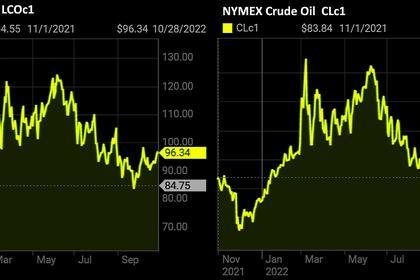

OIL PRICE: BRENT NEAR $95, WTI NEAR $89

REUTERS - Nov 1 - Oil prices rose on Tuesday, recouping losses from the previous session, as a weaker U.S. dollar offset widening COVID-19 curbs in China that have stoked fears of slowing fuel demand in the world's second-largest oil consumer.

Brent crude for January delivery rose $1.95, or 2.1%, to $94.76 per barrel at 1224 GMT. The December contract expired on Monday at $94.83 a barrel, down 1%.

U.S. West Texas Intermediate (WTI) crude rose $1.93, or 2.23%, to $88.46 a barrel, after falling 1.6% in the previous session.

Oil prices rose as the U.S. dollar sank on Tuesday from a one-week high against a basket of major peers, as traders weighed the odds of a less aggressive Federal Reserve at Wednesday's monetary policy meeting.

A weaker greenback makes dollar-denominated oil cheaper for buyers holding other currencies, boosting demand for the commodity.

The Brent and WTI benchmarks both ended October higher, posting their first monthly gains since May, after the Organization of the Petroleum Exporting Countries and allies including Russia, known as OPEC+, said they would cut output by 2 million barrels per day (bpd).

"OPEC+'s upcoming oil output cuts and the U.S.' record oil export data also support oil prices fundamentally," CMC Markets analyst Tina Teng said.

Dwindling oil supply, the possible halt of the Strategic Petroleum Reserve (SPR) release, and reinvigotated oil demand growth could also send oil above $100/bbl again, said Tamas Varga of oil broker PVM.

OPEC raised its forecasts for world oil demand in the medium-and longer-term on Monday, saying that $12.1 trillion of investment is needed to meet this demand.

These bullish factors have offset demand concerns raised by COVID-19 curbs in China, the world's top crude oil importer, which lowered China's factory activity in October and cut into its imports from Japan and South Korea.

In a further cap to price gains, U.S. oil output climbed to nearly 12 million bpd in August, the highest since the start of the COVID-19 pandemic.

U.S. crude oil stocks are likely to rise in the week to Oct. 28, a preliminary Reuters poll showed.

The poll was conducted ahead of reports from the American Petroleum Institute due at 4:30 p.m. EDT (2030 GMT) on Tuesday, and the Energy Information Administration due at 10:30 a.m. (1430 GMT) on Wednesday.

Separately, Libya's oil output has risen to 1.2 million bpd from 600,000 bpd three months ago, National Oil Corporation (NOC) chief Farhat Bengdara said on Tuesday, adding that NOC does not expect any disruption in oil production.

-----

Earlier: