U.S. GAS PRODUCTION DOWN

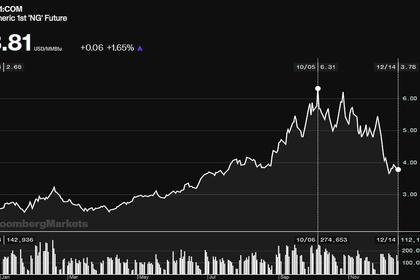

PLATTS - 18 Jan 2022 - NYMEX prompt-month gas futures prices may be edging back toward the $5 level by later this month as flagging domestic gas production and colder weather over the days ahead promise to tighten US supply.

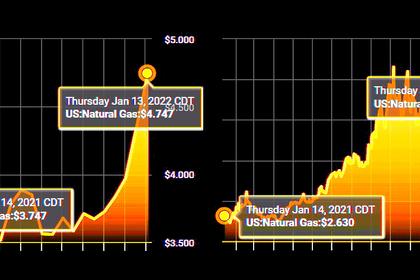

Over the past week, both gas futures and cash prices at the benchmark Henry Hub have zoomed past $4, even trading briefly into the $4.70s to $4.80s/MMBtu, data from S&P Global Platts shows.

On Jan. 18, the prompt-month contract was up as much as 13 cents from its prior settlement to trade around $4.30 to $4.40/MMBtu. In the cash market, Henry Hub gas was also up on the day, rising more than 10 cents to about $4.48/MMBtu, data from CME Group and the Intercontinental Exchange showed.

Renewed bullish sentiment comes as a new year's drop in domestic gas production has endured – erasing supply gains accumulated during the autumn months – just as colder weather lifts gas demand to seasonal highs.

Production

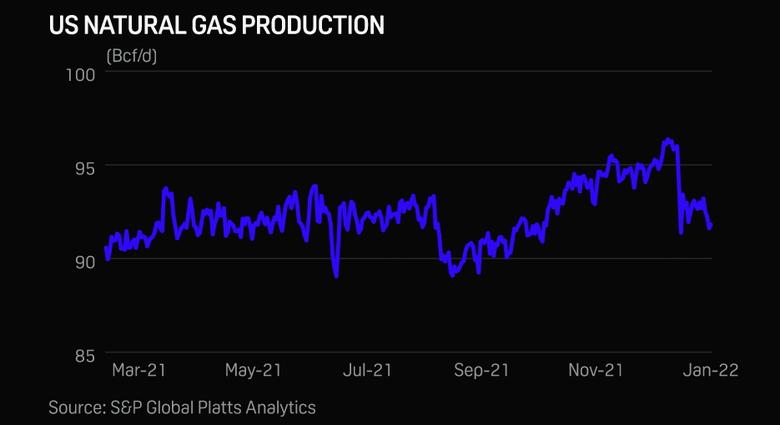

On Jan. 18, initial estimates from S&P Global Platts Analytics showed US gas production at just 91.8 Bcf/d. Following a precipitous drop in output after the new year, production appeared to be on the rebound last week, reaching levels at over 93 Bcf/d.

With the most recent drop, though, doubts loom over the potential duration of this season's new-year decline from levels over 96 Bcf/d in late December. According to Platts Analytics, production declines in January are not uncommon. While US gas production was largely unchanged in the 2020 to 2021 new year, production declines of varying magnitudes and durations were recorded over at least the five new year's prior, dating back to the 2015-2016 winter season.

This year, declines have been widely reported from many of the most prolific associated and dry gas basins including the Permian, the Denver Julesburg, the Bakken, the SCOOP-STACK, the Haynesville and the Marcellus. In all of those basins, though, rig counts remain near recent highs, signaling little change in sentiment among producers – a potential sign that a coming rebound in output could be swift.

Demand

As the gas market await a rebound in production, winter demand is now hitting seasonal highs as colder weather finally arrives in the Northeast and Midwest – both critical regions for gas-fired heating.

In the Northeast, population-weighted temperatures have dipped to an average 30 Fahrenheit over the past week with temps expected to dip into the upper-teens by the coming weekend. In the Midwest, the seven-day temperature average is just 27.5 degrees, with current forecasts calling for a sharp drop into the single digits by later this week.

Over the past 10 days, total US gas demand has surged in response to the colder weather, climbing to nearly 120 Bcf/d – about 13 Bcf/d above it's prior five-year average. For the coming week, demand is now forecast to trend close to, or even above the historical average at an estimated 133 Bcf/d, Platts Analytics data shows.

Storage

Amid weaker production and strong demand, a nascent US gas storage surplus appears likely to evaporate in the weeks ahead. In its latest report, the US Energy Information Administration estimated US inventories at 3.016 Tcf for the reporting week ending Jan. 7 – equivalent to a 72 Bcf surplus.

Based on recent weather trends and current forecasts, Platts Analytics has projected above-average drawdowns over the coming three reporting weeks, fueling a more-than-600 Bcf decline in gas storage levels by the end of this month. If realized, the drop in inventory would push the storage balance into a deficit of about 65 Bcf, forecast data shows.

-----

Earlier: