BRITAIN NEED ENERGY SECURITY

PLATTS - 04 Oct 2022 - The UK is looking to secure long-term gas import contracts as part of efforts to ensure the country's gas supply security, Prime Minister Liz Truss said Oct. 4.

The UK government has said it is currently scouring the market for potential gas import deals as part of a new supply security push.

Asked whether she would consider locking in a multi-year Norwegian gas import contract at close to current prices, Truss said on Sky News: "What I have said is, first of all, we will move forward on our own energy security."

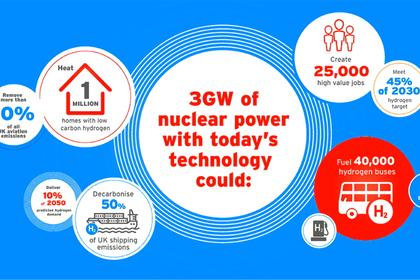

"That's more renewables here in the UK, it's more nuclear power here in the UK, and it's also moving forward faster with using North Sea facilities," Truss said.

"But we are looking at long-term energy contracts with other countries because, as well as making sure we've got a good price, energy security is vitally important," she said.

"And we never want to be in a position again where we're dependent on authoritarian regimes for our energy. That's why we're in the situation we are now."

The UK relies on imported gas to meet around half of its demand, with Norway the top supplier, accounting for some two-thirds of the UK's imports last year, according to government data.

The UK also has three operational LNG import terminals, with LNG supplies making up the bulk of the remaining UK imports last year.

However, the UK is relatively exposed to the spot market for additional LNG purchases so the government is now looking at the potential for new long-term supply deals.

Long-term gas supply contracts can typically last for 20-25 years, though deals with a duration of 10-15 years have also been relatively commonplace.

"We are talking to the market to understand what commercial deals are available," a spokesperson at the UK Department for Business, Energy and Industrial Strategy (BEIS) told S&P Global Commodity Insights in late September.

"A new energy supply taskforce has begun negotiations with domestic and international suppliers to agree long-term contracts that reduce the price they charge for energy and increase security of supply," the spokesperson said.

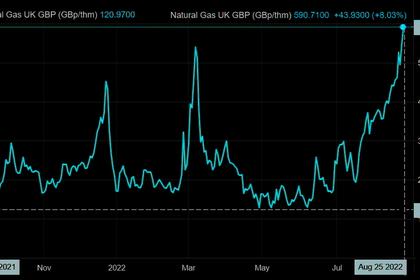

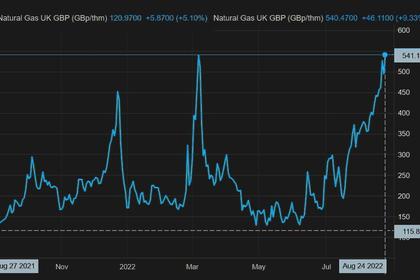

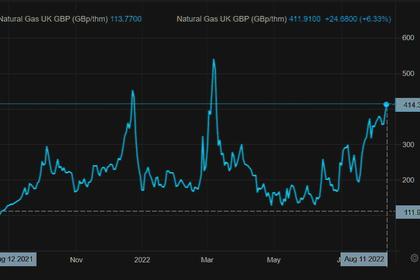

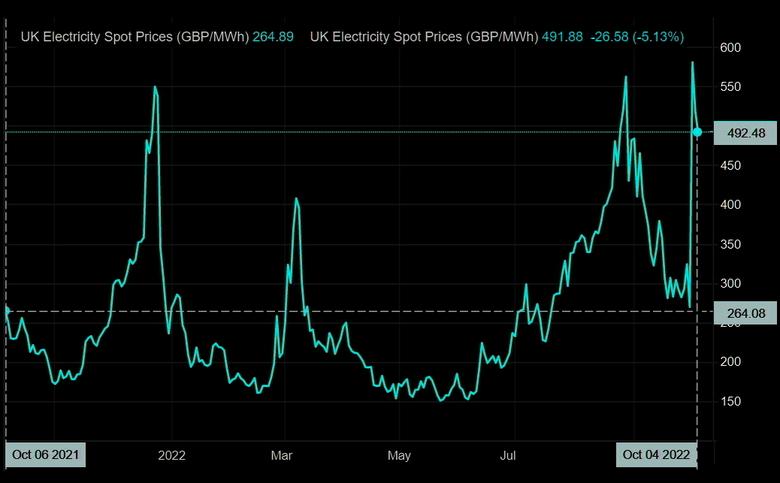

High prices

Spot gas prices across Europe have hit record highs in recent months, while spot LNG prices also remain at sustained highs.

Platts, part of S&P Global Commodity Insights, assessed the Dutch TTF month-ahead price at an all-time high of Eur319.98/MWh Aug. 26. It was last assessed at Eur168.50/MWh on Oct. 3, still 84% higher year on year.

Meanwhile, the Platts benchmark JKM spot LNG price for delivery into northeast Asia also remains high and was assessed Oct. 3 at $30.09/MMBtu.

The US has been the main supplier of LNG to the UK in 2022, with deliveries equating to 7.1 Bcm in the first eight months, followed by Qatar (6.4 Bcm), according to data from S&P Global.

As well as Norwegian gas, the US and Qatar are also front and center of UK efforts to lock in new long-term LNG supply deals.

Qatari energy minister Saad al-Kaabi is currently in London and expected to hold talks with the UK government on LNG deliveries.

UK utility Centrica, meanwhile, has been relatively active in recent months in looking for long-term gas deliveries.

In June, it agreed to take an additional 1 Bcm/year of gas from Norway's Equinor, bringing the total contracted volume to be supplied by Equinor to Centrica to 10 Bcm/year.

Equinor said it typically supplied a total of some 20-22 Bcm/year of gas to the UK, enough to cover more than 25% of UK gas demand.

In August, Centrica also signed a heads of agreement for the purchase of 1 million mt/year of US LNG from Delfin Midstream's planned floating LNG export project off the coast of Louisiana .

The contract -- if finalized -- would be for 15 years on a FOB basis and come into effect in 2026 when the facility begins operations.

Pound vs dollar

In the meantime, the recent weakness in the value of the pound against the dollar is adding to UK LNG procurement costs.

LNG cargoes are mainly traded in dollars, and the recent spot price strength has seen individual cargoes change hands for $200 million or more.

For LNG buyers in the UK, the weakening pound is making spot LNG purchases significantly more expensive.

A $200 million cargo a year ago would have cost a UK buyer around GBP145 million, whereas the same cargo would be valued at GBP175 million in today's money.

-----

Earlier: