GLOBAL OIL DEMAND +2.6 MBD

OPEC - 12 October 2022 - OPEC MONTHLY OIL MARKER REPORT

Oil Market Highlights

Crude Oil Price Movements

The OPEC Reference Basket (ORB) declined m-o-m by $6.58 in September, or 6.5%, to average $95.32/b. Pressure from equity market selling, central bank interest rate hikes, and economic outlook concerns weighed on crude futures prices. The ICE Brent front-month declined $7.17, or 7.3%, to average $90.57/b in September while NYMEX WTI fell by $7.68, or 8.4%, to average $83.80/b. The Brent/WTI futures spread widened again m-o-m, expanding 51¢ to average $6.77/b. The market structure of all three major crude benchmarks remained in backwardation. Hedge funds and other money managers resumed selling in both major futures contracts — ICE Brent and NYMEX WTI — especially during the last week of September.

World Economy

Global economic growth has entered into a period of significant uncertainty and deteriorating macroeconomic conditions, amid intensifying challenges including high inflation levels, tightening monetary policies by major central banks, rising interest rates and persisting supply chain issues. Moreover, geopolitical risks, extensions of COVID-19 related lockdowns and flare ups of the pandemic in the Northern Hemisphere during winter season remain uncertain. By taking these factors into account, the global economic growth forecast for both 2022 and 2023 are revised down to stand at 2.7% and 2.5%, respectively. For the US, GDP growth for 2022 is revised down to 1.5% and for 2023 it is lowered to 0.8%. In the Euro-zone, the 2022 GDP forecast is lowered to 3.0%, and for 2023 it is lowered to 0.3%. Japan’s economic growth forecast for 2022 is revised up to 1.5% while for 2023 it is revised down to 1.0%. China’s 2022 forecast is revised down to 3.1 % while for 2023 it stands at 4.8%. India’s 2022 forecast is revised down for both 2022 and 2023 to 6.5% and 5.6%, respectively. Brazil’s growth forecast for 2022 is unchanged at 1.5% while for 2023 it is revised down to 1.0%. Russia’s 2022 forecast is revised up to show a contraction of 5.7%, with growth of 0.2% expected in 2023. Downside risks to this forecast includes continued inflationary trends, further monetary actions by major central banks, aggravated geopolitical tensions, worsening of the pandemic in the northern hemisphere during winter months, tightening labour markets and further supply chain constraints. These ongoing risks and challenges, especially the economic dynamics in 4Q22 and 1Q23 will require close monitoring.

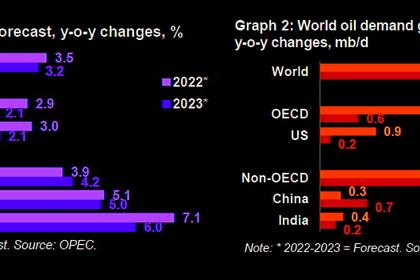

World Oil Demand

Global oil demand growth in 2022 is revised down by 0.5 mb/d to reflect the recent macroeconomic trends and oil demand developments in various regions. These developments include the extension of China's zero-COVID-19 restrictions in some regions, economic challenges in OECD Europe, and inflationary pressures in other key economies, which have weighed on oil demand, especially in 2H22. With this, global oil demand for 2022 is now expected to grow by about 2.6 mb/d. In the OECD, oil demand growth is estimated at about 1.4 mb/d with the non-OECD at about 1.3 mb/d. For 2023, world oil demand growth is revised down to stand at about 2.3 mb/d. The OECD is projected to grow by about 0.4 mb/d, and the non-OECD by about 2.0 mb/d.

World Oil Supply

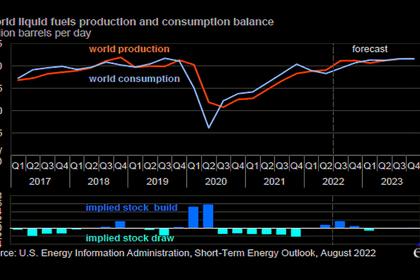

Non-OPEC liquids supply growth in 2022 is forecast at 1.9 mb/d. Upward revisions in Latin America were more than offset by downward revisions to Other Eurasia, OECD Europe and Other Asia. The main drivers of liquids supply growth for 2022 are expected to be the US, Canada, China, Guyana and Brazil, while production is expected to decline mainly in Norway and Thailand. For 2023, the non-OPEC liquids production growth forecast is adjusted down to 1.5 mb/d. The main drivers for 2023 growth are expected to be the US, Norway, Brazil, Canada, Kazakhstan and Guyana, with oil production declines mainly seen coming from Russia and Mexico. Uncertainty about the geopolitical situation remains high, and there is potential for further US shale liquid production. OPEC NGLs and non-conventional liquids in 2022 are forecast to grow by 0.1 mb/d and then by 50 tb/d in 2023 to average 5.4 mb/d. OPEC-13 crude oil production in September increased by 146 tb/d mo-m to average 29.77 mb/d, according to available secondary sources.

Product Markets and Refining Operations

Refinery margins showed diverging trends in September. In the Atlantic Basin, margins increased as the start of peak refinery maintenance season led to a reduction in product output, exerting pressure on product balances, particularly gasoil. This provided solid support to products markets in both the US Gulf Coast and Northwest Europe, mainly for middle distillates. Meanwhile, refinery margins suffered losses in Asia, pressured by the recent release of China’s fourth batch of export quotas as it set the stage for stronger product exports in the near term. In addition, expectations of a fifth batch of export quotas exacerbated bearish product market sentiment within the region, leading ultimately to a downturn in Asian product performance all across the barrel, with the exception of naphtha, which continued to gain favour as the preferred petrochemical feedstock given high natural gas prices. In September, global refinery processing rates declined in line with historical trends, down by 1.2 mb/d in response to a rise in offline capacity amid the start of autumn maintenance season. Preliminary data points to refinery intakes declining further in the coming months by nearly 900 tb/d.

Tanker Market

Very Large Crude Carrier (VLCC) rates continued to gather strength in September, with gains seen on all major routes, supported increased demand on longer haul routes. Spot VLCCs rates on the Middle East-to-East route rose 26%, while on the West Africa-to-East route they gained 23%. Suezmax and Aframax rates fell from the elevated levels seen since March, as the refinery maintenance season kicked off. Suezmax rates on the US Gulf Coast-to-Europe route declined by 7%, while Aframax spot rates on the Mediterranean routes lossed 13%. Clean rates saw diverging trends, with gains East of Suez and declines West of Suez.

Crude and Refined Products Trade

Preliminary data showed that the US crude imports to average 6.3 mb/d in September, while exports reached a record high of 4.0 mb/d. China’s crude imports averaged 9.5 mb/d. The increase came amid expectations for a pickup in domestic product demand in 4Q22 and as the potential for product exports increased. India’s crude imports fell to 4.1 mb/d in August, following strong performance seen over the last four months, but remained broadly in line with seasonal levels. India’s product exports increased, driven primarily by higher outflows of jet fuel and gasoil, despite the government imposing higher export duties. Japan’s crude imports showed strong performance in August, averaging just under 3.0 mb/d, the strongest figure since March 2020, supported by summer demand for gasoline and heathy fuel oil consumption for power generation. Preliminary figures show crude imports into the OECD Europe region remaining high compared with last year, despite steady m-o-m declines in seaborne Russian imports.

Commercial Stock Movements

Preliminary August data shows total OECD commercial oil stocks up 7.8 mb, m-o-m. At 2,712 mb, inventories were 111 mb less than the same month a year ago, 267 mb lower than the latest five-year average, and 273 mb below the 2015–2019 average. Within components, crude and product stocks rose 6.8 mb and 1.0 mb, respectively, compared with the previous month. At 1,315 mb, OECD crude stocks were 0.7 mb lower than the same month last year, 105 mb below the latest five-year average and 133 mb lower than the 2015–2019 average. OECD product stocks stood at 1,398 mb, representing a m-o-m deficit of 110 mb, 162 mb lower than the latest five-year average and 140 mb below the 2015–2019 average. In terms of days of forward cover, OECD commercial stocks rose by 0.2 days m-o-m in August to stand at 59.3 days. This is 1.3 days below August 2021 levels, 5.0 days less than the latest five-year average and 3.8 days lower than the 2015–2019 average.

Balance of Supply and Demand

Demand for OPEC crude in 2022 is revised down by 0.2 mb/d from the last month’s assessment to stand at 28.7 mb/d. This is around 0.6 mb/d higher than in 2021. Demand for OPEC crude in 2023 is revised down by 0.3 mb/d from the last month’s assessment to stand at 29.4 mb/d. This is around 0.8 mb/d higher than in 2022.

-----

Earlier: