ENERGY SECURITY OF CHINA, SAUDI ARABIA

PLATTS - 21 Oct 2022 - Saudi Arabia and China stressed the importance of reliable, long-term oil supply to the markets amid changing geopolitical situations, as Riyadh-led OPEC+ looks to ease concerns about the 2 million b/d supply cuts scheduled to come into place from November onward.

"The kingdom continues to be China's most reliable partner and supplier of crude oil," according to a joint statement carried on SPA from the Saudi Energy Minister Prince Abdulaziz bin Salman and Beijing's National Energy Administrator Zhang Jianhua.

Both sides confirmed "their willingness to work together to support the stability of the international oil market, continue close communication and strengthen co-operation to address emerging risks and challenges," the statement read.

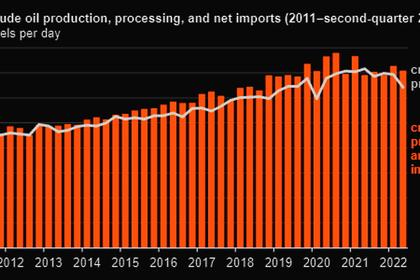

Saudi Arabia is China's top crude supplier with most of the country's refineries designed to crack Middle East crudes.

The producer delivered 1.76 million b/d of shipment in January-August to lift the market share to 17.7% from 16.9% a year earlier, despite the volume edging down 0.3% year on year, according to China's customs data.

The Saudi and Chinese energy counterparts also continued discussions on developing joint integrated refining and petrochemical complexes.

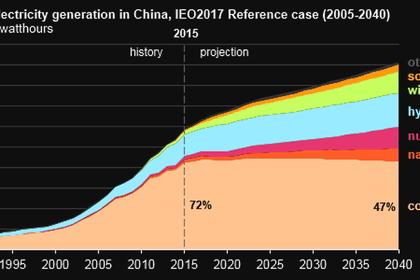

The two sides said they planned to cooperate on the peaceful use of nuclear energy and in developing renewables.

Aramco's Chinese investments

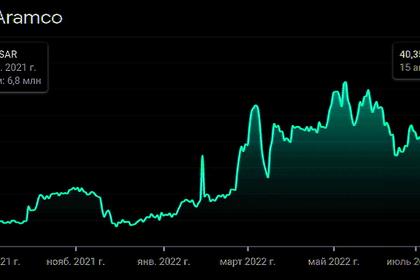

The kingdom's state oil company Saudi Aramco is looking at a number of opportunities with China's state-backed Sinopec, Aramco CEO Amin Nasser said during an earnings call in March.

Aramco has an interest in China's downstream sector as it looks to lock in demand for its crude in Asia's largest economy.

Saudi Aramco decided to move forward with a 300,000 b/d oil refinery and petrochemical project in northeast China March 10.

Aramco said it had taken the final investment decision to develop a liquids-to-chemicals complex under a joint venture with North Huajin Chemical Industries Group Corp. and Panjin Xincheng Industrial Group. Aramco had withdrawn from the project in 2020, but S&P Global Commodity Insights reported in September 2021 the partners had revived negotiations.

The facility, to be built in the city of Panjin, will combine a 300,000 b/d refinery and an ethylene-based steam cracker, with Aramco supplying up to 210,000 b/d of crude oil feedstock. It is expected to be operational in 2024 and will cost some $10 billion.

Chinese state-owned Sinopec also plans to add a petrochemicals plant to its 280,000 b/d Fujian refining complex as part of its phase two expansion plans, S&P Global reported March 9. On March 8, Aramco and Sinopec said they would study possible capacity expansion at the Fujian refinery.

OPEC+ cuts

Saudi Arabia is navigating a challenging oil market environment where it is facing backlash from the US and top global consumers toward OPEC+'s planned move to cut 2 million b/d from the market until the end of 2023.

Saudi ruler King Salman issue a statement Oct. 18 reassuring the markets that the kingdom was "working hard" to ensure energy security and continuity of supply.

King Salman's comments to reassure the markets follow the White House's criticism that the Saudi-led move to reduce crude supply was politically motivated.

The International Energy Agency, which represents consuming nations and has strong US backing, said the cuts would worsen the global energy crisis and limit a much-needed build in oil stocks through the first half of 2023.

The IEA estimated that world oil demand will rise to 100.58 million b/d in the fourth quarter from 99.96 million b/d in the third quarter.

"The OPEC+ bloc's plan to sharply curtail oil supplies to the market has derailed the growth trajectory of oil supply through the remainder of this year and next, with the resulting higher price levels exacerbating market volatility and heightening energy security concerns," the IEA said in its closely watched monthly oil market report Oct. 13.

-----

Earlier: