OPEC+, U.S. OIL RELATIONS

PLATTS - 07 Nov 2022 - Top US and OPEC+ officials met at the Abu Dhabi International Petroleum Exhibition and Conference last week, but the high-profile event did little to allay concerns of a widening rift between Washington and the Saudi-led group on its recent decision to slash output quotas by 2 million b/d.

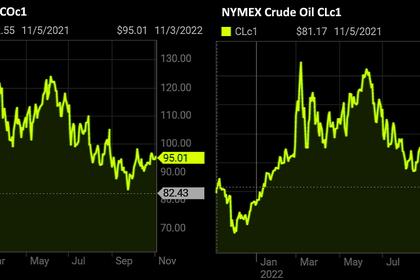

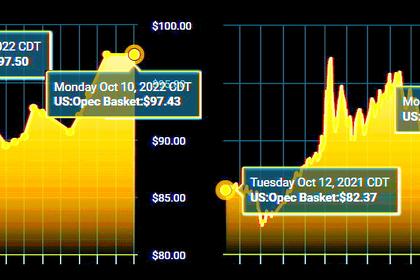

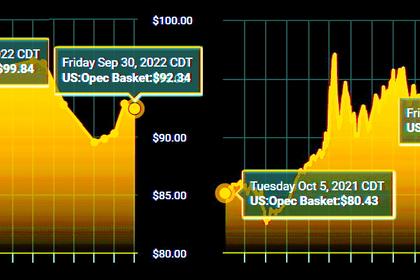

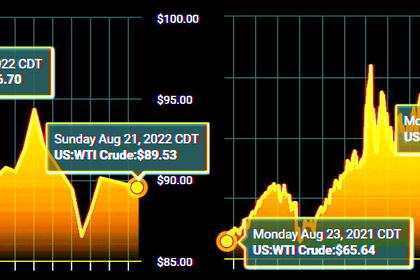

Energy representatives and ministers from the US, Saudi Arabia, UAE and India aired their differences on the supply cuts at the ADIPEC meeting. Crude prices initially shot up close to $100/b in the wake of the OPEC+ announcement, with Platts assessing Dated Brent at $96.995/b on Nov. 2, according to data from S&P Global Commodity Insights.

The US reaction to the Saudi-led decision was swift. President Joe Biden has warned of "consequences," and the country has announced more releases of crude from its strategic reserves. And the "NOPEC" bill that could subject the producer group to antitrust lawsuits for market manipulation also remains an option.

According to Greg Priddy, a consultant at Washington-based Spout Run Advisory, Saudi Arabia is trying to get a "last hurrah" out of a period of high oil prices and keep the needle above $90/b.

What set tongues wagging and US lawmakers considering fresh action against OPEC+ was the magnitude of the OPEC+ cuts, Priddy said.

The move was perceived in Washington as "intended to frustrate American attempts to punish Russia," he said. "The Saudis missed the fact that this is all seen as high politics in Washington," Priddy said "[It is] very much seen as a hostile act in Washington."

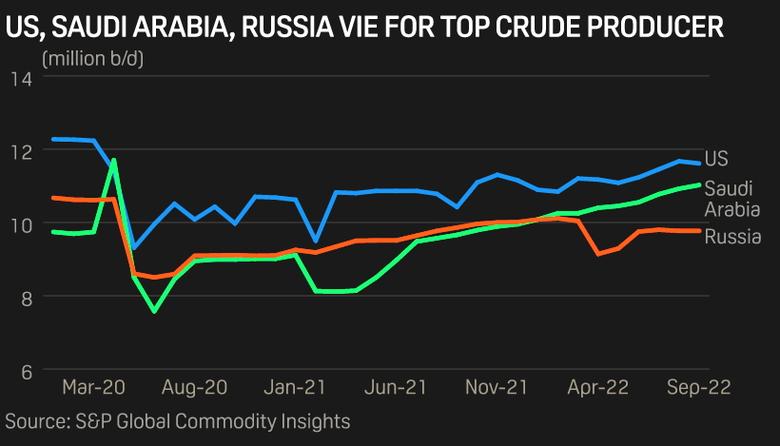

The move by OPEC+, co-chaired by Riyadh and Moscow, also comes at a time of increased volatility in the crude market. The US is the world's top oil producer, thanks to its shale boom of the last decade, but finds its output constrained due to its domestic industry's unwillingness or inability to fund more drilling.

Russia, another major global producer, finds its barrels sanctioned following its invasion of Ukraine, closing off its access to many key economies.

This leaves Saudi Arabia and allies the UAE and Kuwait as the only countries with any real leverage in the global oil markets in the form of spare production capacity.

The trio is also at the last frontier of oil as demand for crude will eventually peak in a world seeking to transition to a carbon-neutral future by the middle of the century.

Adrift in Abu Dhabi

At ADIPEC, OPEC ministers refused to engage with the media on their much-debated cuts, shunning reporters and focusing their talking points on more investment in the oil and gas industry.

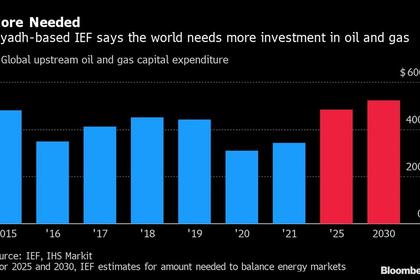

OPEC, which released its World Oil Outlook at ADIPEC, remained bullish on the long-term prospects for hydrocarbons, calling for $12.1 trillion investments in the sector through to 2045, a period close to the target for net-zero emissions for most of the world.

The US, which was represented at the forum by its international energy envoy Amos Hochstein, backed the need for more oil and gas investment even as wider rifts emerged.

"We have very strong disagreements on policy, but not everything has to be a soap opera," he told reporters.

Saudi Arabia has been on the offensive, trying to coalesce more support for the cuts, even as it bristled at actions by the US to release more crude from its strategic reserves.

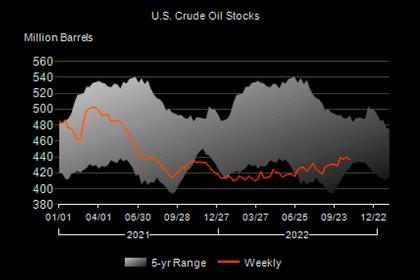

The Biden administration, which in April said it would begin releasing about 1 million b/d from the reserve, plans to sell the last tranche of that crude in Q4 2022. Another 26 million barrels of congressionally mandated sales are also set to be delivered by the end of the year.

Saudi energy minister Prince Abdulaziz bin Salman called the move "manipulative." "It is my profound duty to make it clear to the world that losing emergency stocks may become painful in the months to come," he told the audience.

He also called Saudi Arabia, "the maturer guys" when it came to the spat with the US.

"We keep hearing you ‘are with us or against us.' Is there any room for, ‘We are with the people of Saudi Arabia?'" he asked.

New threats

While there was no public rapprochement between the US and Saudi Arabia in Abu Dhabi, the UAE seemed to chart a different course in maintaining its relationship with the world's largest economy.

UAE President Mohamed bin Zayed and Biden signed a pact which will mobilize $100 billion in financing, investment and other support to deploy globally 100 GW of clean energy by 2035. The two sides also stressed the need for maintaining stability in the energy markets.

The UAE's decision to emphasize that relations were normal and continue energy co-operation comes at a time when Saudi Arabia and its allies face fresh threats in the region from possible attacks by Iran-backed proxies.

With more than 80% of Middle East crude flowing to Asia, following disagreements on OPEC+ policy, questions were being raised as to why the US would continue to protect supplies it no longer critically needs.

"In short, a breakdown in US-Saudi relations would mean a higher Middle East risk premium for the global market and higher oil and fuel prices," Torbjorn Soltvedt, principal MENA analyst at Verisk Maplecroft, said in an Oct. 12 note.

-----

Earlier: