OPEC MARKET DECISIONS

By ROBERT RAPIER Proteum Energy

ENERGYCENTRAL - Oct 31, 2022 - I tell people that to understand OPEC, you have to put yourself in their position. Their objective is to maximize the value of the oil they have in the ground. That objective is directly contrary to the desires of most U.S. politicians and consumers — which is access to cheap gasoline.

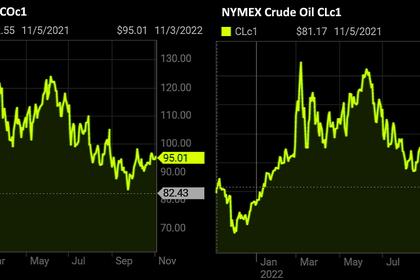

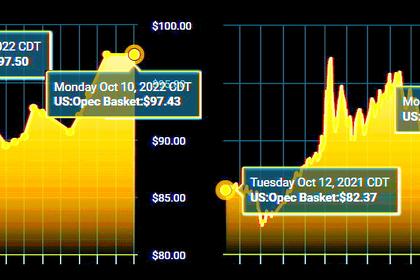

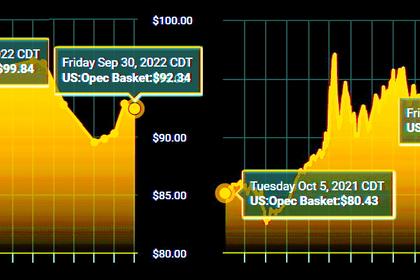

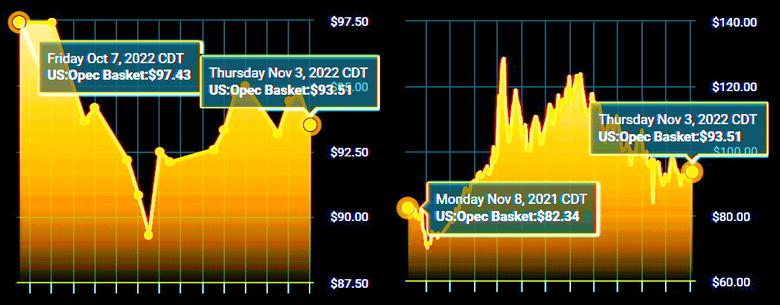

Oil prices have been rising since the pandemic-related production disruption in 2020. That price rise accelerated when Russia invaded Ukraine.

In an effort to combat rising prices, earlier this year President Biden began the largest drawdown of the Strategic Petroleum Reserve (SPR) in U.S. history. That was aimed at combating oil prices that had surged past $100/bbl, and it was certainly a factor that helped reduce oil prices.

To the extent that the SPR drawdown reduced oil prices, it cost OPEC money. Further — with 35% of the world’s 2021 oil production — OPEC holds the trump card. This month they played it.

With the SPR level 33% below the level of a year ago — and at the lowest level since 1984 — OPEC announced deep output cuts.

OPEC and non-OPEC allies — generally referred to as OPEC+ — agreed at this week’s meeting in Vienna to reduce production by 2 million BPD from November levels. In comparison, the rate of drawdown of the SPR over the past six months has been less than 1 million BPD.

Thus, in one fell swoop OPEC+ undid the attempt by the Biden Administration to add more oil to the market.

Draining the SPR was never a sustainable move. Further, it endangered U.S. energy security by reducing our oil reserve, and now OPEC has exploited that vulnerability.

The White House released a statement, indicating its displeasure with OPEC’s move. It read in part:

“The President is disappointed by the shortsighted decision by OPEC+ to cut production quotas while the global economy is dealing with the continued negative impact of Putin’s invasion of Ukraine. At a time when maintaining a global supply of energy is of paramount importance, this decision will have the most negative impact on lower- and middle-income countries that are already reeling from elevated energy prices.”

President Biden surely realizes that OPEC is not our friend. Further — at least with the Saudis — they would probably rather deal with Republicans. So, they may believe that announcing this move just before the November elections could hurt Biden.

What looks shortsighted to President Biden may look brilliant from OPEC’s perspective. Their interests are not our interests. They want to derive as much oil revenue as they can from their reserves, without pushing the world into recession and crashing prices.

That’s bad in general for U.S. consumers, but there are ways to fight OPEC. If you are in the position to do so, buy an electric vehicle and insulate yourself from their attempts to boost prices. If that’s not an option, considering buying yourself some shares in oil companies, which rise when OPEC’s decisions boost oil prices.

To its credit, the White House did say OPEC’s move is a “reminder of why it is so critical that the United States reduce its reliance on foreign sources of fossil fuels.” But that seems to be a lesson that the Biden Administration is having to learn the hard way.

-----

This thought leadership article was originally shared with Energy Central's Energy Collective Group. The communities are a place where professionals in the power industry can share, learn and connect in a collaborative environment. Join the Energy Collective Group today and learn from others who work in the industry.

-----

Earlier: