the second half of December.

A decrease in gas production between the end of one calendar year and the start of a new one is fairly typical, S&P Global Platts Analytics analyst Jack Winters said in a Jan. 12 webinar.

Producers often seek to meet guidance production targets by year-end, which can involve raising production levels towards the end of December, before starting afresh with the new year's guidance in January, Winters said.

In the case of this January, freeze-offs in the Permian Basin deepened the decrease dramatically, with Platts Analytics data showing a 2.4 Bcf/d drop on Jan. 2. Of this, the Permian accounted for 1.6 Bcf.

Technical analysis

Measurements of technical analysis, including the parabolic stop and reverse and the moving average convergence divergence, have been strongly bullish for weeks, Stephen Schork, principal at The Schork Report, told Platts in a phone interview.

The strength of these technical indicators, as well as signs of inflation, has attracted more buyers, with hedge funds coming back into the market, Schork said.

"We haven't seen this in some time, where higher prices are an excuse for even higher prices," Schork said.

Another technical indicator, Fibonacci levels retracement, shows that a key pricing level of $4.66/MMBtu was surpassed in Jan. 12 trading, according to David Thompson, executive vice president at Washington-based brokerage Powerhouse.

Outlook

Even higher prices could be in the cards over the next several days.

"[By going above $4.66/MMBtu], we've exceeded a 38.2% retracement, which opens the door to a test of a 50% retracement, taking us closer to $5/MMBtu," Thompson said.

Temperature forecasts show a continuation of cold weather in the eastern half of the country through the end of the month, with the National Weather Service's eight- to 14-day outlook showing a likelihood of below-normal temperatures across the Northeast and Midwest states.

-----

Earlier: