JAPAN NEED LNG

PLATTS - 25 Nov 2022 - Japan is poised for more spot LNG trades in 2023 as more than 6 million mt/year of long-term LNG supply contracts are due to expire, a trend likely to persist for the next few years at least.

The long-term contractual expiries come at a time when Japan faces stiff competition for LNG from Europe, which has committed to replace Russian gas supply in the wake of Russia's invasion of Ukraine.

Roughly 6.1 million mt of long-term LNG contracts held by Japanese companies are up for expiry in 2023, with Brunei LNG accounting for 56% of the contracts due to expire in the year, according to S&P Global Commodity Insights LNG database.

The 2023 contractual expiries represent roughly 8% of Japan's annual LNG imports of around 74 million mt, a level that will likely be difficult to replace with incremental supply from other long-term term contracts and short-to-mid-term contracts amid tight LNG markets.

"Everybody is seeking term [supplies] including for strip and mid-term [contracts]," a Japanese buyer told S&P Global. "We tapped a few [suppliers] but there are no [suppliers] offering oil-indexed long-term contracts."

"So we are in a situation [where we have] to keep room open helplessly for spot [volumes] because sellers are not willing to offer," said the buyer, adding that Japanese buyers cannot secure their LNG requirements in advance.

The Russian invasion of Ukraine, which has tightened the LNG supply-demand balance and increased uncertainty over supply, including from the Sakhalin 2 project, is also impacting Japanese companies' LNG procurements in 2023, said Hiroshi Hashimoto, senior analyst and head of gas group at the Institute of Energy Economics, Japan.

"Of course, [Japanese companies] must have taken steps for contractual expiries in advance but the situation has slightly changed, which has created the need to move additionally," said Hashimoto, adding that such moves include not only pursuing more long-term LNG supply than previously expected but also seeking spot LNG procurements.

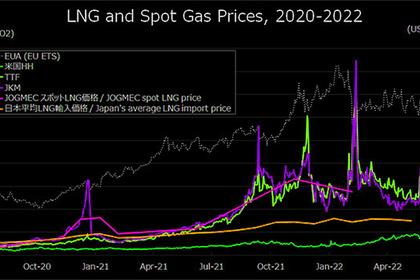

Japan's higher exposure to spot LNG procurement in 2023 comes after the Platts JKM price benchmark rose to an all-time high of 84.762/MMBtu March 7 because of supply uncertainty and rising prices in the Atlantic. Platts, part of S&P Global, assessed JKM for January at $31.368/MMBtu Nov. 24.

Japanese buyers have mostly secured sufficient LNG for the upcoming winter into March 2023 despite facing some supply issues, including from Malaysia LNG and US Freeport LNG, with some still in the midst of working out their annual delivery programs for 2023, according to market sources.

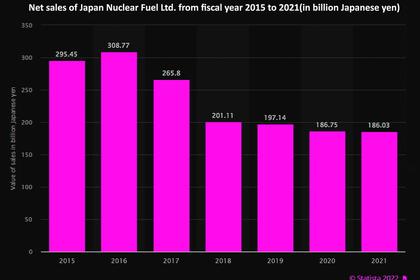

Nuclear restarts

The country's overall LNG procurements, however, might fall on the year in 2023 because of expected restarts of Kansai Electric's 826 MW No. 1 and 826 MW No. 2 Takahama nuclear reactors over the course of the year.

Kansai Electric's No. 1 and No. 2 Takahama nuclear reactors will be restarted in June and July, respectively, for the first time under Japan's new regulatory standards introduced in 2013 following shutdowns for scheduled maintenance in 2011.

The restarts of the No. 1 and No. 2 Takahama reactors would also mark the country's second and third nuclear reactors to see over 40 years of commercial operations following NRA's approvals in 2016, along with Kansai Electric's 826 MW No. 3 Mihama nuclear reactor, which was restarted in 2022.

Japan's economic outlook for 2023 remains challenging and the country's overall power demand will be at a similar level to 2022, said Kaori Tachibana, associate director of gas, power & climate solutions at S&P Global.

"With the ramp up of up to 10 reactors by February 2023, and a further two scheduled for restart next summer, the pressure on LNG is expected to be lifted," Tachibana said.

"With tight supply expected to continue for the next few years, Japan's nuclear restart strategy will help alleviate the situation," she said. "However, nuclear restart remains highly uncertain and delays will place pressure on the tight LNG market as well as on domestic power supply."

The 10 nuclear reactors that will be in operation by February 2023 are Kansai Electric's No. 3 Mihama, 870 MW No. 3 Takahama, 870 MW No. 4 Takahama, 1.18 GW Ooi No. 3 and 1.18 GW Ooi No. 4 nuclear reactors; Kyushu Electric's 890 MW No. 1 and 890 MW No. 2 Sendai nuclear reactors, and 1.18 GW No. 3 and 1.18 GW No. 4 Genkai nuclear reactors; Shikoku Electric's 890 MW No. 3 Ikata nuclear reactor.

Contractual expiry

Japan's exposure to spot LNG trades will continue in the next few years unless it is able to secure some sort of extension to expiring long-term contracts or short-to-mid-term contracts.

The country's long-term LNG contractual volumes are slated to fall to around 62.86 million mt in 2030, compared with 85.11 million mt in 2025 and 89.83 million mt in 2023, according to S&P Global data.

Despite the approach of long-term contractual expiries, Japanese LNG buyers have not been able to secure new long-term LNG supply contracts because of the demand uncertainty in the years ahead due in part to the country's 2050 carbon neutrality commitment.

"Honestly, we have a split view at the company, with some calling for signing long-term contracts," said a Japanese buyer. "Others push for keeping room open for spot [volumes] without signing long-term contracts."

-----

Earlier: