OPEC+ OUTPUT CUT

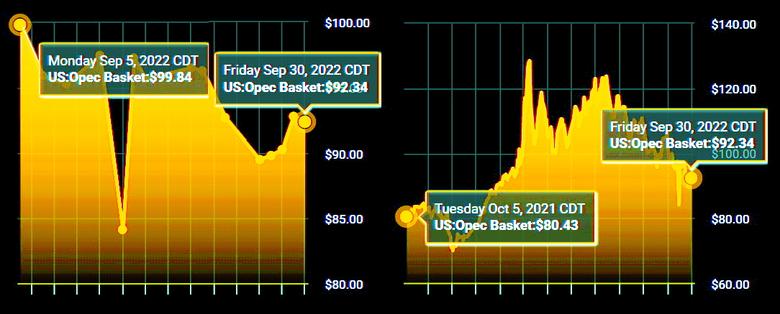

PLATTS - 03 Oct 2022 - OPEC+ meets Oct. 5 to consider a significant output cut, as the Russian invasion of Ukraine and demand concerns raise state budget demands for members of the coalition.

This has affected the largest non-OPEC producer in the group Russia most of all, with Western sanctions exacerbating problems facing the group overall.

Prior to the February invasion Russia's economic position within OPEC+ was seen as comparatively strong, enabling it to secure beneficial conditions in previous negotiations.

It is unclear if Russia will send a delegation to Vienna this week to attend the group's first in-person meetings since early 2020. The OPEC+ JTC will meet Oct. 4 to assess market conditions followed by JMMC and ministerial meetings Oct. 5.

Discussions will take place as Russia is now grappling with months of its key crude grade Urals trading at significant discounts.

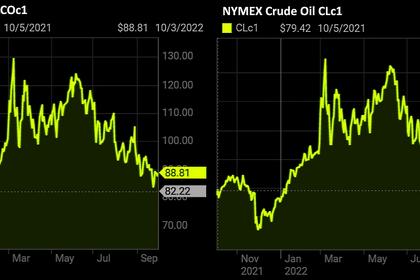

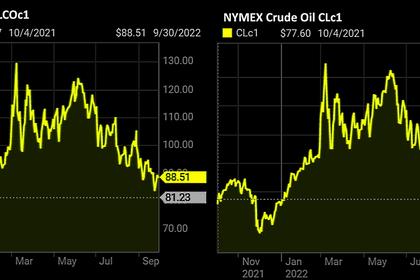

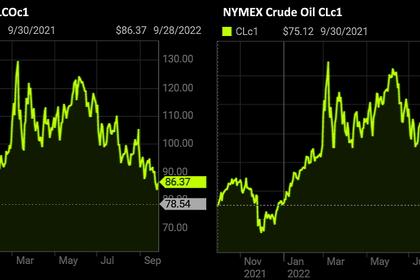

The latest Platts assessment of Urals was $64.07/b on Sept. 30, according to S&P Global Commodity Insights. This compares to Dated Brent at $87.92. Since the invasion began discounts have been as much as $40/b. Prior to the invasion Urals was trading at a discount of around $10/b to Dated Brent.

Russia currently forecasts a further drop in Urals oil price over the next three years – to $70.1/b in 2023, $67.5/b in 2024, and $65/b in 2025. Its 2022 forecast is $80/b.

The G7's plans for a price cap on Russian oil purchases could further exacerbate the situation by year end. There is also set to be a major cut to Russia's export options by early 2023 when further EU sanctions on oil imports and shipping insurance come into force.

Discounts are combining with significant military expenditures to drive up estimates for Russia's fiscal breakeven oil price in 2022.

George Voloshin, Paris-based Eurasia analyst, said that it is difficult to estimate what oil price Russia would need to balance the budget.

"$120/barrel as the headline Brent price would probably do the job, but such a price is currently nowhere to be seen as recession fears are weighing down on everything," Voloshin said.

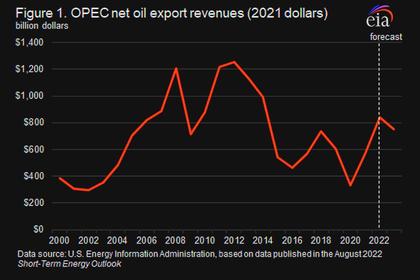

Public spending costs as a result of the covid pandemic as well as rising inflation globally are driving up fiscal breakeven oil estimates for some other OPEC+ producers, but not to the same extent as in Russia.

The strong ruble to dollar exchange rate is also having an impact on Russia's finances.

"The super-strong ruble is a major aggravating factor: the Russian budget is getting considerably less in tax revenue while the ruble is this strong. Without the invasion and the ruble trading for an average of 75 per USD, 2022 would have been a bumper year for the Russian oil and gas industry," Voloshin said.

During previous periods of price volatility Russia devalued the ruble to support energy producers, whose costs are mainly in rubles, and revenues are mainly in US dollars. The fiscal rule also enabled Russia to direct oil revenues above a set price to a sovereign wealth fund to insulate against future price shocks. Western sanctions have prevented Russia from buying USD to manage the exchange rate.

This is making Russia more likely to push for bigger production quota cuts within OPEC+ to support prices. S&P Global Commodity Insights currently forecasts a 1 million b/d cut for November, and another 2 million b/d once the current deal is extended into 2023.

"Russia is pushing for the full 1 million b/d next week, although pressure from the US ahead of Nov. 8 elections could cause hesitation from others," S&P Global said in a global political risk scorecard released Sept. 30.

Despite these risks, and a recent drop in global oil prices, the country continues to receive significant oil revenues. The IEA estimates that Russia earned $17.7 billion in August, down $1.2 billion on July and the lowest level since March.

Furthermore, Russian President Vladimir Putin has said that Russia would respond to a price cap by suspending deliveries to countries where it is implemented, which could drive global oil prices higher.

-----

Earlier: