AUSTRALIA'S COAL RISKS

PLATTS - 19 Oct 2022 - Australia's road map to phasing out a large part of its coal-fired power generation over the next decade may take the country one step closer to its clean fuel ambitions, but analysts fear it may face hurdles in offering affordable fuel to consumers during the transition period as world energy prices surge.

Going by big-ticket announcements of exits from coal in the last few weeks, sentiment in Australia is tilting toward those opposed to coal consumption, but market sources believe in the absence of replacement electricity generation sources, the closure of coal plants will inflate consumer power prices.

The country's major coal producing state Queensland announced in September that it will end its reliance on coal-fired power by 2035 and meet 80% its energy requirements through renewable sources by that time. In 2021, Queensland relied on thermal coal to meet 65% of its electricity requirements.

Similarly, energy producer AGL Energy Ltd. said it will exit coal-fired power generation in financial year 2035. The company said it will shut Long Yang power station by 2035, which provides 30% of power in the state of Victoria. The state relies on coal-fired generation for 63% of its requirements.

"Since the announcement of plants being shut down, major energy companies are forecasting an increase in consumer prices by up to 35%-38%, which I think is an unpopular decision and maybe the government has to rethink about how it will do this," an Australia-based trader said. "Other alternatives are being discussed but they are not there, which will hit consumer pockets with power prices."

While the Australian government aims to achieve around 80% renewables in the electricity grid by 2030, experts say construction of more renewable energy generation capacity needs to be in place first to ensure a seamless transition.

Referring to recent media statements by Jeff Dimery, CEO of Alinta Energy, who said governments should not promise a reduction in energy costs, market sources noted if the coal-fired assets are closed before new ones are up and running, it is going to raise prices.

Climate change and transition to cleaner energy sources were key issues in the country's change of government at its federal election in May and the scrutiny of coal-fired power has subsequently increased, coal traders said.

Investment in renewables key

Companies are planning to invest in wind, solar and hydro energy to replace coal, but market participants are unsure of how energy companies and consumers will absorb the cost of this transition and investment.

As part of AGL's plan, the company is mulling investments of up to A$20 billion ($13 billion) in renewable energy by 2036. The investment plan includes an interim target to have up to 5 GW of new renewables in place by 2030.

The Queensland announcement was part of the state's $62 billion energy and jobs plan, which will see a new "supergrid" connecting solar, wind, battery and hydrogen generators across the state, unlocking 22 GW of new renewable capacity, eight times the state's current level.

For the global thermal coal market, analysts believe that such scrutiny of coal consumption is disincentivizing an increase in production, even though thermal coal prices are near record highs.

Newcastle 6,000 kcal/kg NAR is currently priced at $380-$390/mt FOB, according to market sources. Platts assessed high-ash Newcastle 5,500 kcal/kg NAR coal with 23% ash at $153.80/mt FOB Oct. 18, S&P Global Commodity Insights data showed. Newcastle 5,500 kcal/kg NAR coal with 23% ash has averaged $184.95/mt FOB to date in 2022, surging from $73.50/mt FOB in the same period a year earlier.

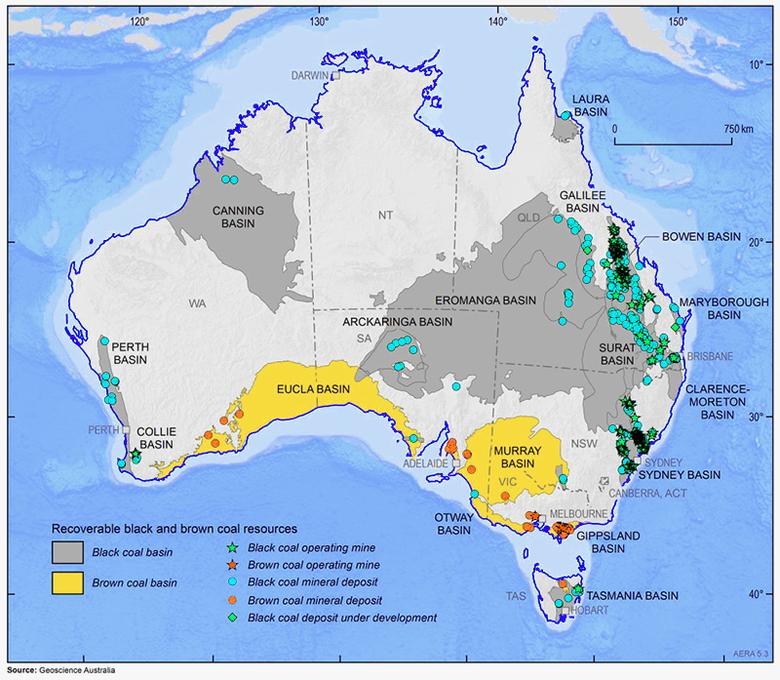

"Coal is being increasingly affected by global energy transition, with investment in new coal capacity continuing to decline," the Australian government's Office of the Chief Economist said in its latest Energy and Resources Quarterly report published Oct. 4.

"This lack of investment hampers the ability of coal producers to respond to high prices with additional supply. In the short term, these shortfalls may be exacerbated by shortages of skilled labor in some areas. In the longer term, it is likely to be exacerbated by the increasing average depth of deposits and falling coal quality, leading to a further, gradual tightening in affordable supply," the office said in the report.

Energy security

Australia's increased scrutiny of coal comes at a time when demand for the fuel has increased from European countries including Germany, the UK, the Netherlands, Austria and France after the EU imposed sanctions on Russian coal following its invasion of Ukraine.

Furthermore, Australian coal's market share in countries such as Japan and South Korea is expected to increase as these countries try to replace Russian coal, with coal importing nations having to pay elevated prices to maintain energy security.

S&P Global Commodity Insights reported Oct. 11 that Japanese energy producer Tohoku had signed a one-year supply deal with global coal producer Glencore for 6,322 kcal/kg GAR coal at $395/mt, more than three times higher than the $109.97/mt FOB agreed to in June 2021.

"Miners that can supply [for] export and the domestic market will just compare the prices for each market and sell to who is paying the most, but yes there is limited investment in Australian coal mines, so supply is not growing," another Australia-based trader said.

-----

Earlier: