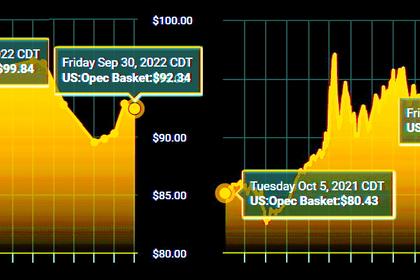

OIL PRICE: BRENT ABOVE $91, WTI NEAR $86

REUTERS - Oct 5 - Oil inched lower on Wednesday after gains in recent days as OPEC+ producers looked set to agree deep output target cuts later in the day despite a tight market.

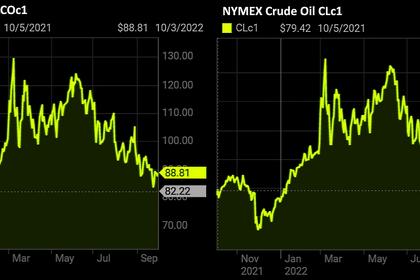

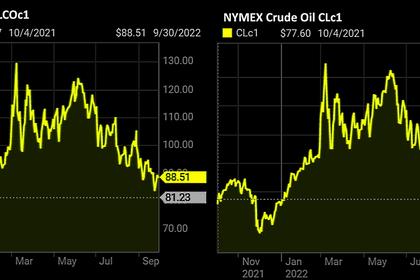

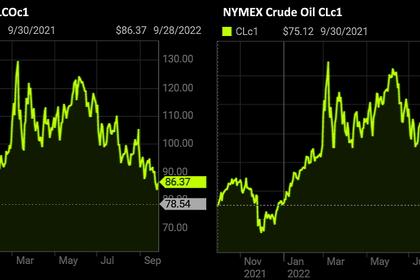

Brent crude was down 23 cents, or 0.3%, at $91.57 a barrel at 0839 GMT while U.S. West Texas Intermediate (WTI) crude fell 32 cents, or 0.4%, to $86.20 a barrel. Both contracts rose sharply in the last two days.

Oil has risen so far this week in anticipation of the largest output cut by OPEC+ since the depths of the COVID-19 pandemic in 2020, said Fiona Cincotta, senior financial markets analyst at City Index.

"In reality, the real impact of a large cut would be smaller, given that some of the members are failing to reach their output quotas," Cincotta added.

The Organization of the Petroleum Exporting Countries (OPEC) and allies led by Russia, together called OPEC+, will meet in Vienna to discuss output cuts of up to 2 million barrels per day (bpd), an OPEC source told Reuters.

"OPEC+ has a fine balance to walk in the scale of output cuts likely to be announced today. Close the taps too much and prices will soar at the cost of demand destruction. Cut too little and the sell-off will hamper OPEC+ revenue," said Ehsan Khoman, MUFG's head of emerging markets research.

The United States is pressing OPEC+ producers to avoid making deep cuts, a source familiar with the matter told Reuters, as President Joe Biden looks to prevent a rise in U.S. gasoline prices.

The real impact on supply from a lower output target would be limited as several OPEC+ countries are already pumping well below their existing quotas. In August, OPEC+ missed its production target by 3.58 million bpd.

However an agreement on big cuts "would send a strong message that the group is determined to support the market," ANZ Research analysts said in a note, adding that it "would significantly tighten the market".

U.S. crude oil stocks fell by about 1.8 million barrels for the week ended Sept. 30, according to market sources citing American Petroleum Institute figures on Tuesday.

A rise in the U.S. dollar has also put pressure on crude prices as it makes oil more expensive for buyers holding other currencies.

-----

Earlier: