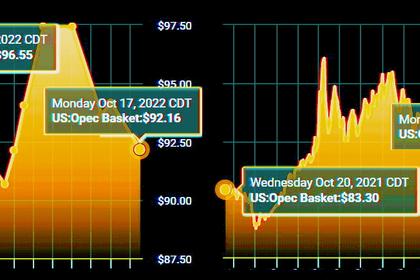

OIL PRICE: BRENT NEAR $92, WTI BELOW $84

REUTERS - Oct 25 - Oil prices fell by more than $1 per barrel on Tuesday as bearish economic data from key global economies heightened demand fears.

International benchmark Brent crude futures fell by $1.30 to $91.96 per barrel by 1117 GMT, after easing 0.3% in the previous session.

U.S. West Texas Intermediate crude futures for December delivery fell by $1.24 to $83.34 per barrel, after a previous decline of 0.6%.

Supply and demand fundamentals remain largely stable, leaving economic sentiment centre-stage for the oil market, said Vandana Hari, founder of oil market analysis provider Vanda Insights.

"Much of the souring outlook on demand has already been baked in, so any further downward pressure may be slow-acting," she said.

Signs of uncertain economic activity in the United States and China, the world's two biggest oil consumers, continued to weigh on prices on Tuesday.

Government data on Monday showed China's crude oil imports in September were 2% lower than a year earlier, continuing a trend of lower imports at the same time it reported slowing retail sales.

U.S. business activity contracted for a fourth month in October, with manufacturers and services firms saying in a monthly S&P Global survey of purchasing managers published on Monday that client demand is falling.

Business activity also contracted in the manufacturing sectors in the euro zone and the United Kingdom.

Goldman Sachs CEO David Solomon said on Tuesday he believes a U.S. recession is "most likely", while a recession may be occurring in Europe.

The U.S. Federal Reserve could hike rates beyond 4.5-4.75% if it does not see real changes in behaviour, he said at Saudi Arabia's flagship investment conference FII.

U.S. crude oil inventories are also expected to rise this week, which may limit price gains. Analysts polled by Reuters estimated on average that crude inventories rose by 200,000 barrels in the week to Oct. 21.

Separately, International Energy Agency head Fatih Birol said the world will still need Russian oil to flow to the market despite a price cap, with between 80% to 90% an "encouraging level" to meet demand.

Many details of a price cap on Russian oil still have to be ironed out, Birol said during the Singapore International Energy Week.

Russia's top producer Rosneft has issued a tender to sell six cargoes of Sokol crude for loading in November to early December, a tender document reviewed by Reuters showed.

-----

Earlier: