EUROPEAN ENERGY CRISIS CONTINUES

FT - NOVEMBER 24 2022 - Europe’s energy crisis is set to persist for years if the region fails to reduce demand and secure new gas supplies, according to fresh warnings from energy industry executives and analysts.

Mild autumn weather and a dash to fill up storage sites across Europe has bolstered the region’s energy security this winter, but concerns are starting to mount over whether sufficient supplies will be available next summer and for the winter that follows.

“We are in a gas crisis, and we will continue to be in a little bit of a crisis mode for the next two or three years,” said Sid Bambawale, head of liquefied natural gas for the Asia region at Vitol, the world’s largest independent energy trader, speaking at the Financial Times Commodities Asia Summit in Singapore. “So let’s not develop a false sense of security.”

The warnings present European policymakers with an uncomfortable reality. Despite having already spent hundreds of billions of euros ensuring storage sites are filled this winter and providing support to households and businesses, the strain on public funds as well as pain for households and businesses are likely to continue next year.

The renewed concerns ensue as flows of gas from Russia have come to a near standstill in response to western sanctions for Vladimir Putin’s war in Ukraine. A new threat this week from Moscow to limit output from the only remaining pipeline connecting Russia and Europe has highlighted the importance of locking-in supplies from other global producers and taking action to reduce fuel consumption by industry and householders.

Kosuke Tanaka, head of Asian LNG origination at Japan’s energy trader Jera Global Markets, said: “The [gas] market is currently balanced with demand destruction, including fuel switching to oil and coal. And we will still need such demand response to balance the market in the coming years.”

Europe’s gas storage at the end of September, the time when heating demand usually begins to pick up, stood at about 90 per cent this year, broadly in line with the previous five-year average of 86 per cent, despite Russia largely severing gas supplies in recent months.

In addition to the demand reduction — households and industries have reduced demand by 13 per cent year to date compared with the three-year average, according to think-tank Bruegel — while the region has succeeded in importing record amounts of LNG, aided by China’s lacklustre demand. China was also exporting excess LNG to Europe.

But high storage levels could lead to complacency and a slowdown of demand reduction, those in the energy industry have argued. They also warn that Russian pipeline gas to Europe will fall to negligible levels next year, resulting in a bigger gap to fill, while China could also gradually ease its zero Covid policy and consume more gas than last year.

Speaking at the FT summit, Russell Hardy, chief executive of Vitol, said gas prices would have to stay sufficiently high to suppress demand for the fuel over the summer from industrial users in order to refill storage and keep the lights on.

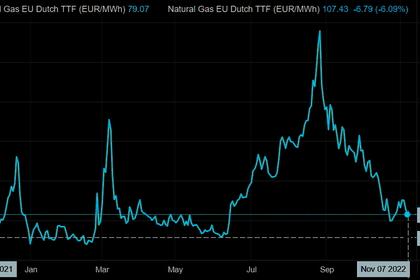

European gas prices have averaged €108 a megawatt hour in 2023, more than four times the average of the previous decade.

“High prices will have to compress demand largely every month of next summer. It’s not a good thing — it’s an absolutely awful thing for European businesses and that’s the genesis of the recession,” he said.

A recent analysis by Paula Di Mattia, European gas market analyst at commodities consultancy ICIS, also showed that in five out of seven scenarios, Europe could head into the winter of 2023-24 with gas storage sites at only 65 per cent of capacity, the lowest level at that point since at least 2016, when records began.

The analysis assumes the majority of Russian pipeline flows to Europe will remain cut off, excluding the southern TurkStream pipeline.

Scenarios that would allow Europe to have ample storage levels involved significant demand destruction either in the winter or throughout November 2022 to September 2023, as well as raised LNG imports to 440mn cubic metres a day, more than this year.

“The challenges for refilling storage during summer 2023 will highly depend on their utilisation in winter 2022-23,” Di Mattia said. “Ongoing demand destruction and high LNG inflows are key to maintaining a supply-demand balance throughout 2023.”

But Europe’s need for LNG may face infrastructure constraints, with years of under-investment in fossil fuel-related projects.

Business advisory FTI Consulting calculates that should the EU replace all of Russian gas with LNG, there is a total gap of 40bn cubic metres a year in European regasification capacity — facilities needed to turn LNG back into gas — which could rise to 60 bcm a year in a cold winter.

FTI’s calculation does not take into account regasification capacity in the Iberian peninsula as they have limited pipeline connections to the rest of Europe.

Countries such as Germany, the Netherlands, Italy, France and Croatia have been pushing for new regasification terminals, including the chartering of floating storage and regasification units, or FSRUs.

In total, Europe could add 40 bcm a year of import capacity by October 2023, said Emmanuel Grand, senior managing director at FTI Consulting. But, he warned, “some of the projects are not supported by firm LNG commitments, and there are risks that these projects may be delayed.”

-----

Earlier: