EUROPEAN GAS LIMITS

FT - Nov 30, 2022 - The EU’s goal since the outbreak of war in Ukraine has been to rapidly reduce its reliance on Russian fossil fuels while keeping a lid on prices, but the results of its endeavours have been decidedly mixed.

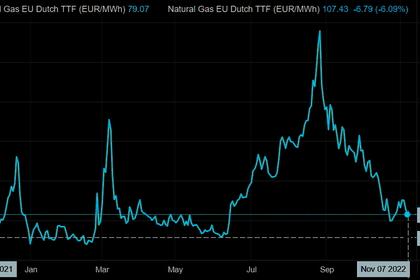

The bloc has managed to pare back its use of Russian gas and oil more quickly than expected by many officials and analysts, but measures to tackle soaring energy prices have triggered deep divisions in EU capitals. A proposal outlined last week by Brussels for a cap on month-ahead wholesale gas of €275 per megawatt hour was labelled a “joke” by critics who said it would not have addressed this summer’s price surge.

As EU leaders prepare for a summit next month where they will aim to finalise an energy package that stabilises gas prices and supply, what are the key elements of Brussels’ wartime energy policy and how successful are they likely to be?

What is the EU doing to wean itself off Russian gas?

In May, the EU unveiled a €210bn plan called RePowerEU that would speed up the rollout of renewable energy, make industry more energy-efficient and increase production of domestic fossil fuels.

There has also been a successful effort to cut gas demand after energy ministers signed a voluntary target in July to reduce consumption by 15 per cent across the bloc. A proposal by Berlin to increase this to 25 per cent has yet to win much support.

However, Europe could still face a 30bn cubic-metre shortfall during next summer’s key storage refilling period if Russia halts all pipeline deliveries and Chinese demand for liquefied natural gas increases as it lifts more coronavirus restrictions, according to the International Energy Agency.

Piped gas from Russia previously accounted for around 40 per cent of the EU’s supply but that has dropped to less than 8 per cent.

Where is it sourcing gas from?

EU member states have begun replacing the 155 bcm a year of Russian pipeline gas.

Deals with Algeria, Azerbaijan, Egypt and the US have contributed to around 24 bcm more gas from those countries between January and October this year compared with 2021. Germany’s LNG deal with Qatar announced on Wednesday will add about 2.7 bcm a year.

The EU aims to end its reliance on Russian fossil fuels by 2027. For now, Moscow’s move to halt supplies through the main Nord Stream 1 pipeline has led the bloc to increase shipments of Russian seaborne gas by around 50 per cent.

It has also been negotiating with Norway, now its biggest supplier of piped gas, for more deliveries.

How has the bloc tried to limit prices?

EU ministers are close to agreeing a third emergency package to curb energy costs.

Previous measures agreed include two windfall taxes — one targeting renewable energy suppliers benefiting from selling electricity linked to high gas prices and one on the profits of oil and gas producers. National governments must sign the taxes into law by December 1, and should recycle the funds to consumers and businesses. But officials and diplomats from several EU countries have said the tariffs will be complex to collect, and in some member states may not amount to much.

The plan to cap wholesale gas prices in the third package has proved more divisive. The commission proposed this month an emergency limit that would be triggered should month-ahead contracts on the benchmark Dutch TTF futures market exceed €275/MWh for two consecutive weeks and be €58 higher than that of LNG for 10 consecutive days.

Some member states say the proposed cap would not have been triggered even when gas prices hit all-time highs in August. Others say that intervening in the market threatens supply, as price controls would damage Europe’s attempts to attract imports.

Those that want the cap, such as Italy and Greece, insist they will not approve the third package, which includes co-ordinating gas purchases across the bloc, unless a price limit is introduced.

A meeting of energy ministers has been called for December 13, while ambassadors will make a first effort to reach a compromise this Friday. But diplomats fear it will be hard to agree a deal.

What about Russian oil?

The EU is working alongside the G7 nations to implement a price ceiling on seaborne Russian oil, permitting crude to continue flowing while pushing down Moscow’s revenues.

The idea behind the initiative is to bar insurance and other services enabling shipments of Russian crude sold above a certain price. It is an adjustment to earlier EU plans for a phased-in ban on Russian oil shipments, which is meant to kick in on December 5. Some Russian pipeline crude is exempt due to concerns about energy security in eastern Europe.

The initiative has been pushed hard by the US, which wants to avoid a sharp fall in Russian exports to avoid steep rises in crude prices. Member-states will not be able to buy seaborne cargoes under the cap as the EU’s own import ban supersedes it, but it is designed to keep oil flowing to countries such as India and China.

Bringing the measure into force will require agreement not only by the G7 allies but also by EU member states. EU capitals were on Tuesday discussing a price cap of as low as $62 a barrel, but they have yet to strike a deal because of a Poland-led push for a lower price.

What happens if caps are not effective or agreed?

European industry has for months issued dire warnings about production cuts and closures as a result of high energy bills. Combined with US legislation offering billions of dollars in tax credits and subsidies for green technologies, ministers and executives fear a mass deindustrialisation of the bloc.

Vladimír Dlouhý, president of the Czech chamber of commerce, said policymakers could “cripple industries in Europe with a combination of high prices, indefinite indecisiveness [and] overall regulation”.

While national subsidies have protected households, several EU leaders have also warned of widespread social unrest unless prices come down.

Henning Gloystein, director of energy, climate and resources at Eurasia Group, said that while more non-interventionist states seemed to have the upper hand in resisting the gas price cap, “depending how this winter and 2023 develop I’m not sure it will stay that way”.

-----

Earlier: