EUROPEAN GAS PRICES FALL

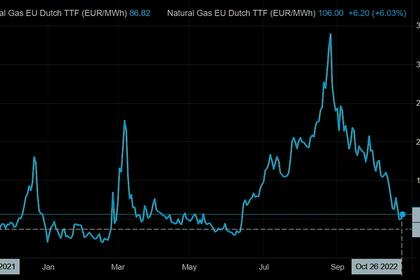

BLOOMBERG- Nov 1, 2022 - Natural gas prices in Europe fell further as a spell of warm weather delayed the heating season, providing some respite to regional economies on the brink of recession.

Benchmark futures dropped as much as 5.5%. Prices have declined sharply in recent weeks as a hot October allowed more gas to be pumped into already fuller than normal storage sites. Ample inflows of liquefied natural gas and reduced consumption by industries have also helped offset Russia’s supply cuts.

The mild weather is likely to extend into this month, with forecasters Maxar Technologies LLC and Marex expecting no cold spells in November. It comes as a relief for consumers worried about the cost of heating and for governments keen to ensure healthy gas stockpiles for as long as possible.

“Record warmth in October has eroded as much as 10% of weather-related demand,” analysts at JPMorgan Chase & Co. said in a note. The bank lowered its price estimates for the forth quarter, “reflecting the current softness in the balance, but assume normal December weather.”

Europe’s gas storage sites are nearly 95% full, providing a buffer for when the weather turns colder. Reserves in the biggest gas consumer, Germany, have risen to 99%, according to Gas Infrastructure Europe.

Inventories are in a good shape, but the big question is how winter progresses, meaning prices will continue to be volatile, Alfred Stern, chief executive officer of Austrian energy company OMV AG, told Bloomberg TV.

Dutch gas futures for December, Europe’s benchmark, were 4.7% lower at €117.51 per megawatt-hour by 9:40 a.m. in Amsterdam. The UK equivalent contact declined 4.8%.

Coming at a Cost

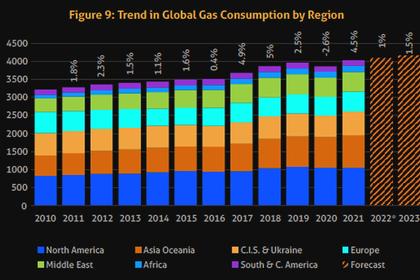

Risks still remain on the horizon as global supplies are tight. Despite the recent decline in prices, European gas is about four times higher than normal for this time of year. While supply concerns for this winter are easing, next year could be harder as refilling inventories is likely to be more challenging without the usual Russian supply.

“Alternative fuel sources will fill the gap, but they will come at a cost,” Caroline Bain, chief commodities economist at Capital Economics, said in a note. The group expects energy prices in general to remain elevated in 2023.

Policy makers are weighing more measures to ensure Europe’s economies are protected from any further surge in energy costs. European Union energy ministers are targeting clinching a deal on another batch of proposals later this month.

-----

Earlier: