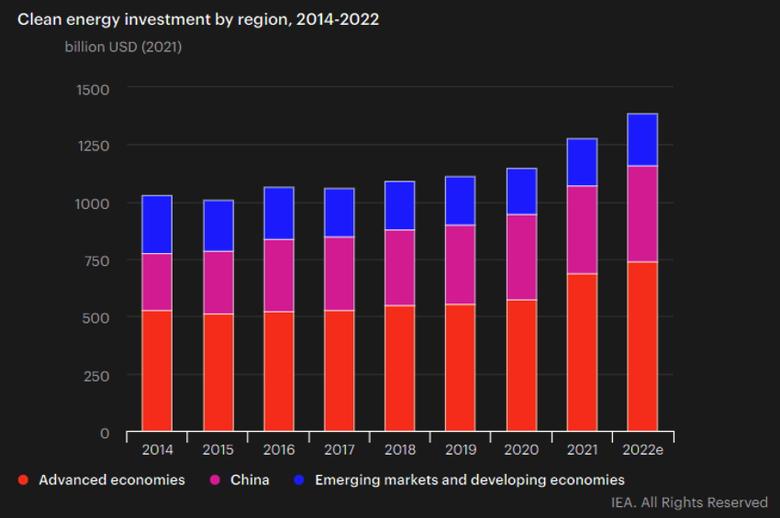

GLOBAL CLEAN ENERGY: SLOWLY AND EXPENSIVE

By RON MILLER Principal Reliant Energy Solutions LLC

ENERGYCENTRAL - Oct 11, 2022 - As the world seeks lower emission energy sources, the demand for certain key minerals such as copper, lithium, copper, nickel, cobalt and rare-earths will certainly rise. A key determinant of how successful the world will be in the new low-emission age, will be access to and production of these key minerals.

The shift we will see in this and subsequent decades will be from a fuel-intensive to a material-intensive energy system with the emphasis on renewable energy mineral supply and demand. A mismatch between the world's climate ambitions and the availability of critical minerals could mean a slower and more expensive energy transition, according to a report from the International Energy Agency (IEA).

Progress on the world’s rising climate action ambitions could be undermined by a shortage of some of the critical minerals used in clean-energy technologies including wind turbines, solar farms and electric vehicles (EVs), according to a far-reaching report from the IEA’s Fatih Birol.

Not addressing the supply/demand mismatches in a timely fashion could significantly increase the risks of mineral price volatility and supply disruptions.

Mineral Demand:

Demand outlooks and supply vulnerabilities vary widely by mineral, but the energy sector’s overall appetite for critical minerals could grow six-fold by 2040, according to the IEA.

In IEA’s World Energy Outlook report, it stated that an onshore wind plant needs “nine times more mineral resources than a similarly sized gas-fired power plant”, while EVs requires six times the quantities of minerals used in internal combustion engine-driven car as shown in Figure 1, along with similar data for power generation.

In climate-driven scenarios, mineral demand for use in batteries for EVs and grid storage is a “major force”, according to the IEA report, growing “at least thirty times” by the end of the next decade.

Wind is expected to “take the lead, bolstered by material-intensive offshore projects”, followed by PV, and then the demand for copper and aluminum that will come with the expected expansion of electricity networks around the world.

The IEA report highlights a range of key areas of action by policy makers to ensure that critical minerals “enable an accelerated transition to clean-energy rather than becoming a bottleneck”.

Since 2010 the average amount of minerals needed for a new unit of power generation capacity has increased by 50% as the share of renewables in new investment has risen.

Minerals used in clean energy technologies compared to other power generation sources are the following: copper, nickel, manganese, cobalt, chromium, molybdenum, zinc, rare earths, and silicon.

Lithium, nickel, cobalt, manganese and graphite are crucial to battery performance, longevity and energy density. Rare earth elements are essential for permanent magnets that are vital for wind turbines and EV motors. Electricity networks need a huge amount of copper and aluminum, with copper being a cornerstone for all electricity-related technologies.

The shift to a clean energy system is set to drive a huge increase in the requirements for these key minerals, meaning that the energy sector is emerging as a major force in mineral markets. In a scenario that meets the Paris Agreement goals (as in the IEA Sustainable Development Scenario (SDS), clean energy technology mineral’s share of total demand rises significantly over the next two decades to over 40% for copper and rare earth elements, 60-70% for nickel and cobalt, and almost 90% for lithium. EVs and battery storage have already displaced consumer electronics to become the largest consumer of lithium and are set to take over from stainless steel as the largest end user of nickel by 2040.

To reach the goals of the Paris Agreement (climate stabilization at “well below 2°C global temperature rise”, as in the SDS) would mean a quadrupling of mineral requirements for clean energy technologies by 2040. An even faster transition, to hit net-zero globally by 2050, would require six times more mineral inputs in 2040 than today. Likewise rare earth elements may see three to seven times a higher demand in 2040 than today.

Mineral demand for clean energy technologies would rise by at least four times by 2040 to meet climate goals, with particularly high growth for EV-related mineral as shown in Figure 2, and six times to meet the net-zero by 2050 goal .

The demand growth of key minerals by 2040 such as lithium, graphite, cobalt, nickel, and rare earths will see huge multiples compared to 2020 demand numbers as shown in Figure 3. The index for 2020 is 1 compared to the high 2040 mineral demand growth numbers.

Which sectors do these increases come from? In climate-driven scenarios, mineral demand for use in EVs and battery storage is a major force, growing at least thirty times to 2040. Lithium sees the fastest growth, with demand growing by over 40 times in the SDS by 2040, followed by graphite, cobalt and nickel (around 20-25 times). The expansion of electricity networks means that copper demand for grid lines more than doubles over the same period.

For example, cobalt demand could be anything from 6 to 30 times higher than today’s levels depending on assumptions about the evolution of battery chemistry and climate policies.

The World Bank Group reports that minerals such as graphite, lithium and cobalt, could increase by nearly 500% by 2050, with over 3 billion tons of minerals and metals that will be needed to deploy wind, solar and geothermal power, as well as energy storage, required for achieving a below 2°C future.

Aluminum is used widely for both energy generation and storage technologies, with roughly 103 million tons of aluminum needed to supply 87% of solar PV to achieve a below 2°C future.

The prospect of a rapid rise in demand for critical minerals, well above anything seen previously, poses huge questions about the availability, reliability, and pricing of supply.

Mineral Supply:

Mining and processing of minerals such as lithium, cobalt and some rare earth elements are highly concentrated in a small number of countries, bringing with it geopolitical risk of supply security. Production of many energy transition minerals today is more geographically concentrated than that of oil or natural gas, as shown in Figure 4.

For lithium, cobalt and rare earth elements, the world’s top three producing nations control well over three-quarters of global output. The Democratic Republic of the Congo (DRC) and People’s Republic of China (China) were responsible for some 70% and 60% of global production of cobalt and rare earth elements respectively in 2019.

Raw materials are a significant element in the cost structure of many technologies required in energy transitions.

The world has more than enough mineral resources to make transitions work, but that is not a guarantee that supplies will be readily and affordably available where and when they are needed. The more ambitious climate targets, the more minerals needed for a clean energy transition with locations as shown in Figure 5 for EV minerals.

Issues for mineral supply:

Long project development lead times with some mines taking up to 16 years from discovery to first production.

Declining resource quality (i.e. Chile copper ore grade declined by 30% over the past 15 years) will require more energy, exerting upward pressure on production costs, greenhouse gas emissions and waste volumes.

Growing scrutiny of environmental and social performance which could harm local communities and disrupt supply.

Higher exposure to climate risks as copper and lithium mining are vulnerable to water stress given their high water requirements.

Future Mineral Pricing:

The future clean energy mineral supply demand mismatch will provide the opportunity for price volatility in the future as shown in Figure 6.

Even as technology learning and economies of scale for lithium-ion batteries have pushed down overall costs by 90% over the past decade, raw material costs will now loom larger in the future, accounting for some 50-70% of total battery costs, up from 40-50% five years ago.

For an expanded electricity network to accommodate electrification, copper and aluminum currently representing ~20% of total grid investment costs, higher mineral prices as a result of tight supply could greatly influence the level of grid investment.

Figure 7 depicts how key clean energy metals prices fared in 2021.

The role of government and industry for future mineral transition:

Earlier: