RUSSIA'S OIL EXPORTS DOWN

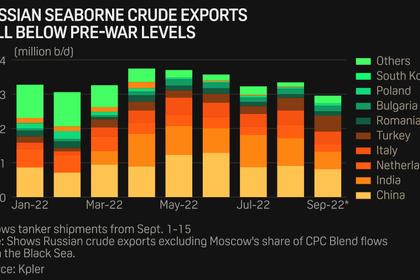

PLATTS - 06 Oct 2022 - Russian crude exports fell to a 12-month low in September, according to tanker tracking data, as European buyers continued to wind down their purchases of Moscow's oil ahead of looming sanctions despite surging flows into Turkey, which has become the third largest buyer of Russia's oil behind China and India.

Excluding Russia's share of Kazakhstan's CPC Blend exports, Russian crude exports averaged 2.99 million b/d in the month, down 290,000 b/d on the August levels and lowest since September 2021 when global oil demand was still recovering from pandemic lockdowns, according to S&P Global Commodities at Sea.

Russian flows to the Netherlands—home to Europe's biggest refining hub—were cut by more than half on the month to 165,000 b/d in September, down from 390,000 b/d in August and from pre-war levels of about 525,000 b/d, Commodities at Sea data shows.

European buyers have been shunning Russian oil ahead of the EU sanctions on imports of Russian crude and products which are set to kick in Dec. 5 and Feb 5, 2023, respectively.

Overall, Russian crude cargoes bound for Europe have now sunk below 1 million b/d for the first time since July 2020, the data shows, down from pre-war levels of 1.5 million b/d.

At the same time, Russian exports to Turkey rose 19% on the month to a record 414,000 b/d as local refiners continued to snap up Russia's discounted oil. As a result, Turkey has become Russia's third largest buyer of crude behind China and India, the data shows, with Turkey's state-run dominated refining sector exporting more refined products to Europe and further afield since the war.

Before Russia's invasion of Ukraine, Turkey's five refineries were importing around 130,000 b/d of Russian crude.

Asian shift

The data shows that China and India continue to dominate the list of Russian crude importers, buying 60% of Russian exports in the month, up from 54% in August. Flows to China dipped by 76,000 b/d on the month but Indian imports rose by 60,000 b/d on the month to average a combined 1.77 million b/d.

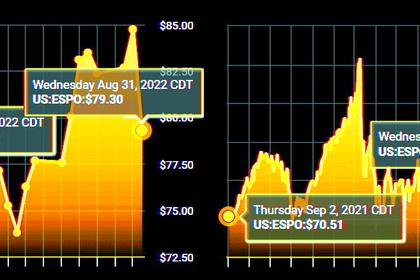

Discounts for Russian crudes narrowed sharply in August, denting their appeal over non-Russian alternatives. The discount for Russia's key Urals export crude to Dated Brent in Europe averaged $22/b in September, down from $27/b in August, S&P Global data shows. Crude tanker rates to transport Russian crude to Asia have also jumped sharply since February, making it less attractive to buy Moscow's oil compared with Asia's traditional supply sources in the Middle East.

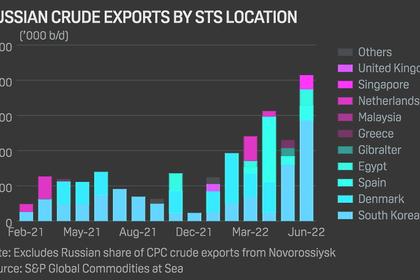

Russian crude flows to Asia are expected to rise further by year-end if a US-led price cap on Russian oil comes into force.

The G7-planned price cap would likely ease the potential trade flow disruptions for Russia, according to S&P Global Commodity Insights, as Moscow needs to redirect some 2.5 million b/d of crude and product exports currently exported to Europe.

"We still forecast a majority of soon-to-be banned EU imports to find alternate buyers, with or without a "price exception", on ships not requiring Western insurance or services," Paul Sheldon, chief geopolitical adviser at S&P Global said.

Lukoil in Europe

Elsewhere in Europe, the data shows that Russia's Lukoil continues to feed discounted Urals crude to its two EU-based refineries in Italy and Bulgaria. Keen to take advantage of sky-high refining margins from processing cheap Russian crude, Russian oil imports to Bulgaria averaged 155,000 b/d in September, more than double pre-war levels. Bulgaria, which imports Russian crude through the Black Sea to supply the Lukoil-owned, 190,000 b/d Neftokhim refinery in Burgas, is allowed to buy Russian crude for another two years until December 2024.

In Italy, where Lukoil owns the 320,000 b/d ISAB refining complex in Sicily—Italy's biggest plant—Russian imports stood at 325,000 b/d in September, the data shows, up from pre-war levels of around 150,000 b/d.

Margins for processing Urals crude in a typical Northwest European refinery averaged around $40/b in September, according to S&P Global estimates, double the refining margin for processing Bonny Light or WTI crudes.

Exports of Russian refined products also continue their downward trend, the data shows, averaging 2.1 million b/d in September, an 11% reduction from the first-half average of 2.41 million b/d.

-----

Earlier: