EUROPEAN GAS SHORTAGE

PLATTS - 27 Oct 2022 - The International Energy Agency warned Oct. 27 that Russia's political motivations could impact the remaining volume of gas it will supply to Europe this winter, risking potential gas shortages and rationing.

In its latest World Energy Outlook, the IEA said the curtailments of Russian supply since the invasion of Ukraine in February had left the gas sector in the EU in "disarray."

Deliveries from Russia to the EU fell by nearly 40% in the first half of 2022, while the EU set in motion its own plan to phase out Russian imports in its REPowerEU initiative.

"During the winter ahead, the amount of Russian gas supplied to Europe may well be dictated by Russia's own political ends rather than by European policies, raising the risk of possible supply shortfalls and rationing," the IEA said.

Russia sharply reduced gas deliveries to Europe in 2022, with exports halted via the Nord Stream and Yamal-Europe pipelines.

It now delivers gas to Europe only via the Sudzha entry point on the border with Ukraine and the TurkStream pipeline.

A number of major Gazprom customers in the EU are still supplied with Russian gas via the two routes including in Hungary, Austria and Italy.

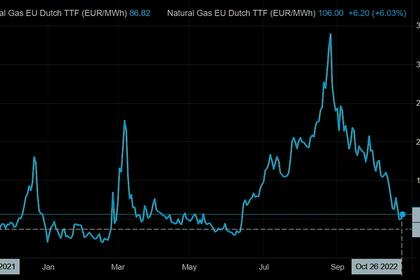

Lower Russian supplies sent European gas prices to all-time highs in late August though prices have come down sharply as storage sites across the EU were filled to close to capacity.

Platts, part of S&P Global Commodity Insights, assessed the Dutch TTF month-ahead price at an all-time high of Eur319.98/MWh Aug. 26. It was last assessed at Eur101.10/MWh Oct. 26.

Contract, spot 'dilemma'

EU gas buyers also now face a dilemma of whether to contract for new capacity or rely on the spot market to fill the supply gap left by the loss of Russian gas, the IEA said.

The IEA said that in principle, the EU supply gap could mostly be filled by attracting LNG cargoes from the spot market through paying a premium that diverts them from other markets.

"Around 50% of current global LNG trade, or 250 Bcm, can be considered contractually flexible, and therefore open to competition to determine its end destination," the agency said.

The proportion is expected to increase over the coming years, as existing contracts expire and around 55% of the 200 Bcm/year of LNG export capacity coming online between 2022 and 2026 is also flexible.

"However, a high level of exposure to short-term markets may put European gas buyers at the mercy of volatile global LNG supply dynamics, especially in the near term," it said.

Flexible volumes may also be converted to firm, long-term contracts by other buyers seeking assured supply.

Another solution, the IEA said, was to sponsor new LNG export projects, thereby securing firm offtake.

"However, this requires long-term commitment, as capital-intensive LNG projects require long lead times to construct, a minimum take-or-pay volume commitment lasting around 20 years, and an operational lifetime of at least 30 years," it said.

Many gas buyers in the EU would be looking to phase out gas in their energy systems well before 2050, it said.

Import demand

Demand for imported gas in the EU is, however, set to fall, the agency said, from 370 Bcm in 2021 to just 230 Bcm/year by 2030 under the IEA's Announced Pledges Scenario (APS).

The APS assumes that all targets announced by governments are met on time and in full, including their long-term net zero and energy access goals.

Gas import demand is expected to decline further to 140 Bcm/year in 2035 and to just 40 Bcm/year by 2050 in the APS.

The IEA said gas deliveries from Russia would gradually fall to zero before 2030 in the APS.

"In parallel, European gas buyers maximize LNG shipments to existing facilities while also developing new facilities for LNG imports," it said.

LNG imports are expected to average 140 Bcm/year over the 2022-2027 period, meeting almost 60% of the EU non-Russian import requirements.

EU gas demand is also set to fall by an average of 6%/year by 2030 in the APS, it said.

"Gas use in the power sector over this period drops at a faster pace than coal use did in the EU from 2010 to 2020," it added.

'Golden age'

In its outlook, the IEA also questioned whether the "golden age" of gas -- which it first pointed to in a special report in 2011 -- was now over.

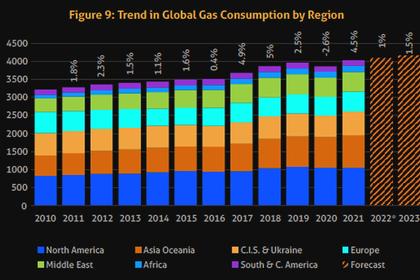

It said that more than a decade later, the growth in global gas consumption had turned out to have been "very much in line with the projections made in that report."

However, the agency said, current longer-term projections indicate a "diminished" role for gas.

It said the key pillars for growth in the Golden Age scenario were the competitiveness of gas as large volumes of shale gas were developed in the US, strong economic growth across Asia, and supportive policies.

"The competitiveness of gas, however, has come under pressure, and competition from low-cost renewables such as solar and wind has now narrowed the space for growth in gas," it said.

"There are also reasons to think that the age of supportive policies for gas may be drawing to a close," it said.

"Near-term supply scarcity and energy security concerns have not only driven up gas prices but have also sparked long-term gas affordability concerns, and net zero emissions pledges have focused minds on an eventual phase out of unabated natural gas."

-----

Earlier: