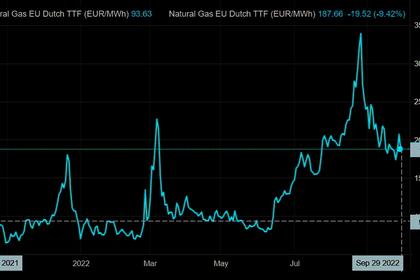

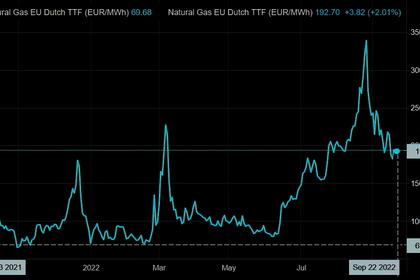

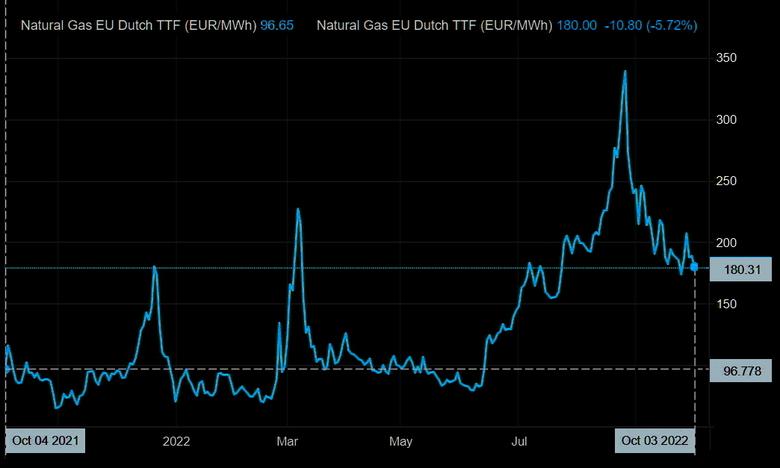

EUROPEAN GAS PRICES STILL DOWN

BLOOMBERG - Oct 3, 2022 - Natural gas prices in Europe fell amid signs it will be able to navigate this winter as the EU promised more steps to contain the crisis after an initial package was agreed last week.

Benchmark futures declined as much as 5.9%. Ministers supported measures including a power-demand reduction goal and a profit grab from energy companies, and said more was likely this week. The issue of a cap on wholesale gas prices is set to return to the table.

The European Union is being pressed in to action after Russia’s gas supply cuts have pushed the region’s economy to the brink of recession and helped drive up inflation. Tensions with Moscow heightened recently after blasts at the Nord Stream pipelines that European politicians are calling sabotage. While the links are idle, the latest incident removes the possibility of supply on the route being reinstated any time soon.

“The good news is that Russia looks close to having played its last card in terms of gas leverage over Europe,” Timera Energy said in a note. “However Europe’s challenges will not disappear with the daffodils next spring.”

Russia gas is still flowing to Europe through Ukraine, but those remain at risk as long as the war continues. There’s also supply through the TurkStream pipeline to some smaller consuming nations and Turkey. Over the weekend, Gazprom PJSC suspended deliveries to Italy in an apparent scuffle over regulation in Austria.

Dutch gas for November delivery, a benchmark for Europe, fell to 177.70 euros a megawatt-hour by 8:59 a.m. in Amsterdam.

A big question remains about Europe’s ability to replenish storage sites next year in the absence of the usual volumes of Russian supply. Inventories are about 88% full aided by high imports of liquefied natural gas, but those will get eroded over the coming colder months. The European Union is urging a 15% voluntary reduction in demand to help tide over the winter.

“It is very unlikely that Europeans will freeze this winter due to gas supply cuts,” Timera said. “It is demand that will need to react to balance the market and avoid outright supply cuts.”

-----

Earlier: