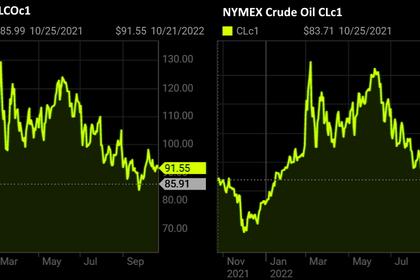

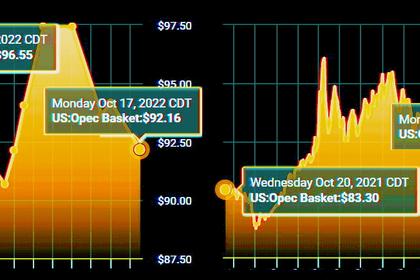

OIL PRICE: BRENT NEAR $92, WTI ABOVE $83

REUTERS - Oct 24 - Oil prices slid more than 1% on Monday after Chinese data showed that demand from the world's largest crude importer remained lacklustre in September as strict COVID-19 policies and fuel export curbs depressed consumption.

Brent crude futures for December settlement slid $1, or 1.1%, to $92.50 a barrel by 0609 GMT after rising 2% last week. U.S. West Texas Intermediate crude for December delivery was at $84.02 a barrel, down $1.03, or 1.2%.

Although higher than in August, China's September crude imports of 9.79 million barrels per day were 2% below a year earlier, customs data showed on Monday, as independent refiners curbed throughput amid thin margins and lacklustre demand.

"The recent recovery in oil imports faltered in September," ANZ analysts said in a note, adding that independent refiners failed to utilise increased quotas as ongoing COVID-related lockdowns weighed on demand.

"This was exacerbated by falling refinery margins and product export curbs," the analysts said.

Saudi Arabia and Russia were neck and neck as China's top two suppliers in September.

Uncertainty over China's zero-COVID policy and property crisis are undermining the effectiveness of pro-growth measures, ING analysts said in a note, even though third-quarter gross domestic product (GDP) growth beat expectations.

The GDP data came a day after China's Xi Jinping secured a precedent-breaking third leadership term on Sunday, cementing his place as the country's most powerful ruler since Mao Zedong.

Brent rose last week despite U.S. President Joe Biden announcing the sale of a remaining 15 million barrels of oil from the U.S. Strategic Petroleum Reserves. The sale is part of a record 180 million-barrel release that began in May.

Biden added that his aim would be to replenish stocks when U.S. crude is around $70 a barrel.

"Biden's comments that the U.S. will only buy crude once prices hit USD70/bbl provides a strong support level," ANZ said.

Last week, U.S. energy firms added oil and natural gas rigs for the second week in a row as relatively high oil prices encourage firms to drill more, energy services firm Baker Hughes Co said in a report on Friday.

-----

Earlier: