GLOBAL OIL: MURKY WATERS

Taking into account the recent developments within the Oil Markets, it is safe to say that we are within the murky waters with very troubled vessels to act as a shield.

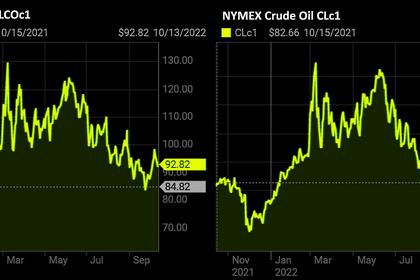

Crude Oil WTI has been within the stipulated price range,maintaining the $101.35/bbl ceiling after the turmoil release of SPR creating somewhat of whipsaw majorly biasness being experienced by the Bears.

All eyes are with the coming midterms,pricecaps also being a point to look into.

If any tanker moves Russian cargo outside of the price cap(on the event Europe adopts it),that ship gets barred from all future EU access.

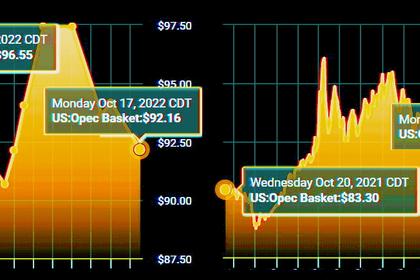

Below is a chart for monthly exports to Russia by countries,this may help us understand what the whole idea of 'pricecaps' means to the general trading partners.

Stockpiles of American distillate fuels are exceptionally low which could signal higher pricing within sectors of trucking,farming and construction.

On the Asian Equities front,we have a scenario building up within the HangSeng #Tech hitting record lows this Asia session which is a significant indicator for the economic health.

Investors are not impressed with the #HongKong policy address.

The HangSeng Index is down 2.8%, around 450 points, at 16,060.

If the index ends the day at this level, it will be the lowest close since May 2009.

BoJ announces unscheduled bond buying as key yield broke the stipulated ceiling.

This should be keenly observed for Asian equity traders.

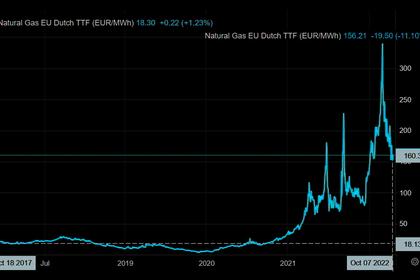

Let us wait for the winter season to get back on the LNG discussion of things,Nordstreams and whatnot.

In the event of such,we do hope since its Libra season,we may see a balance of things within the global macro-scales,only time will tell,lovely week ahead from my team,many blessings.

Andy Warr,

TophatFinance.

-----

Earlier: